The global hydrogen market is entering a pivotal growth phase. In 2024, the market is estimated at US$ 18.23 billion, and by the end of 2034 it is projected to reach approximately US$ 47.83 billion, reflecting a compound annual growth rate (CAGR) of 10.4% over the decade. This remarkable growth underscores hydrogen’s shift from a niche industrial feedstock to a broad-based clean energy carrier driving decarbonisation across transportation, industry, power generation and chemicals.

The Drivers of Accelerated Adoption

Several major themes are converging to support hydrogen’s growth. First, global policy momentum is strong: countries around the world are advancing net-zero targets, mandating lower carbon emissions, and viewing hydrogen (especially low-carbon or “green” hydrogen) as a critical enabler.

Second, hydrogen’s versatility is attracting widespread interest. It is used in oil refining, ammonia and methanol production, steel manufacture, transportation (fuel cell vehicles), and emerging applications such as energy storage and grid balancing.

Third, technology improvements—particularly in electrolysis, fuel-cells, storage, pipeline transport and hydrogen logistics—are steadily reducing cost per kilogram of hydrogen, improving scalability and making new applications viable.

Finally, large scale investments and strategic partnerships between industrial gas companies, energy majors, chemical firms and governments are providing the necessary infrastructure and supply-chain development to support the scale-up.

Market Segmentation & Key Trends

Production Mode & Delivery

Centralised production remains the dominant mode, due to economies of scale, ability to optimise feedstock and infrastructure, and logistics efficiencies. In 2024, centralised production is estimated to generate over 60% of hydrogen output; this delivery model is set to expand further through 2034.

Application Domains

Hydrogen’s largest current applications remain industrial: refining, chemicals (especially ammonia), and long-established uses as feedstock. However, the fastest growth is expected in mobility (fuel-cell vehicles), power-generation support, industrial processes such as steel-making and cement, and emerging areas like hydrogen-based synthetic fuels.

Geographic Dynamics

-

North America: The region is forecast to grow at one of the highest regional CAGRs (about 10.9%) between 2024 and 2034, driven by strong policy support, renewable energy resources for green hydrogen, and infrastructure build-out.

-

East Asia: With a projected CAGR of around 10.6%, East Asia (including China, South Korea and Japan) is a critical growth engine. Large policy programmes, capacity build-out of electrolyzers, and industrial scale-up of hydrogen use underpin this expansion.

-

Other Regions: Europe, the Middle East & Africa and Latin America will also see robust growth, albeit from smaller bases. Europe’s advanced manufacturing and regulation-driven decarbonisation add momentum; the Middle East is building export-oriented hydrogen infrastructure; Latin America holds long-term promise thanks to abundant renewable resources.

Competitive Landscape & Key Players

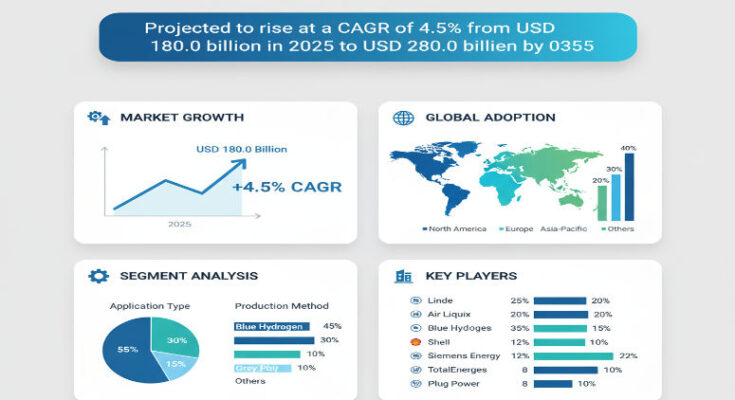

The hydrogen market is characterised by major industrial gas companies, energy firms, and technology providers. Leading companies profiled include Linde plc, Air Liquide, Messer Group, Nel ASA, Teledyne Technologies, Southern Industrial Gas, Air Products & Chemicals, Chevron Corporation, and others.

These players are advancing through strategic partnerships (for example, between industrial gases firms and electrolyser manufacturers), large-scale production projects (including green-hydrogen plants), offtake agreements with major industrial users, and investments in pipeline, storage and logistics infrastructure. Their aims: to secure supply chains, reap scale economies, reduce cost per kg H₂, and enable new applications beyond traditional industrial use.

Challenges and Market Barriers

Despite strong momentum, some constraints remain. Chief among them is cost: green hydrogen (produced via renewable-powered electrolysis) remains significantly more expensive than conventional “gray” or “blue” hydrogen in many markets, making economic adoption slower in some sectors.

Other challenges include infrastructure—hydrogen transport, storage, refuelling stations for fuel-cell vehicles, and distribution networks are still being developed in many regions. Standardisation and regulation also pose risks: hydrogen safety, certification, and international supply-chain norms are still evolving. Moreover, competition from alternatives—battery-electric vehicles, other low-carbon fuels, localised solutions—means hydrogen must prove strong value propositions in each application.

Strategic Outlook & Opportunities

Looking ahead, the hydrogen market presents several key opportunities. Companies and investors should prioritise:

-

Expanding green and low-carbon hydrogen production to meet policy and decarbonisation imperatives.

-

Developing supply chain infrastructure, including pipelines, storage, shipping and distributed delivery, to move hydrogen from point of production to end-use.

-

Targeting high-growth applications such as heavy-duty transport (trucks, buses, maritime), industrial decarbonisation (steel, chemicals, cement), and grid services (energy storage, balancing).

-

Partnering with industrial anchors and governments, to secure offtake agreements, co-develop production hubs and de-risk investments.

-

Investing in technological improvements to lower cost per kilogram of hydrogen—namely, advanced electrolysis, catalysts, modular production systems, and automation.

Browse Full Report: https://www.factmr.com/report/hydrogen-market

Editorial Perspective

Hydrogen is no longer just a “future fuel”—it is rapidly moving into mainstream industrial and energy applications. The forecast to reach nearly US$ 47.83 billion by 2034 at a 10.4% CAGR reflects that momentum. While hurdles remain, the convergence of policy drivers, technology advances and industrial demand means hydrogen is increasingly becoming essential to the transition to a low-carbon economy. Stakeholders who position themselves early—by building capacity, securing supply chains and leveraging partnerships—are likely to be at the forefront of this transformation.