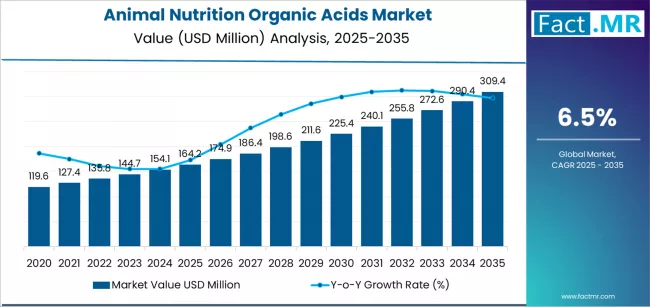

The global animal nutrition organic acids market is set for robust expansion over the next decade, driven by the rising emphasis on gut-health management, antibiotic alternatives, and improved feed conversion efficiencies. According to the latest analysis by Fact.MR, the market—currently valued at USD 164.2 million in 2025—is projected to reach USD 309.4 million by 2035, reflecting a strong CAGR of 6.5% and an absolute increase of USD 145.2 million through the forecast period.

Growing concerns around antimicrobial resistance (AMR), coupled with increasing bans on antibiotic growth promoters (AGPs), are steering livestock producers toward natural, safe, and performance-enhancing feed additives. Organic acids, known for improving gut integrity, pathogen control, and nutrient absorption, are emerging as a critical component in modern animal nutrition systems.

Strategic Market Drivers

Shift Toward Antibiotic-Free Nutrition Gains Global Traction

Stringent regulations on antibiotic usage in livestock across Europe, North America, and several Asian economies have accelerated adoption of organic acids as effective and natural growth promoters. Their ability to enhance gastrointestinal health, reduce pathogenic bacteria, and improve nutrient utilization is driving widespread application in poultry, swine, aquaculture, and ruminant diets.

Rising Demand for High-Quality Protein & Efficient Feed Utilization

Expanding global demand for high-quality animal protein—particularly poultry and dairy—is pushing producers to adopt feed solutions that support better weight gain, immunity, and feed conversion ratios (FCR). Organic acids help enhance digestive processes, enabling optimized growth performance and improved farm economics.

Browse Full Report: https://www.factmr.com/report/animal-nutrition-organic-acids-market

Clean-Label, Sustainable & Functional Additives Gain Momentum

Growing preference for natural, non-residual, and eco-friendly feed ingredients is reshaping product innovation. Manufacturers are expanding portfolios with blends of citric, lactic, fumaric, formic, and propionic acids—offering targeted benefits such as pH regulation, mold inhibition, and pathogen mitigation.

Additionally, advancements in microencapsulation technologies are improving acid stability, controlled release, and heat resistance during feed processing, enabling broader usage across species and feed types.

Strengthening Supply Chains Through Global Feed & Agri-Nutrition Expansion

Rising penetration of integrated feed mills, livestock farms, and organized retail channels—especially across Asia-Pacific and Latin America—is accelerating product availability. E-commerce expansion in veterinary and livestock supplement categories is further enhancing market accessibility.

Modernization of agriculture, higher disposable incomes, and sustainability-driven livestock management practices are strengthening adoption across developing regions.

Regional Growth Highlights

North America: Regulatory Push Toward Antibiotic Alternatives

The U.S. and Canada continue to adopt organic acid-based feed solutions, supported by strong AGP restrictions, focus on high-quality meat production, and increasing investments in advanced feed technologies.

Europe: Leader in Clean-Label, Sustainable Feed Additives

Europe remains the innovation hub, driven by strict EFSA regulations, sustainability commitments, and strong adoption across poultry and swine sectors. Germany, the U.K., France, and the Netherlands are leading consumers.

East Asia: Fastest-Growing Market with High Livestock Intensification

China and Southeast Asia are experiencing rapid livestock sector modernization, fueling demand for cost-effective, safe, and efficient feed additives. Aquaculture growth in Vietnam, Indonesia, and China further boosts consumption.

Emerging Markets: Significant Upside Potential

Latin America, India, and the Middle East present strong future opportunities due to expanding poultry consumption, commercial feed operations, and rising awareness of gut-health enhancers.

Market Segmentation Insights

By Type

- Propionic & Formic Acids – Widely used for mold control and pathogen reduction.

- Citric & Lactic Acids – Increasing use in gut-health enhancement.

- Fumaric & Malic Acids – Strong adoption in swine and poultry for performance improvement.

- Blended & Buffered Organic Acids – Fastest-growing due to enhanced stability and targeted action.

By Animal Type

- Poultry – Largest segment, driven by demand for efficient growth and disease control.

- Swine – Increasing adoption to reduce digestive disorders and improve feed conversion.

- Ruminants – Growing usage for improved milk yield and metabolic health.

- Aquaculture – Rapid uptake due to water stability and digestive benefits.

By Form

- Dry/Powdered Acids – Preferred for easy mixing and stability.

- Liquid Acids – Strong growth in large-scale feed mills and water-line applications.

Challenges Impacting Market Growth

- High Cost of Organic Acid Blends – May limit adoption among small-scale farmers.

- Volatile Raw Material Prices – Affects production costs and margins.

- Competition from Probiotics & Enzymes – Other natural additives intensify market rivalry.

- Formulation Stability Issues – Sensitive ingredients require advanced encapsulation technologies.

Competitive Landscape

The animal nutrition organic acids market is moderately concentrated, with key players focusing on capacity expansion, species-specific formulations, and collaborations with feed manufacturers.

Leading Companies Profiled:

- BASF SE

• Cargill

• Archer Daniels Midland (ADM)

• Evonik Industries AG

• Kemin Industries

• DSM-Firmenich

• Novus International

• Perstorp Holding AB

• Nutreco

• Anpario PLC

These companies are investing in R&D, sustainable production technologies, advanced encapsulation methods, and region-specific product customization.

Recent Developments

- 2024: Multiple feed additive companies launched pH-regulating organic acid blends tailored for poultry and broiler performance.

- 2023: Asia-Pacific witnessed strong expansion of encapsulated organic acids designed for aquafeed stability.

- 2022: European manufacturers introduced carbon-neutral and bio-based acid production models aligned with ESG goals.

Future Outlook: A Decade of Natural, Efficient, and Sustainable Feed Solutions

The next decade will witness high momentum in the animal nutrition organic acids market as producers shift firmly toward antibiotic-free, natural, and performance-enhancing feed strategies. Innovations in multi-acid blends, encapsulation technologies, and species-specific formulations will define competitive success.

With strong adoption across both industrial and developing livestock sectors, the market is poised for sustained, resilient, and innovation-driven growth through 2035.