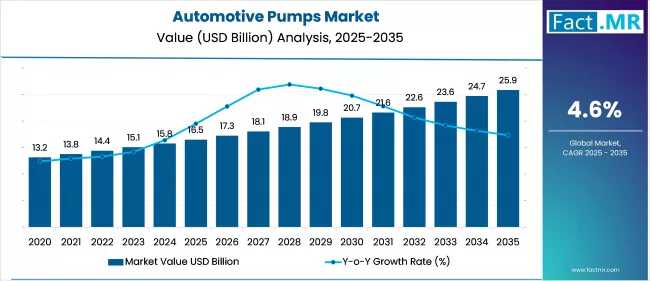

The global automotive pumps market is projected to grow from USD 16.5 billion in 2025 to USD 25.9 billion by 2035, representing a CAGR of 4.6%, according to Future Market Insights (FMI). The growth is primarily driven by the increasing adoption of electric and hybrid vehicles, advanced thermal and fluid management systems, and stringent global emission standards.

Market Overview

-

2025 Market Value: USD 16.5 billion

-

2035 Forecast Value: USD 25.9 billion

-

CAGR (2025–2035): 4.6%

-

Leading Pump Type (2025): Fuel Injection Pumps (38% market share)

-

Fastest-Growing Technology: Electric Pumps

-

Key Growth Region: Asia-Pacific

Growth Drivers

-

Electrification: Electric and hybrid vehicles require electric coolant, brake vacuum, and transmission fluid pumps. Independent operation from engine RPM reduces energy loss and improves efficiency.

-

Emission Compliance: Regulatory standards such as Euro 6/7, CAFE, and BS-VI drive adoption of energy-efficient pumps.

-

Thermal Management: Advanced cooling and fluid circulation systems support battery safety and vehicle efficiency.

-

Emerging Market Production: Vehicle production growth in India, Southeast Asia, and Latin America increases demand for mechanical and hybrid pump systems.

-

Connected Systems: Integration of sensors and ECUs allows real-time diagnostics, predictive maintenance, and smart fluid management.

Segment Analysis

By Pump Type

-

Fuel Injection Pumps: 38% share, dominant globally.

-

Coolant Pumps: Fastest-growing segment due to EV and hybrid adoption.

-

Others: Engine oil pumps, transmission oil pumps, steering pumps, vacuum pumps, windshield washer pumps.

By Technology

-

Mechanical Pumps: Largest volume; widely used in ICE vehicles.

-

Electric Pumps: Fastest-growing; essential in EVs and hybrids for thermal and brake management.

By Vehicle Type

-

Passenger Cars: Largest share; high volume production and advanced thermal/fuel systems.

-

Heavy Commercial Vehicles (HCVs): Fastest-growing; increased logistics, stricter emission norms, adoption of electric pumps.

By Sales Channel

-

OEM: Largest revenue share; primary integration during vehicle manufacturing.

-

Aftermarket: Fastest-growing; replacement demand, high-mileage vehicle maintenance, e-commerce sales growth.

Regional Insights

-

Asia-Pacific: Market leader; China and India drive EV-related pump demand. Electric coolant and vacuum pumps dominate.

-

North America: Moderate growth; driven by hybrid and EV adoption, large ICE fleet, and federal incentives.

-

Europe: Steady growth; regulatory compliance and EV adoption in Germany, France, Netherlands.

-

Latin America, Middle East, Africa (LAMEA): Emerging markets; ICE vehicles dominate; gradual EV pump adoption.

Key Market Trends

-

Shift from mechanical to electric pumps, particularly for battery thermal management.

-

Increased adoption of smart pumps with IoT connectivity and predictive analytics.

-

Multi-circuit and modular pump systems for EVs and high-efficiency ICE vehicles.

-

OEM partnerships with EV startups for co-development of thermal management solutions.

Market Challenges

-

High costs of electric and smart pumps limit adoption in low-cost vehicles and developing regions.

-

Complexity integrating pumps with hybrid and EV powertrains.

-

Uneven EV adoption across regions slows global penetration of electric pumps.

-

Supply chain disruptions and raw material price volatility impact production.

Competitive Landscape

Major players dominating the automotive pumps market:

-

Robert Bosch GmbH – Fuel and oil pumps; electric coolant solutions.

-

Denso Corporation – Fuel injection, coolant, and vacuum pumps.

-

Aisin Corporation – High-performance mechanical and electric pumps.

-

Delphi Technologies – Advanced fuel and oil pump solutions.

-

Continental AG – Transmission and steering pumps; electric pump integration.

-

Valeo S.A., Mahle GmbH – Thermal management, electric pumps for EVs.

Recent Developments

-

TI Fluid Systems, Feb 2025: Launched 12V Electric Coolant Pump for BEVs at Tianjin, China facility. Features precise temperature regulation, energy efficiency, and environmentally conscious design.

-

OEMs increasingly integrating IoT-enabled, predictive-maintenance pumps for hybrid and electric platforms.

Outlook (2025–2035)

-

Electric pumps to gain a larger share of revenue, particularly in EVs and hybrids.

-

Mechanical pumps remain essential for ICE vehicles and emerging markets.

-

Growth supported by predictive analytics, connected vehicle ecosystems, and energy-efficient pump technologies.

-

Asia-Pacific expected to continue leading global market share, with North America and Europe maintaining steady growth.

Browse Full report : https://www.factmr.com/report/25/automotive-pump-market

Conclusion

The automotive pumps market is evolving from conventional mechanical dominance to a hybrid ecosystem of mechanical and smart electric pumps. Market leaders focusing on innovation, electrification, and connected solutions will shape the competitive landscape over the next decade.