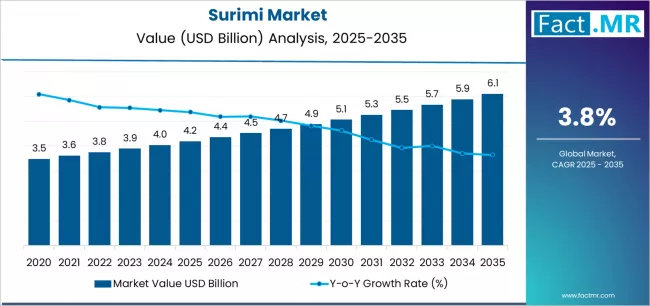

The global surimi market is entering a phase of steady, sustained growth as demand for affordable, protein-rich, and versatile seafood products accelerates worldwide. According to a recent analysis (source removed), the market is valued at USD 4.2 billion in 2025 and is projected to reach USD 6.1 billion by 2035, marking an absolute increase of USD 1.9 billion over the forecast period. This represents a total growth of 45.2%, with the market set to expand at a CAGR of 3.8% between 2025 and 2035. Overall market size is expected to rise 1.45X by the end of the assessment period.

Surimi products—valued for their texture, mild flavor, and functionality—continue to gain traction in retail, foodservice, and processed seafood segments. As the global food industry seeks cost-efficient and sustainable protein solutions, surimi stands out as a preferred choice across key consumption regions.

Strategic Market Drivers

Surging Demand for Processed and Ready-to-Cook Seafood

Urban consumers increasingly favor convenient and protein-rich food options. Surimi fits this trend by offering high nutritional value, long shelf life, and versatility across snacks, seafood analogs, and ready-to-eat products. The rising popularity of imitation crab (kani), fish balls, and surimi-based sausages continues to boost market growth.

Expansion of Aquaculture and Sustainable Fishing Practices

The availability of fish species suitable for surimi production—such as Alaska pollock, threadfin bream, and hake—is improving with better aquaculture management. This is helping stabilize raw material supply and support long-term industry growth.

Growing Adoption of Seafood Analogues in Plant-Leaning Diets

While surimi is fish-based, its use in hybrid and low-fat seafood analogs aligns with consumer interest in healthier and more sustainable diets. Manufacturers are innovating with cleaner labels, reduced sodium levels, and improved texture technologies.

Rising Penetration in Foodservice and Institutional Markets

Hotels, QSR chains, cafeterias, and catering services are expanding their use of surimi due to its cost-effectiveness and consistency. This segment remains one of the strongest growth contributors globally.

Browse Full Report: https://www.factmr.com/report/5014/surimi-market

Regional Growth Highlights

East Asia: The Global Powerhouse

East Asia remains the largest producer and consumer of surimi products. Japan, China, and South Korea continue to lead in innovation, value-added surimi snacks, and advanced processing technologies. The region benefits from strong seafood consumption culture and robust distribution networks.

North America: Growing Shift Toward Value-Added Seafood

The U.S. and Canada are witnessing rising consumption of imitation crab and surimi-based convenience foods. Consumer preference for low-fat, budget-friendly seafood drives product innovation in salads, sushi, sandwiches, and frozen meal kits.

Europe: Demand for Sustainable and Traceable Seafood

European consumers prioritize quality and environmental responsibility. Surimi producers in the region are focusing on traceable sourcing, reduced additives, and MSC-certified raw materials. France, Spain, and the U.K. remain high-consumption markets.

Emerging Markets: Rising Protein Demand

Latin America, the Middle East, and South Asia present substantial growth potential. Urbanization, expanding retail infrastructure, and rising disposable incomes are supporting adoption of surimi products in both frozen and chilled formats.

Market Segmentation Insights

By Source

- Alaska Pollock – Dominant source due to supply stability and mild flavor profile.

- Other Species (Hake, Threadfin Bream, Pacific Whiting) – Gaining traction based on regional availability.

By Form

- Frozen Surimi – Preferred by industrial processors for consistent quality.

- Chilled/Refrigerated Surimi – Increasing demand in retail and foodservice segments.

By End Use

- Food Processing Industry – Largest consumer of surimi for crabsticks, fish balls, and ready-to-cook products.

- Foodservice – Rapid adoption driven by cost efficiency.

- Retail/Household Consumption – Rising interest in quick meal solutions.

Challenges and Market Considerations

- Raw Material Availability Issues: Overfishing concerns and natural stock fluctuations can impact supply chains.

- Price Sensitivity in Developing Markets: Competing protein sources often offer lower production costs.

- Need for Clean-Label Upgrades: Growing consumer scrutiny drives demand for reduced additives and healthier formulations.

- Logistics and Cold Chain Constraints: Proper temperature control remains critical for product safety and quality.

Competitive Landscape

The global surimi market is shaped by innovation-driven competition, where leading players focus on advanced processing technologies, sustainable sourcing, and premium textures.

Key Companies Profiled:

- Nippon Suisan Kaisha, Ltd. (Nissui)

- Thai Union Group

- Maruha Nichiro Corporation

- Viciunai Group

- Pacific Seafood Group

- Glendale Foods

- Gadre Marine

- Oceana Group

Companies are ramping up investments in cold chain logistics, product differentiation (e.g., flavored surimi, snacks, sticks), and sustainable fishing certifications.

Recent Industry Developments

- Surimi manufacturers have increased investments in MSC-certified fish sources, reinforcing sustainability credibility.

- New product launches in Asia and Europe feature high-protein, low-sodium, and clean-label surimi offerings for retail and foodservice.

- Automation and AI-based inspection systems are being adopted to enhance texture consistency and reduce processing waste.

Future Outlook: Toward Sustainable, Convenient, and Versatile Seafood Solutions

The surimi market is positioned for resilient growth in the decade ahead. As consumers seek affordable, nutritious, and convenient food options, surimi-based products will gain further traction across global markets. Companies that prioritize sustainable sourcing, product innovation, and value-added applications will lead the next phase of evolution—delivering versatile seafood solutions for a fast-changing global food landscape.