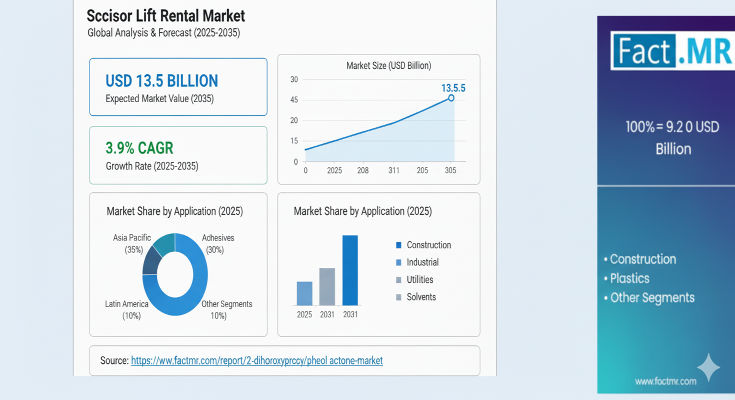

The global scissor lift rental market is projected to grow from approximately USD 9.2 billion in 2025 to about USD 13.5 billion by 2035, at a compound annual growth rate (CAGR) of 3.9% over the the forecast period.

Industrial and Construction Demand Underpin Market Expansion:

Scissor lifts are essential rental equipment across construction, maintenance, industrial, and warehousing applications, enabling safe and efficient work at elevated heights. Rental models are preferred due to flexibility, cost-effectiveness, and ability to scale with short-term project demands across infrastructure and facility maintenance sectors. Rental fleet utilization is being strengthened by equipment management systems and increasing adoption of electric lifts, especially in indoor or low-emission environments.

Segmentation & Key Drivers:

-

By power source / type: Electric scissor lifts dominate the rental market, capturing about 65% share of the rental equipment mix thanks to battery-powered systems, low noise, zero emissions, and suitability for indoor work.

-

By lift height: The 6–12 m platform height segment leads with around 40% of rental share, being suited for mid-level height tasks in construction, maintenance, commercial fit-outs, and industrial settings.

-

End-use / applications: Key demand arises from construction and building maintenance, facility maintenance, warehousing or indoor industrial operations, and periodic maintenance tasks requiring elevated access.

-

Key drivers: Rising infrastructure development, increased construction and renovation activities, urban development, facility maintenance demand, and preference for rental over purchase for flexible project scheduling.

To Access the Complete Data Tables & in-depth Insights, Request a Discount on this report: https://www.factmr.com/connectus/sample?flag=S&rep_id=8626

Key Market Insights at a Glance:

-

Market Value (2025): USD 9.2 billion

-

Forecast Value (2035): USD 13.5 billion

-

CAGR (2025-2035): 3.9%

-

Dominant type / power source: Electric scissor lifts (~65% share)

-

Leading lift height segment: 6 – 12 m lifts (~40% share)

-

Primary application: Construction / maintenance & industrial rental

-

Fastest-growing adoption regions: Asia Pacific, emerging economies, plus strong rental growth in North America

Five Forces Driving Market Growth:

-

Rental flexibility: The ability to rent rather than buy reduces capital expenditure for contractors or maintenance teams, making scissor lifts attractive for short or mid-term projects.

-

Electrification push: Electric lifts reduce emissions, noise, and regulatory compliance burdens, especially for indoor or urban projects, increasing adoption in rental fleets.

-

Infrastructure expansion: Growing construction and renovation projects globally drive demand for aerial access equipment rental rather than investment in owned equipment.

-

Fleet management & digital tools: Rental operators are increasingly using digital equipment management, telematics, maintenance scheduling, and fleet optimization to boost utilization and reduce downtime.

-

Regulation & safety standards: Stricter safety regulations for working at height push adoption of safer, regulated equipment (scissor lifts) rather than manual or ladder methods, boosting rental demand.

Regional & Country Highlights:

-

Rapid infrastructure and construction growth in regions like Asia Pacific (especially emerging economies) is boosting rental demand significantly.

-

North America also remains a major rental market, driven by commercial construction, warehouse maintenance, facility upgrades, and strong rental industry infrastructure.

-

Other emerging markets are seeing rising demand due to urbanization, industrial facility expansion, and increasing awareness of rental as a flexible equipment strategy.

Competitive Landscape

Major players in the the rental / equipment / aerial work platform / scissor lift industry include global OEMs and rental companies operating large fleets of scissor lifts. These players invest in electric / battery-powered models, mid-height lifts, and maintenance & operator training to service rental clients effectively.

Market Outlook & Strategic Insights:

Over the forecast decade, the scissor lift rental market is expected to shift even more toward electric battery-powered lifts and mid-height platforms (6–12 m) that match typical construction / maintenance demands. Rental companies that invest in digital fleet management, maintenance, and battery upgrades will be well positioned to capture growing demand from infrastructure, facility maintenance, and industrial uses.

Purchase Full Report for In-Depth Insights:https://www.factmr.com/checkout/8626

“Rental operators who adopt electric lifts and optimize fleet utilization through digital systems will capture significant opportunities in height access across construction, maintenance and industrial sectors.”

About Fact.MR:

Fact.MR is a global market research & consulting organization providing data-backed insights, forecasts, and strategic intelligence across equipment rental, construction, industrial and infrastructure markets. It helps stakeholders make informed decisions via comprehensive market analysis, trend forecasting, and competitive benchmarking.