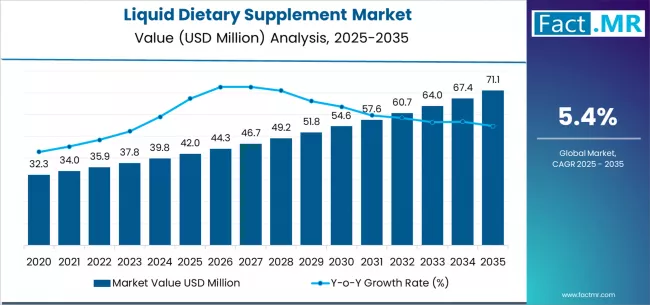

The global liquid dietary supplement market is projected to expand from approximately USD 42.0 billion in 2025 to around USD 71.2 billion by 2035, representing a compound annual growth rate (CAGR) of about 5.4% over the forecast period. Growth is being driven by heightened consumer demand for convenient, bio‑available nutrition formats, increasing health‑wellness awareness, and expansion of distribution across pharmacy, online and mass‑retail channels.

Liquid dietary supplements — including liquid formats of vitamins, minerals, botanicals, proteins and other functional nutrients — are growing in appeal as consumers seek alternatives to traditional pills and capsules. The convenience, faster absorption and suitability for multiple consumer groups (adults, seniors, kids) are helping to shift usage patterns globally.

Key Market Insights at a Glance

- Market Value (2025): USD 42.0 billion

- Forecast Value (2035): USD 71.2 billion

- CAGR (2025–2035): ~5.4%

- Leading Product Type: Vitamins & Minerals (~47 % share)

- Dominant Distribution Channel: Pharmacies/Drugstores (~39 % share)

- Key Growth Regions: Asia Pacific, North America, Europe

- Top Key Players: Bayer; Haleon; Procter & Gamble; Nestlé Health Science; Pharmavite

To Access the Complete Data Tables & in-depth Insights, Request a Discount on this report: https://www.factmr.com/connectus/sample?flag=S&rep_id=46

Market Drivers / Growth Overview

Several factors are underpinning growth in the liquid dietary supplement market:

- Growing health‑wellness and prevention mindset: Consumers increasingly adopt supplements to support immunity, general wellness, performance and ageing‑well‑being, favouring liquid formats for ease of use.

- Convenience and superior absorption: Liquid formats are perceived as more user‑friendly and potentially more bio‑available than some solid formats, which appeals especially to children, seniors and on‑the‑go consumers.

- Expanding distribution and retail access: Pharmacies, drugstores and online channels are scaling liquid supplement offerings; improved product visibility and logistics are driving volume.

- Innovation in formulation and format: Brands are introducing flavour‑varied, sugar‑reduced/zero‑added and premium liquid supplements, widening appeal and boosting premium value.

- Emerging‑market growth and rising wellness spending: In regions such as Asia Pacific and Latin America, rising disposable income and wellness awareness are creating strong new demand for advanced supplement formats.

Challenges for market participants include regulatory scrutiny around claims, quality assurance in liquid formats, competition from capsule/powder supplements and cost‑sensitivity in certain demographics.

Segmentation & Key Drivers

By Product Type:

- Vitamins & Minerals – dominate market share due to broad usage and high recognition.

- Herbal/Botanicals – growing as consumer interest in natural wellness rises.

- Omega/Proteins/Others – emerging formats especially in sports, active lifestyle and premium segments.

By Distribution Channel:

- Pharmacies/Drugstores – largest share owing to professional recommendation and formatted‑liquid trust.

- Online/D2C – fastest growth channel as e‑commerce penetration increases and convenience builds.

- Mass/Grocery & Other Retail – maintain volume base via impulse and health‑food retailing.

Key segmentation drivers include consumer preferences, accessibility of liquid formats, pricing and brand positioning, regulatory category (over‑the‑counter vs wellness), and regional retail infrastructure.

Regional & Country Insights

- Asia Pacific: The fastest growing region, propelled by expanding wellness markets, rising disposable income, modernising retail infrastructure and increased adoption of convenient supplement formats.

- North America: A mature market with steady growth, driven by advanced health‑wellness culture, high consumer expectation for convenience and strong online retail growth.

- Europe: Moderate growth supported by developed retailers, regulatory framework and increasing interest in functional nutrition though pricing and regulatory complexity may moderate pace.

- Latin America / Middle East & Africa: Emerging opportunities as wellness culture develops, retail modernises and import/distribution of advanced supplements improves.

Regional growth depends on wellness culture penetration, retail channel expansion, affordability of liquid formats, regulatory clarity and brand awareness.

Competitive Landscape

The liquid dietary supplement market is moderately competitive, with leading global consumer‑health and nutrition firms holding significant share, alongside niche specialty‑brands. Key players include Bayer, Haleon, Procter & Gamble, Nestlé Health Science and Pharmavite.

Competitive strategies include:

- Launching clinically‑supported liquid formulations with advanced claims (e.g., high absorption, targeted wellness).

- Expanding online and subscription‑model channels for recurring revenue and direct‑consumer relationships.

- Partnering with retail pharmacies, health‑food retailers and e‑commerce platforms to strengthen shelf presence and distribution‑reach.

- Investing in flavour innovation, premium packaging, multi‑serving formats and region‑specific variants to differentiate.

Market Outlook & Strategic Insights

Over the forecast period through 2035, the liquid dietary supplement market is expected to deliver steady, moderate growth as consumers increasingly prefer liquid and convenient formats. Strategic imperatives for stakeholders include:

- Prioritising vitamin & mineral liquid formats, which currently dominate share and remain broad base usage.

- Targeting emerging markets (Asia Pacific, Latin America) where growth from low base and rising wellness adoption is strongest.

- Investing in online/D2C and subscription models to capture recurring usage and build brand loyalty.

- Innovating in flavour, format (shots, RTD bottles), premium positioning and multi‑benefit claims to drive margin expansion.

- Navigating regulatory and quality control frameworks for liquid supplements, ensuring product integrity, safety and consumer trust.

Companies that align with these strategic priorities—while managing cost, regulatory compliance and consumer experience—will be well‑positioned to capture value in a market projected to reach approximately USD 71.2 billion by 2035.

Purchase Full Report for Detailed Insights

For access to full forecasts, regional breakouts, company share analysis, and emerging trend assessments, you can purchase the the complete report: https://www.factmr.com/checkout/46

Have specific requirements and need assistance on report pricing or have a limited budget? Please contact sales@factmr.com

Contact:

US Sales Office

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583, +353-1-4434-232

Email: sales@factmr.com

About Fact.MR:

Fact.MR is a global market research and consulting firm, trusted by Fortune 500 companies and emerging businesses for reliable insights and strategic intelligence. With a presence across the U.S., UK, India, and Dubai, we deliver data-driven research and tailored consulting solutions across 30+ industries and 1,000+ markets. Backed by deep expertise and advanced analytics, Fact.MR helps organizations uncover opportunities, reduce risks, and make informed decisions for sustainable growth.