The USA coffee concentrates industry is set for healthy expansion from 2025 to 2035, supported by rapid adoption of ready-to-use beverage formats, rising demand for premium and functional coffee products, and strong penetration of convenience-driven consumption channels. Coffee concentrates, including liquid concentrates, cold-brew concentrates, shelf-stable formats, and foodservice-grade blends, continue to gain relevance across cafés, quick-service restaurants, grocery retail, and at-home brewing. This report outlines market size, demand drivers, technology advancements, competitive dynamics, and strategic considerations shaping growth through 2035.

Market Size and Growth

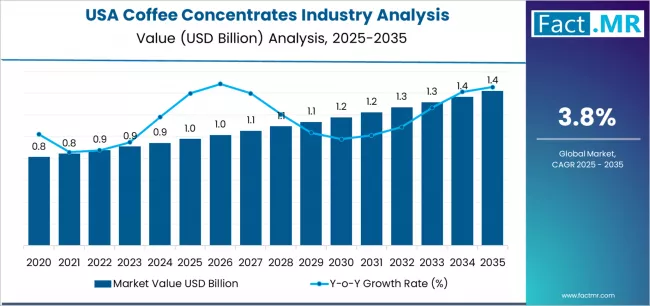

Demand for coffee concentrates in the USA is projected to rise from USD 0.98 billion in 2025 to approximately USD 1.42 billion by 2035. The industry will record an absolute increase of USD 0.44 billion, representing total growth of 44.9 percent and a compound annual growth rate (CAGR) of 3.8 percent. The market’s trajectory reflects expanding consumer preference for premium, quick-prep beverage solutions and the rising influence of café-style products in retail and e-commerce.

Browse Full Report: https://www.factmr.com/report/usa-coffee-concentrates-industry-analysis

Key Growth Drivers

- Convenience-led consumption: Consumers continue to shift toward formats that offer speed, consistency, and minimal preparation effort. Multi-serve and single-serve coffee concentrates support this trend across both home and foodservice channels.

- Cold brew and premiumization: The surge in cold-brew adoption and demand for richer flavor profiles is boosting usage of premium concentrates in cafés, QSRs, and ready-to-drink (RTD) manufacturing.

- Innovation in formulations: Brands are introducing clean-label, functional, low-acid, and specialty-roast concentrates to meet evolving taste expectations and dietary preferences.

- Expansion of foodservice and RTD applications: Coffee concentrates serve as a core input for RTD beverages, flavored beverages, desserts, and culinary applications, strengthening their role in commercial production.

USA Market Insights

The USA remains one of the world’s most mature and innovation-driven coffee markets. Growth is strongest in cold brew concentrates, which continue to gain share in retail and foodservice. Premium and specialty blends dominate value contribution, while functional concentrates enhanced with protein, vitamins, or adaptogens are emerging as high-growth niches.

E-commerce channels, subscription-based delivery, and private-label launches across supermarkets are reshaping consumer access. However, cost-sensitive segments continue to gravitate toward value-tier concentrates and bulk formats.

Technology Trends and Competition

Several trends define competitive differentiation in the USA market:

- Advanced extraction methods improving flavor retention and consistency.

• Shelf-stable, low-acid formulations extending distribution range and reducing losses.

• Clean-label and natural ingredient claims influencing purchasing decisions.

• Automated dispensing systems gaining traction in QSR and institutional foodservice.

• Sustainability-driven packaging innovations, including recyclable and lightweight formats.

Intense competition exists among established coffee brands, specialty roasters, RTD beverage manufacturers, and private-label retailers, each focusing on improved flavor quality, sourcing transparency, and flexible product formats.

Challenges

While outlook remains positive, key constraints include:

- Pricing sensitivity in mainstream consumer segments.

• Seasonal fluctuations affecting cold-brew concentrate demand.

• Supply-chain volatility in coffee sourcing, particularly for specialty-grade beans.

• Growing competition from RTD coffee beverages reducing demand for home-prep categories in some segments.

Strategic Implications

For manufacturers: Build a dual strategy combining premium, specialty-based concentrates with competitively priced mainstream products. Prioritize clean-label innovation, cold-brew quality enhancement, and expanded foodservice partnerships.

For retailers and cafés: Optimize assortment toward premium, cold-brew, and functional concentrates. Strengthen private-label offerings and leverage concentrates to expand beverage customization options.

For investors: Steady growth, strong consumer adoption, and product diversification make the USA coffee concentrates market a resilient investment opportunity, especially across premium and specialty sub-segments.

Outlook Summary

Between 2025 and 2035, the USA coffee concentrates market will maintain steady expansion driven by convenience demand, premiumization, foodservice adoption, and continuous product innovation. While supply-chain variability and pricing pressures may temper short-term growth, long-term demand remains aligned with evolving beverage consumption behaviors and increasing reliance on ready-to-use coffee formats.