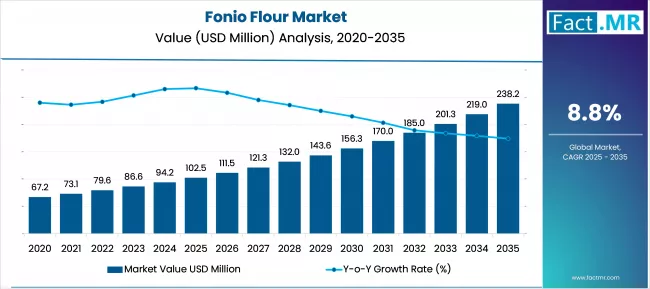

The global fonio flour market is poised for exceptional growth, driven by surging demand for gluten-free, nutrient-rich, and heritage grain alternatives. According to a recent analysis, the market is projected to expand from USD 102.5 million in 2025 to USD 238.2 million by 2035, registering a robust CAGR of 8.8% during the forecast period.

Fonio flour—derived from one of Africa’s oldest cultivated grains—is gaining global relevance as consumers and manufacturers prioritize natural, sustainable, and functional ingredients across food and beverage applications.

Key Market Drivers

Gluten-Free and Clean-Label Food Demand Surges

Consumers increasingly seek minimally processed, allergen-free grains, pushing fonio flour into mainstream food formulations. Its naturally gluten-free profile, high amino acid content, and fast-cooking properties make it a preferred ingredient in baked goods, snacks, cereals, and health foods. Clean-label brands are incorporating fonio flour as a premium alternative to rice, millet, and quinoa.

Rising Adoption in Health and Functional Foods

Fonio flour’s rich micronutrient composition—including iron, potassium, and B-vitamins—drives adoption in functional foods tailored for cardiovascular health, weight management, and digestive wellness. Its low glycemic index and easy digestibility contribute to expanding usage in diabetic-friendly and performance-nutrition product lines.

Growing Interest in Ancient and Sustainable Grains

As sustainability becomes an industry priority, fonio’s low water requirement and climate-resilient cultivation methods position it as an eco-friendly grain. Food manufacturers are exploring fonio flour to reduce carbon footprint and diversify resilient supply chains amid climate-related agricultural uncertainty.

Browse Full Report: https://www.factmr.com/report/5334/fonio-flour-market

Regional Growth Highlights

North America: Fastest Adoption Rate

The U.S. and Canada continue to dominate demand for gluten-free and plant-based ingredients. Rising consumer interest in African heritage grains and strong penetration of health-focused brands are accelerating the region’s fonio flour market footprint.

Europe: Sustainability and Specialty Food Trends Drive Growth

European countries exhibit high consumption of ancient grains and ethical food products. The region’s premium food sector, along with support for sustainable agricultural imports, bolsters uptake of fonio flour in bakery, snack, and nutraceutical categories.

Africa: Production Core and Export Expansion

West African nations—including Mali, Senegal, Burkina Faso, and Guinea—remain the world’s primary fonio producers. Increasing government support for commercialization and export development is strengthening Africa’s position in global supply.

Asia-Pacific: Emerging Market with Strong Potential

Growing health-conscious consumer segments in Japan, South Korea, and Australia are driving early-stage adoption. Local food manufacturers are exploring fonio flour for clean-label packaged foods and gluten-free product lines.

Market Segmentation Insights

By Product Type

- Organic Fonio Flour – Gains popularity among premium and clean-label buyers.

- Conventional Fonio Flour – Dominant in mass-market and industrial applications.

By End Use

- Bakery & Confectionery – Strong adoption in bread, cookies, pastries, and gluten-free mixes.

- Snacks & Ready-to-Eat Foods – Increasing use in chips, crackers, and energy bars.

- Nutraceuticals & Health Foods – Expanding presence in dietary supplements and functional blends.

- Foodservice Industry – Growing deployment in specialty restaurants and ethnic cuisines.

Market Challenges

Despite promising growth prospects, the fonio flour market faces key constraints:

- Supply Chain Limitations: Limited mechanization and fragmented production across West Africa affect export scalability.

- Higher Cost Compared to Conventional Flours: Price sensitivity may restrict consumption in developing regions.

- Lack of Global Awareness: Consumer familiarity with fonio remains relatively low outside niche health food circles.

- Quality Standardization Needs: Ensuring consistent milling quality and grain purity remains an industry priority.

Competitive Landscape

The fonio flour market is moderately fragmented, with companies focusing on fair-trade sourcing, sustainable processing, and innovative product development. Key players are expanding distribution networks, enhancing supply chain traceability, and partnering with African cooperatives to stabilize sourcing.

Prominent Companies Include:

- Yolélé Foods

- Aduna Ltd.

- Soma Nutrition

- African Wholefoods

- Exotic Grains International

- Agrowex

These companies are promoting fonio-based product lines and introducing innovative blends to meet fast-growing global demand.

Future Outlook: Toward Sustainable, Ethical, and Functional Food Innovation

The next decade will see fonio flour transition from a niche African grain to a globally recognized functional ingredient. As brands prioritize sustainability, nutrient density, and clean-label credibility, fonio flour will play a central role in next-generation food formulations.

Manufacturers that invest in ethical sourcing, supply chain modernization, and product diversification stand to gain the most as the market moves toward rapid expansion.