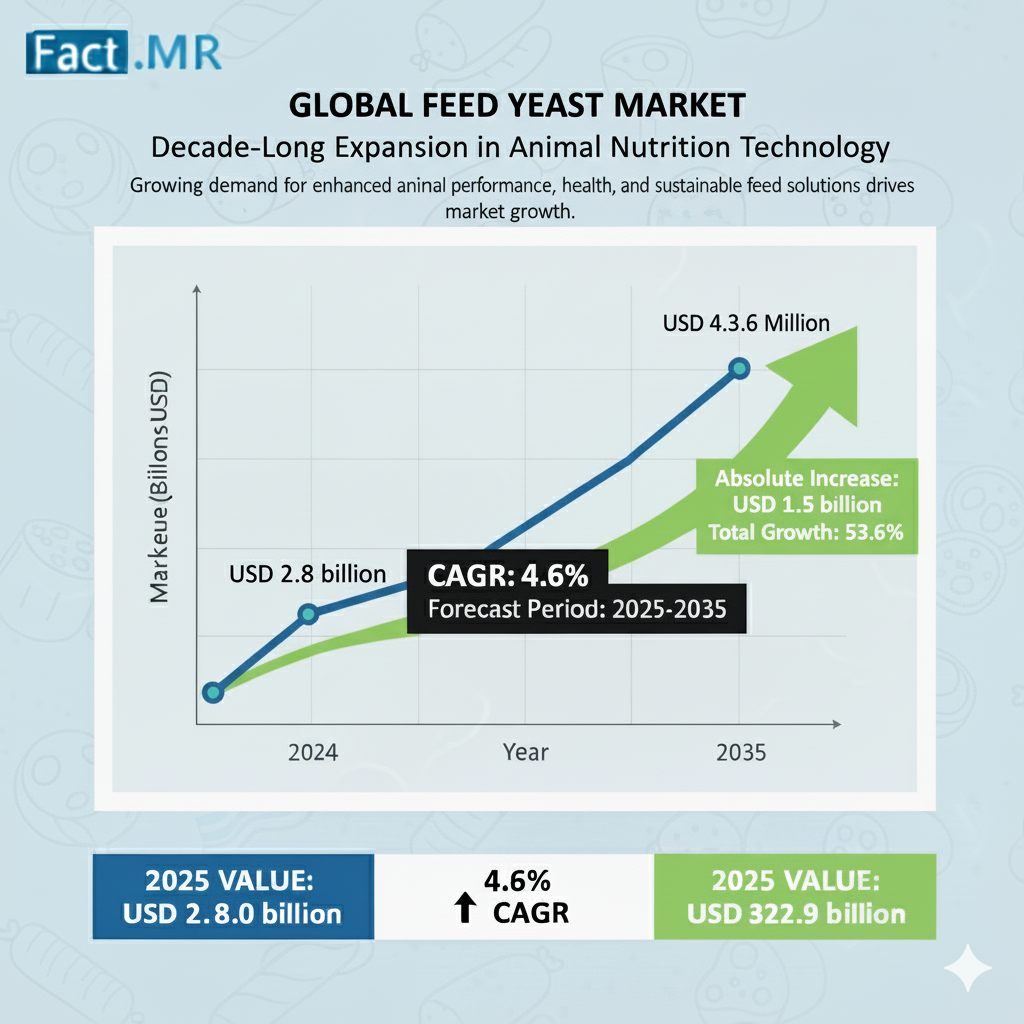

The feed yeast market stands at the threshold of a decade-long expansion trajectory that promises to reshape animal nutrition technology and livestock feeding solutions. The market’s journey from USD 2.8 billion in 2025 to USD 4.3 billion by 2035 represents substantial growth, The market will rise at a CAGR of 4.6% which This decade-long expansion underscores the accelerating adoption of advanced yeast technologies and nutrition optimization solutions across livestock operations, poultry facilities, and aquaculture sectors worldwide.

Strategic Growth Phases in Feed Yeast Adoption:

The first half of the decade (2025–2030) will see the market rise from USD 2.8 billion to approximately USD 3.5 billion, contributing USD 0.7 billion, or 45% of the total projected growth. This phase will be defined by the widespread adoption of live yeast feeding systems, driven by rising livestock production volumes and an increasing need for high-performance nutritional solutions. Enhanced digestibility capabilities and automated feeding systems are expected to shift from premium options to industry-standard requirements, enabling facilities to maximize livestock health and productivity.

The latter half of the decade (2030–2035) is forecasted to deliver an additional USD 0.8 billion in market value, accounting for 55% of the total decade’s growth. This period will mark the mass-market penetration of yeast extract technologies and seamless integration with comprehensive nutrition management platforms. The evolution highlights a fundamental shift in livestock nutrition strategies, emphasizing technology-driven, data-enabled feeding solutions that optimize animal health and operational efficiency.

Quick Stats for Feed Yeast Market:

- Market Value (2025): USD 2.8 billion

- Market Forecast (2035): USD 4.3 billion

- CAGR: 4.6%

- Leading Yeast Type: Live Yeast

- Key Growth Regions: Asia Pacific, Europe, North America

- Top Players: Lesaffre, AB Mauri, Angel Yeast, Alltech, Phileo

Key Market Insights:

The feed yeast market is underpinned by strong fundamentals, with live yeast systems commanding a dominant position through probiotic capabilities and livestock nutrition optimization. Ruminants lead in demand, particularly dairy and beef operations, supported by increasing nutrition requirements and modern farming practices. Asia Pacific is emerging as the primary growth engine, while Europe and North America sustain steady expansion, driven by advanced livestock infrastructure and technology adoption.

Feed Yeast Market Opportunities for Stakeholders:

Industry players are advised to design versatile feed yeast solutions beyond basic nutritional content. Offering comprehensive packages—including yeast products, feeding protocols, technical support, and digital integration—ensures operational efficiency for livestock facilities. Smart feeding systems with real-time nutrition analytics, predictive health monitoring, and IoT connectivity are becoming essential differentiators.

Quality-by-design approaches, automated viability control, and paperless feeding documentation are key trends shaping market competitiveness. Value-based pricing, incorporating transparent service tiers and performance guarantees, enhances adoption and customer loyalty.

Feed Yeast Market Segmentation Analysis:

– By Type: Live yeast dominates, followed by extract/derivative and spent yeast, reflecting the transition from basic nutrition to specialized feeding solutions.

– By Livestock: Ruminants (40%) lead, followed by poultry (30%), swine (20%), and aquaculture (10%).

– By Form: Dry yeast leads at 70%, with liquid systems representing 30%, highlighting varied application methods.

– By Region: Asia Pacific leads, driven by livestock expansion; Europe and North America maintain strong presence via modernization initiatives.

Feed Yeast Market Drivers and Trends:

– Drivers: Livestock industry growth, antibiotic reduction regulations, production efficiency, and feed conversion optimization.

– Restraints: Raw material price volatility, storage, and handling challenges.

– Trends: Digital feeding systems, nutrition monitoring, and regional livestock expansion, particularly in India and China, are reshaping adoption patterns.

Feed Yeast Market Regional Highlights:

– India: Fastest-growing market (6.2% CAGR) due to livestock modernization programs and domestic yeast innovations.

– China: High-volume adoption (5.0% CAGR), driven by government investment in agricultural development.

– Mexico: Growth at 4.0% CAGR with emphasis on cost-effective yeast solutions.

– Germany: Technology leader (3.9% CAGR), leveraging precision yeast systems and premium livestock installations.

– United States: Advanced applications (3.8% CAGR), integrating yeast systems across dairy and poultry operations.

– South Korea & Japan: Mature markets emphasizing operational optimization and premium nutrition solutions

Feed Yeast Market Competitive Landscape:

The feed yeast market features 12–15 credible players, with the top five commanding 40–45% of revenue. Market leadership is defined by technology innovation, nutritional reliability, and operational versatility. Commoditization of basic yeast formulations is accelerating, while margin opportunities exist in custom nutrition solutions, technical feeding programs, and integrated livestock system services.

Top Industry Players: Lesaffre, AB Mauri, Angel Yeast, Alltech, Phileo, ADM, Cargill, DSM, Kerry, Lallemand, Nutreco, Novus, Evonik, Kemin, Diamond V.

Feed Yeast Market Outlook:

As livestock operations embrace precision feeding, probiotic supplementation, and digital nutrition management, the feed yeast market is set to deliver unprecedented growth over the next decade. Industry stakeholders and manufacturers are uniquely positioned to leverage advancements in yeast technology, operational integration, and livestock nutrition optimization to capture market share and drive sustainable growth.

Browse Full Report-