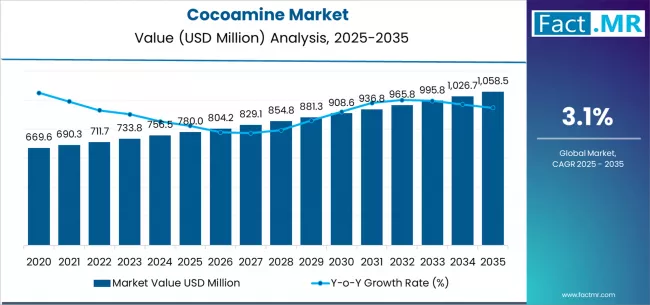

The global cocoamine market is projected to expand from approximately USD 780.0 million in 2025 to around USD 1,060.0 million by 2035, representing a compound annual growth rate (CAGR) of about 3.1% over the forecast period. Growth is underpinned by increasing global demand for bio‑based surfactants, growing adoption of cocoamine derivatives in agrochemical formulations, and a rising focus on natural‑ingredient sourcing driving premium oleochemical procurement across various industrial and specialty chemical applications.

Key Market Insights at a Glance

- Market Value (2025): USD 780.0 million

- Forecast Value (2035): USD 1,060.0 million

- CAGR (2025–2035): ~3.1%

- Leading Product Type (2025): Primary cocoamines (~55.0% share)

- Leading Application Segment (2025): Surfactants (~40.0% share)

- Dominant Source (2025): Coconut oil (100.0% share)

- Key Growth Regions: Asia‑Pacific, North America, Europe

- Top Players: Kao Corp; Evonik; Huntsman; Clariant; AkzoNobel

To Access the Complete Data Tables & in-depth Insights, Request a Discount on this report: https://www.factmr.com/connectus/sample?flag=S&rep_id=8744

Market Drivers / Growth Overview

Key factors propelling the cocoamine market include:

- Growing preference for bio‑based chemicals: Demand for coconut‑derived amines is rising as industries adopt sustainable and natural solution chemistries.

- Expanding industrial chemical applications: Cocoamines are increasingly used in surfactants, agrochemicals and lubricant additives due to favourable performance and regulatory appeal.

- Agrochemical formulation innovation: Adoption of cocoamine derivatives as adjuvants, emulsifiers or specialty intermediates is increasing across precision agriculture and chemical‑input innovation.

- Industrial chemistry performance needs: Customer demand for superior surface‑activity, compatibility and processing efficiency is supporting cocoamine uptake in specialty and industrial chemical markets.

- Feed‑stock sourcing and cost‑efficiency: Coconut oil as the exclusive source aligns production with established oleochemical infrastructure, supporting cost‑predictability and supply‑chain stability.

Still, the market faces challenges including raw‑material price volatility (particularly coconut oil), competition from synthetic amine alternatives and complexity of manufacturing high‑performance cocoamine derivatives.

Segmentation & Key Drivers

By Type:

- Primary cocoamines lead the market (~55% share) due to their broad applicability in surfactants and industrial usage.

- Secondary cocoamines and tertiary cocoamines serve more specialised or higher‑value segments but have smaller base shares.

By Application:

- Surfactants segment (~40% share) dominates, thanks to demand in personal care, household-cleaning and industrial‑detergent markets.

- Lubricants, agrochemicals and other industrial specialties contribute meaningful growth potential driven by performance‑chemistry or regulatory‑shift needs.

By Source:

- Coconut oil derived cocoamine holds a dominant share (~100%) in 2025, reflecting the entrenched oleochemical supply chain.

- Other feed‑sources remain negligible or emerging in 2025 but may become more relevant under raw‑material pressure.

Segmentation growth is influenced by regulatory trends (bio‑based chemical mandates), application switching behaviour, feed‑stock availability and regional cost environments.

Regional & Country Insights

- Asia‑Pacific: Emerging as the fastest‑growing region thanks to strong oleochemical production in countries such as Indonesia, Philippines and India, alongside rising industrial chemical demand.

- North America: Mature region driven by performance‑chemistry adoption, regulatory push for sustainable ingredients and high‑volume surfactant industry demand.

- Europe: Steady growth supported by sustainability regulations, strong oleochemical capabilities and industrial chemical applications, albeit at more modest growth rates.

- Latin America / Middle East & Africa: Smaller base but increasing potential as chemical manufacturing expands and sustainability‑driven formulations gain traction.

Regional performance is shaped by oleochemical feed‑stock availability, manufacturing investment, regulation on bio‑based chemistries and industrial end‑use growth.

Competitive Landscape

The cocoamine market is moderately competitive, with global oleochemical integrators and specialty chemical firms competing for share. Leading companies include Kao Corp, Evonik, Huntsman, Clariant, AkzoNobel, Sasol, Stepan, Croda, KLK Oleo, and Wilmar.

Competitive strategies include:

- Expanding production capabilities and optimizing cost structures in oleochemical processing.

- Enhancing product portfolios with high‑purity grades or application‑specific cocoamine derivatives for niche markets.

- Regionalizing supply‑chain footprint (particularly in Asia‑Pacific) to ensure feed‑stock security and local responsiveness.

- Partnering with downstream surfactant and agrochemical formulators to secure long‑term supply contracts.

Market Outlook & Strategic Insights

Over the forecast period through 2035, the cocoamine market is expected to deliver steady growth, with value‑migration toward higher‑performance grades and industrial‑specialty applications rather than purely volume expansion. Strategic priorities for stakeholders include:

- Focusing on surfactants and industrial‑chemical applications, which currently capture the largest share and will continue to drive demand.

- Investing in high‑purity cocoamine grades and derivatives to address specialty chemical requirements and capture premium pricing.

- Targeting emerging manufacturing hubs in Asia‑Pacific to capitalise on feed‑stock proximity, growing chemical industry and cost advantages.

- Monitoring raw‑material price volatility, particularly coconut oil, and securing supply‑chain resilience to safeguard margins.

- Collaborating with end‑users on application‑specific cocoamine formulations to deepen customer relationships and reduce substitution risk.

Companies that align with these strategic initiatives — while maintaining operational flexibility, feed‑stock security and product optimisation — will be well‑positioned to capture value in a market projected to reach approximately USD 1,060.0 million by 2035.

Purchase Full Report for Detailed Insights

For access to full forecasts, regional breakouts, company share analysis, and emerging trend assessments, you can purchase the the complete report: https://www.factmr.com/checkout/8744

Have specific requirements and need assistance on report pricing or have a limited budget? Please contact sales@factmr.com

Contact:

US Sales Office

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583, +353-1-4434-232

Email: sales@factmr.com

About Fact.MR:

Fact.MR is a global market research and consulting firm, trusted by Fortune 500 companies and emerging businesses for reliable insights and strategic intelligence. With a presence across the U.S., UK, India, and Dubai, we deliver data-driven research and tailored consulting solutions across 30+ industries and 1,000+ markets. Backed by deep expertise and advanced analytics, Fact.MR helps organizations uncover opportunities, reduce risks, and make informed decisions for sustainable growth.