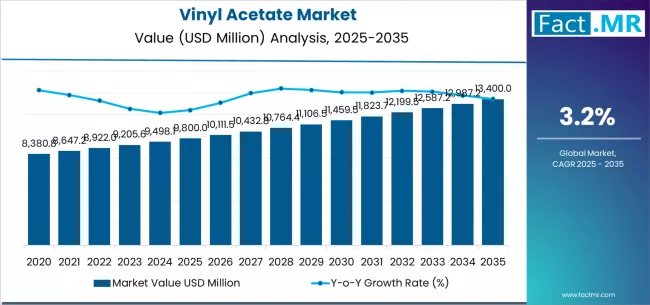

The global vinyl acetate market is projected to expand from approximately USD 9.8 billion in 2025 to around USD 13.4 billion by 2035, representing a compound annual growth rate (CAGR) of about 3.2% over the forecast period. Growth is underpinned by sustained industrial expansion, rising demand for polyvinyl acetate (PVA) and emulsion applications, and increasing adoption in adhesives, coatings, packaging, construction and other high‑performance chemical sectors.

Vinyl acetate—a key monomer intermediate that underpins a range of polymers and resins—remains a foundational building block in modern chemical formulations. As end‑use industries demand improved adhesion, film‑forming, durability, moisture resistance and cost‑efficiency, the role of vinyl acetate continues to evolve.

Key Market Insights at a Glance

- Market Value (2025): USD 9,800 million

- Forecast Value (2035): USD 13,400 million

- CAGR (2025–2035): ~3.2%

- Leading Application Segment: PVA / Emulsions (~45% share)

- Dominant End‑Use Sectors: Adhesives (~30% share) and coatings

- Key Growth Regions: Asia‑Pacific leads, followed by North America and Europe

- Top Players: Celanese Corporation; Dow; LyondellBasell; Sinopec; Kuraray; Wacker Chemie; Clariant

To Access the Complete Data Tables & in-depth Insights, Request a Discount on this report: https://www.factmr.com/connectus/sample?flag=S&rep_id=8755

Market Drivers / Growth Overview

A set of core factors are driving the vinyl acetate market’s expansion:

- Industrial & infrastructure growth: Demand from construction, packaging and manufacturing sectors supports vinyl acetate uptake as adhesives and coatings become more prevalent in developing regions.

- Adhesives and coatings performance requirements: Vinyl acetate‑based polymers deliver improved bond strength, flexibility and environmental compliance, pushing demand upward.

- Regional manufacturing expansion, especially Asia‑Pacific: Emerging economies such as India and China are scaling up chemical production and downstream polymer facilities, improving local demand for vinyl acetate.

- Value‑chain integration and specialty grades: Producers are focusing on tailored vinyl acetate intermediates to meet specific performance or regulatory standards, supporting premium product demand.

However, the market is moderated by cost pressures from feedstock volatility, substitution risk from alternative chemistries, and slower growth in mature markets.

Segmentation & Key Drivers

By Application:

- PVA / Emulsions lead the market (≈45% share) as the staple use case in adhesives, coatings and film.

- Adhesives (~30%) follow, reflecting strong bonding demand in construction, packaging and building sectors.

- Additional applications include coatings, packaging films, textiles and others.

By End‑Use Industry:

- Construction & infrastructure adoption of vinyl acetate‑based adhesives and coatings is a major driver.

- Packaging and films are rising due to demand for performance polymers in flexible and sustainable packaging.

- Automotive and manufacturing also contribute via specialty polymer demand.

Segmentation growth is influenced by end‑use industry growth rates, regional production capacity, polymer formulation trends and regulatory requirements.

Regional & Country Insights

- Asia‑Pacific: The fastest‑growing region, driven by manufacturing, packaging, building activity and investment in chemical infrastructure in China, India and Southeast Asia.

- North America: A mature market with innovation‑led demand; growth is moderate and tied to specialty grades and downstream formulation upgrades.

- Europe: Steady growth supported by regulatory compliance, high‑perform‑ance polymer use and established chemical industry base.

- Latin America / Middle East & Africa: Emerging opportunities exist via expansion of manufacturing and infrastructure, though current base volumes are lower.

Regional growth is shaped by local industrial investment, supply‑chain infrastructure, feedstock access and regional chemical integration.

Competitive Landscape

The vinyl acetate market is moderately consolidated with major global chemical producers holding leading positions. Key companies include Celanese Corporation, Dow, LyondellBasell, Sinopec, Kuraray, Wacker Chemie and Clariant.

Competitive strategies include:

- Scaling production capacity and feed‑stock integration to manage cost and ensure supply reliability.

- Developing specialty vinyl acetate grades (bio‑based, low‑VOC, high‑purity) to capture value beyond commodity volume.

- Expanding into high‑growth regions via local plants or joint‑ventures to secure regional demand.

- Partnering with downstream formulators (adhesives, coatings, packaging manufacturers) for co‑development and supply assurance.

Market Outlook & Strategic Insights

Over the forecast period through 2035, the vinyl acetate market is expected to deliver steady growth, though at a relatively modest rate compared to some specialty chemical segments. Key strategic imperatives for stakeholders include:

- Focusing on specialty grades and value‑added applications (higher purity, bio‑based, performance adhesives) to differentiate and enhance margins.

- Targeting emerging manufacturing geographies, especially within Asia‑Pacific where foundational demand expansion will be strongest.

- Strengthening supply‑chain and feed‑stock resilience, particularly given raw‑material volatility and cost exposure.

- Collaborating with end‑user formulators (packaging, adhesives, coatings) to align product development and secure longer‑term contracts.

- Monitoring sustainability and regulatory trends, which drive demand for eco‑compliant and performance‑enhanced vinyl acetate derivatives.

Companies that align with these strategic priorities—while maintaining operational efficiency, feed‑stock optimization and global footprint—will be well‑positioned to capture value in a market projected to reach approximately USD 13.4 billion by 2035.

Purchase Full Report for Detailed Insights

For access to full forecasts, regional breakouts, company share analysis, and emerging trend assessments, you can purchase the the complete report: https://www.factmr.com/checkout/8755

Have specific requirements and need assistance on report pricing or have a limited budget? Please contact sales@factmr.com

Contact:

US Sales Office

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583, +353-1-4434-232

Email: sales@factmr.com

About Fact.MR:

Fact.MR is a global market research and consulting firm, trusted by Fortune 500 companies and emerging businesses for reliable insights and strategic intelligence. With a presence across the U.S., UK, India, and Dubai, we deliver data-driven research and tailored consulting solutions across 30+ industries and 1,000+ markets. Backed by deep expertise and advanced analytics, Fact.MR helps organizations uncover opportunities, reduce risks, and make informed decisions for sustainable growth.