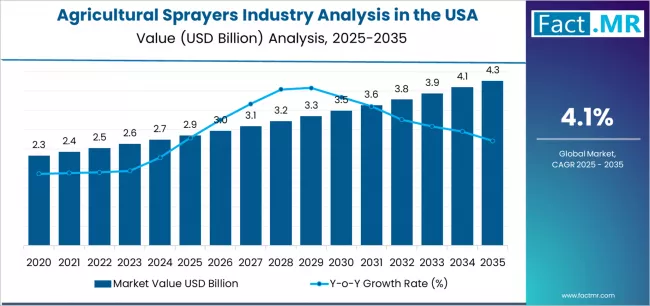

The United States agricultural sprayers industry is set for robust expansion over the next decade, backed by rapid advancements in precision agriculture, growing mechanization across large and small farms, and rising adoption of sustainable crop protection practices. The market is projected to grow from USD 2.85 billion in 2025 to USD 4.20 billion by 2035, marking an absolute increase of USD 1.35 billion. This reflects a total growth of 47.37%, with demand forecast to expand at a CAGR of 4.10% during the assessment period.

As farmers shift toward optimized chemical application, labor-saving machinery, and smart farm technologies, agricultural sprayers are becoming indispensable tools for crop health monitoring and input efficiency. Demand is also supported by government incentives, digital agriculture platforms, and the modernization of agribusiness operations.

Strategic Market Drivers

Precision Agriculture Adoption Accelerates Equipment Demand

The rapid adoption of GPS-based farming, variable rate technology (VRT), and remote sensing tools is transforming crop-management practices across the U.S. Agricultural sprayers equipped with advanced sensors, auto-height control, and sectional shutoff systems are gaining traction due to their ability to reduce chemical waste, improve accuracy, and enhance yield consistency.

Rising Labor Shortages Fuel Mechanization

Persistent labor shortages in farming communities are accelerating the transition from manual spraying methods to automated and tractor-mounted sprayer systems. Farmers increasingly prefer high-capacity sprayers that enable efficient field coverage, reduced operator fatigue, and consistent chemical dispersion.

Sustainable Farming & Input Efficiency Strengthen Market Position

With growing emphasis on climate-resilient agriculture and environmental compliance, sprayers with drift-control systems, low-volume spray technology, and eco-friendly nozzles are witnessing rising adoption. These solutions support reduced pesticide usage, water conservation, and responsible chemical application.

Technological Advancements in Smart Spraying Systems

Manufacturers are introducing sprayers with AI-enabled detection systems, real-time pressure monitoring, and telematics integration. These innovations allow farmers to map field variability, track equipment performance, and automate chemical application for improved productivity.

Browse Full Report: https://www.factmr.com/report/united-states-agricultural-sprayers-industry-analysis

Regional Insights: Strong Adoption Across Key Agricultural States

Midwest: Mechanization Heartland

The Midwest—led by Iowa, Illinois, Nebraska, and Minnesota—dominates market demand due to extensive corn and soybean cultivation. Large farms, high equipment adoption rates, and strong dealer networks support significant sales.

South & Southeast: Rapid Expansion Across Row-Crop Farms

Growing mechanization in states such as Texas, Arkansas, Georgia, and North Carolina, combined with expanding cotton and grain farms, is driving increased reliance on high-efficiency sprayers.

Western USA: Adoption Driven by High-Value Crops

California and Washington are witnessing strong uptake of airblast and orchard sprayers tailored for vineyards, nut farms, and fruit production.

Northern Plains: Precision Farming Hub

North Dakota and South Dakota are emerging as hotspots for GPS-guided sprayer usage due to the rapid penetration of digital farming practices.

Market Segmentation Insights

By Product Type

- Self-Propelled Sprayers – Fast-growing category driven by automation and large-acreage farming.

- Trailed/Towed Sprayers – Preferred among mid-sized farms due to cost efficiency.

- Mounted Sprayers – Popular in specialty crop farming and compact fields.

- Air-Assisted & Aerial Sprayers – Increasing adoption for orchards and high-value crops.

By Technology

- Hydraulic Sprayers – Widely used for broad-acre farming.

- Ultra-Low Volume (ULV) Sprayers – Gain traction in areas with water scarcity.

- Electric & Battery-Operated Sprayers – Growing among small farms and greenhouse applications.

- Smart Spraying Systems – High growth driven by AI, sensors, and automation.

By Farm Size

- Large Farms – Major revenue contributors; rapid adoption of self-propelled units.

- Medium Farms – Increasing shift toward tractor-mounted sprayers.

- Small Farms & Specialty Growers – Adoption driven by affordability and compact machinery.

Challenges Impacting Market Growth

- High Initial Investment Costs – Advanced self-propelled sprayers require significant upfront capital.

- Maintenance Complexity – Smart systems require technical expertise and periodic upgrades.

- Fluctuating Chemical Prices – Variability in pesticide and fertilizer costs affects sprayer usage rates.

- Weather Uncertainty – Unpredictable climatic conditions impact spraying windows and machine utilization.

Competitive Landscape

The U.S. agricultural sprayers industry is moderately consolidated, with companies focusing on autonomous sprayer development, precision control technologies, and sustainable application systems.

Key Companies Profiled:

- John Deere

- Case IH

- AGCO Corporation

- Kubota Corporation

- Hardi North America

- TeeJet Technologies

- CNH Industrial

- Mahindra USA

- Yamaha Motor Co. (sprayer drones)

- STIHL

Manufacturers are investing in electrically driven sprayers, AI-driven variable rate systems, drone-based spraying platforms, and low-drift nozzle technologies.

Recent Developments

- 2024: Launch of AI-powered weed-detection sprayers capable of selective chemical application.

- 2023: Expansion of drone sprayer usage across specialty crop farms and vineyards.

- 2022: Introduction of eco-friendly sprayer tanks, recyclable materials, and low-drift nozzle systems to support sustainable farming.

Future Outlook: A Decade of Smart, Sustainable, and Automated Spraying

The next decade will mark a transformative shift in the U.S. agricultural sprayers market. With increasing adoption of AI-based systems, autonomous sprayers, lightweight drone technologies, and sustainability-driven equipment, the sector is expected to witness rapid modernization. Manufacturers that focus on digital integration, advanced material engineering, and precision input management will lead the next wave of innovation.

As U.S. farms continue to transition toward high-efficiency production systems, agricultural sprayers will remain central to enhancing crop yields, reducing operational costs, and supporting climate-smart farming. The industry is well-positioned for stable, technology-driven, and resilient growth through 2035.