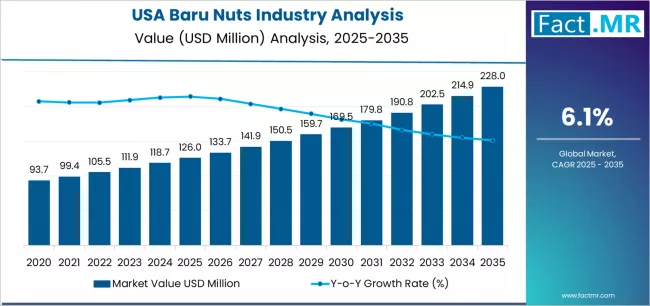

The USA baru nuts industry is poised for remarkable expansion over the next decade, supported by surging demand for clean-label protein sources, rising adoption of plant-based diets, and increasing availability across mainstream retail and e-commerce platforms. According to a recent analysis by Fact.MR, the market is projected to grow from USD 126.0 million in 2025 to USD 228.0 million by 2035, marking an absolute increase of USD 102.0 million. This reflects a total growth of 81.0%, with demand expected to rise at a CAGR of 6.1% during the forecast period.

As Americans seek healthier alternatives to conventional nuts and high-calorie snacks, baru nuts—known for their exceptional nutrition profile, mild flavor, and sustainability credentials—are emerging as one of the fastest-growing superfood categories.

Strategic Market Drivers

Plant-Based Protein Demand Fuels Baru Nut Adoption

Growing preference for plant-based, high-protein foods is boosting demand for baru nuts, which deliver a nutrient-rich profile with more protein than many traditional nuts. Their naturally roasted flavor, low allergenic potential, and rich micronutrient composition make them appealing to fitness enthusiasts, vegans, and clean-eating consumers.

Clean-Label and Sustainable Sourcing Gain Momentum

Baru nuts align perfectly with clean-label expectations—they are free from additives, preservatives, and allergens commonly associated with other nut categories. Their cultivation in Brazil’s Cerrado biome supports biodiversity and regenerative agriculture, strengthening appeal among environmentally conscious consumers.

Rising Penetration Across Retail & E-commerce

Supermarkets, organic stores, premium grocery chains, and online health-food platforms in the USA are increasingly stocking baru nut products ranging from raw and roasted nuts to nut butter, bars, and powdered snacks. Subscription-based online models are enabling year-round consumption.

Expanding Product Formulations Accelerate Growth

Food and beverage manufacturers are incorporating baru nuts into snack bars, plant-based dairy alternatives, confectionery, sports nutrition blends, and bakery formulations. Their neutral yet flavorful profile makes them suitable for gourmet applications and health-focused formulations.

Browse Full Report: https://www.factmr.com/report/usa-baru-nuts-industry-analysis

Regional & Consumer Trends

Health-Conscious States Lead Adoption

Regions such as California, New York, Washington, Colorado, and Texas are witnessing high demand driven by wellness-oriented consumer groups and a strong presence of natural food retailers.

Premium & Organic Food Trends Support Growth

The USA’s thriving organic snack segment and rising demand for ethically sourced ingredients are lifting sales of premium baru nut products. Artisanal brands and gourmet snack labels are shaping the category’s premiumization.

Youth & Fitness Communities Drive Market Acceleration

Millennials and Gen Z consumers continue to be the primary adopters due to heightened interest in protein-rich, clean-label, and sustainable snacks.

Market Segmentation Insights

By Product Type

- Raw & Roasted Baru Nuts – Largest and most popular form due to clean eating trends.

- Baru Nut Butter – Fast-growing, driven by protein-rich spreads.

- Baru Nut Powder & Flour – Increasingly used in baking and sports nutrition.

- Value-Added Products – Bars, granola mixes, and confectionery items gaining traction.

By Distribution Channel

- Supermarkets & Hypermarkets – Dominant due to strong visibility and consumer trust.

- Online Retail – Fastest-growing, supported by health-food e-commerce platforms.

- Specialty & Organic Stores – Key channel for premium, ethically sourced products.

- Convenience Stores – Emerging opportunity for single-serve healthy snacks.

Challenges Influencing Market Growth

- Low Consumer Awareness – Baru nuts remain relatively unfamiliar compared with almonds or cashews.

- Pricing Pressure – Premium positioning and import costs elevate retail prices.

- Supply Chain Variability – Dependence on Brazilian harvest cycles may create supply fluctuations.

- Competition from Established Nuts – Almonds, walnuts, cashews, and pistachios dominate consumer preferences.

Competitive Landscape

The USA baru nuts market consists of emerging natural food brands, premium snack manufacturers, and companies specializing in sustainably sourced ingredients. Players are focusing on supply chain transparency, nutritional marketing, and innovative product launches.

Key Companies Profiled:

• Baru Baron

• Areté Foods

• Nutty Yogi (US offerings)

• Health-focused private labels

• Regional artisanal snack brands

Manufacturers are increasingly investing in organic certification, flavor innovation, eco-friendly packaging, and partnerships with Brazilian cooperatives to ensure ethical sourcing.

Recent Industry Developments

- 2024: Launch of new organic roasted baru nut SKUs in U.S. natural food chains.

- 2023: Expansion of baru nut spreads and protein bars in premium grocery retailers.

- 2022: Introduction of sustainable packaging formats and partnerships with Cerrado farming cooperatives.

Future Outlook: A Decade of High-Protein, Sustainable Snacking

The next decade will see strong momentum in the USA baru nuts industry driven by protein innovation, sustainability-led branding, and premium functional snacks. As awareness grows, baru nuts are expected to enter mainstream retail shelves, sports nutrition portfolios, and gourmet culinary applications.

With clean-label credentials, nutrient density, and environmentally friendly sourcing, the USA baru nuts market is on track for stable, robust, and long-term growth through 2035