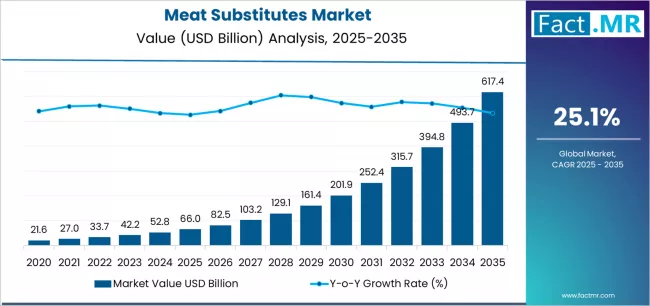

The global meat substitutes market is on track for extraordinary growth over the next decade. It is projected to expand from USD 66.0 billion in 2025 to a staggering USD 617.4 billion by 2035, reflecting a compound annual growth rate (CAGR) of 25.1%.

Key Market Highlights

-

2025 Market Size: USD 66.0 billion

-

2035 Forecast Value: USD 617.4 billion

-

Projected CAGR (2025–2035): 25.1%

-

Leading Source: Plant-based protein (~62% share)

-

Primary Distribution Channel: Retail (approximately 68% share)

-

High-Growth Regions: Europe, North America, Asia-Pacific

-

Major Players: Beyond Meat, Impossible Foods, Quorn Foods, Kellogg, Unilever, Amy’s Kitchen, Tofurky, Tyson Foods, VBites, SunFed

To Access the Complete Data Tables & in-depth Insights, Request a Discount on this report: https://www.factmr.com/connectus/sample?flag=S&rep_id=11645

Five Key Drivers Fueling Market GrowthMea

-

Widespread Adoption of Plant-Based Diets

As consumers increasingly embrace flexitarian and plant-focused lifestyles, demand for high-quality meat alternatives is soaring. Meat substitutes are now featured across retail shelves, fast-casual restaurants, and home-cooking settings, driving large-scale adoption. -

Innovation in Protein Technologies

Companies are continuously investing in advanced protein extraction and texturization techniques to create products that mimic the taste, texture, and cooking behavior of real meat — including patties, strips, and ground formats. -

Sustainability & Environmental Awareness

With growing concern about climate change and livestock emissions, consumers are turning to meat alternatives that offer a smaller carbon footprint and a more sustainable protein source. -

Retail Penetration & Accessibility

Retailers are aggressively expanding their plant-based offerings in both refrigerated and frozen categories. Simultaneously, e-commerce and foodservice channels are increasing access to meat substitutes through diversified formats and menu options. -

Personalized & Functional Nutrition

Demand is rising for meat substitutes tailored for specific nutritional needs, such as high-protein, fortified, low-fat, or clean-label products. This customization is helping meat substitutes penetrate mainstream diets and niche wellness segments.

Market Segmentation

By Source

-

Plant-Based Protein: Dominates with ~62% share, driven by legume (e.g., pea), soy, and pulse protein sources.

-

Mycoprotein, Soy-Based & Others: Also gaining traction, especially in niche and specialty formats.

By Distribution Channel

-

Retail: Accounts for approximately 68% share, fueled by strong consumer demand and product variety.

-

Foodservice: Rapidly expanding, especially in quick-service restaurants, casual dining, and institutional catering.

Regional Outlook

-

Europe: A key growth market due to a strong vegan population, regulatory support, and innovation in plant-based food technology.

-

North America: Sustained by large-scale investments, rising dietary flexitarianism, and major retail adoption.

-

Asia‑Pacific: Experiencing rapid growth with modern retail expansion, growing middle-class, and increasing demand for protein alternatives.

Challenges & Market Risks

-

Raw Material Costs & Supply Constraints: Scaling protein extraction and production can be expensive, and raw material sourcing (e.g., peas, soy) is subject to agricultural volatility.

-

Taste and Texture: Continued innovation is required to close the gap between plant-based alternatives and traditional meat in sensory experience.

-

Regulatory & Labeling Issues: Different global standards around “meat alternative” claims and health positioning can complicate market expansion.

-

Price Competition: Although premium alternative meats appeal to affluent and health-conscious consumers, pricing remains a challenge for widespread adoption.

Competitive Landscape

Major players are driving innovation across the value chain by:

-

Developing new formats (burgers, nuggets, strips, mince) and protein sources

-

Partnering with retail and foodservice channels to increase market reach

-

Investing in sustainability, clean-label formulations, and process optimization

-

Scaling up manufacturing capacity to meet exploding demand

Companies such as Beyond Meat, Impossible Foods, Quorn, Kellogg, Unilever, and Amy’s Kitchen are leading the charge with new product launches, global expansion, and strategic partnerships.

Strategic Recommendations

-

Expand Nutritional Innovation: Develop fortified, high-protein, or functional meat substitutes to cater to health-conscious and aging populations.

-

Deepen Retail Partnerships: Work closely with major grocery chains and online platforms to ensure strong shelf presence and distribution.

-

Increase R&D for Taste & Texture: Invest in advanced processing and experiential research to closely mimic real meat.

-

Scale Production Infrastructure: Enhance manufacturing capabilities to reduce costs and support large-scale adoption.

-

Educate Consumers & Policymakers: Communicate the environmental, health, and ethical benefits of meat substitutes to drive wider acceptance.

Market Outlook

By 2035, the meat substitutes market is expected to transform into a mainstream protein ecosystem. With projected growth to USD 617.4 billion, meat analogs are set to become a staple in global diets, driven by innovation, retail expansion, and a fundamental shift in how consumers think about protein and sustainability.

Companies that combine cutting-edge food technology with efficient production and strong market reach will be best positioned to lead this rapidly evolving and high-impact industry.

Browse Full Report: https://www.factmr.com/report/meat-substitutes-market

About Fact.MR:

Fact.MR is a global market research and consulting firm, trusted by Fortune 500 companies and emerging businesses for reliable insights and strategic intelligence. With a presence across the U.S., UK, India, and Dubai, we deliver data-driven research and tailored consulting solutions across 30+ industries and 1,000+ markets. Backed by deep expertise and advanced analytics, Fact.MR helps organizations uncover opportunities, reduce risks, and make informed decisions for sustainable growth.