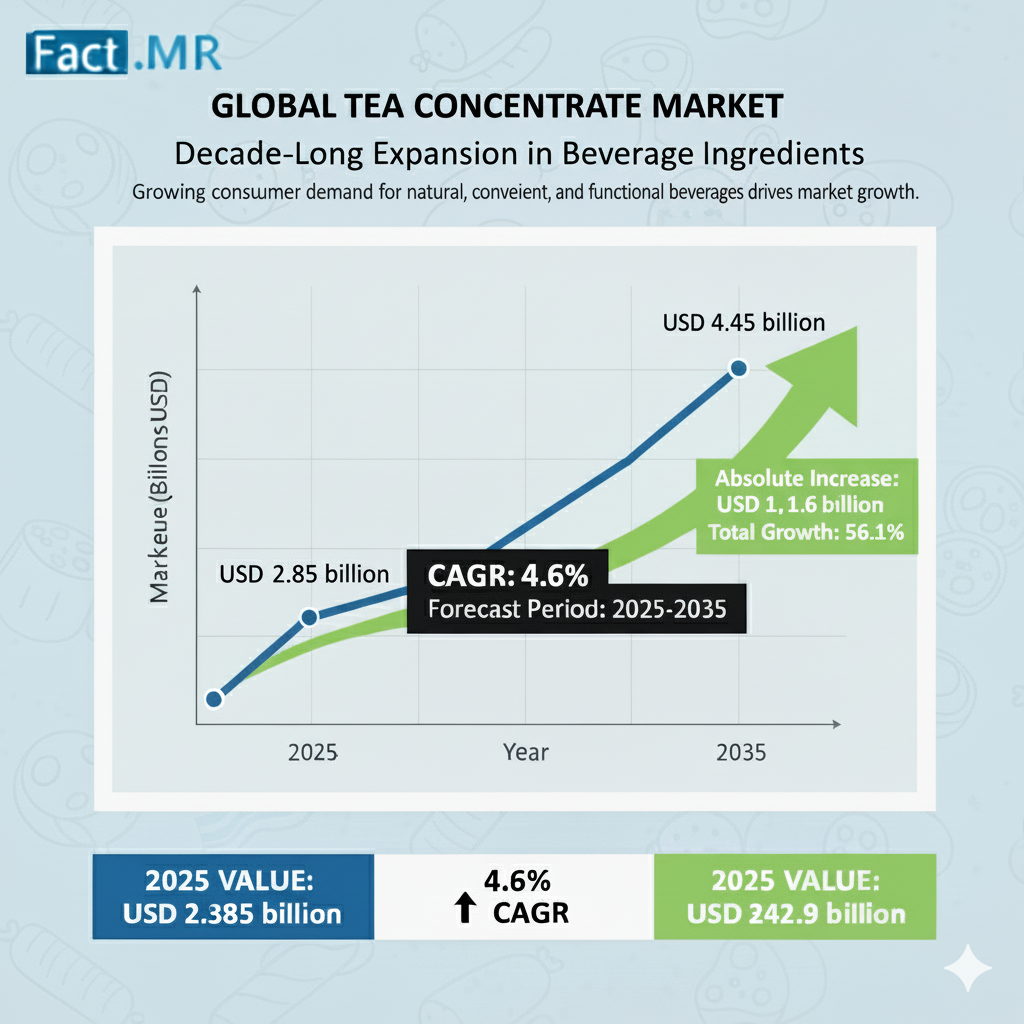

The global tea concentrate market is projected to reach USD 4.45 billion by 2035, recording an absolute increase of USD 1.6 billion over the forecast period. The market is valued at USD 2.85 billion in 2025 and is set to rise at a CAGR of 4.6% during the assessment period.The market’s growth trajectory underscores a dynamic transformation in beverage manufacturing, where efficiency, flavor consistency, and convenience are reshaping tea processing technologies worldwide.

The expansion is fueled by rising global consumption of ready-to-drink (RTD) beverages, rapid growth in foodservice operations, and ongoing innovation in extraction and flavor standardization technologies. However, the industry faces challenges linked to complex extraction processes and technical constraints in maintaining flavor uniformity, which create opportunities for advanced solution providers and technology investors.

Tea Concentrate Market Snapshot:

- Market Value (2025): USD 2.85 Billion

- Forecast Value (2035): USD 4.45 Billion

- CAGR (2025–2035): 4.6%

- Leading Product Type: Black Tea Concentrate

- Top Growth Regions: Asia Pacific, North America, Europe

- Major Players: Tata Consumer, Unilever, Nestlé, Keurig Dr Pepper, Ito En, Coca-Cola, Starbucks, Kerry Group, Döhler, Hain Celestial

Strong Market Momentum Across Two Growth Phases

Between 2025 and 2030, the tea concentrate market is expected to expand by USD 750 million, accounting for nearly 47% of total decade growth. This acceleration is supported by rising RTD consumption, product innovation, and technological improvements in extraction systems. Companies investing in automated processing systems and specialized flavor platforms are positioned to capture maximum value during this phase.

From 2030 to 2035, the market is projected to add another USD 850 million, representing 53% of total ten-year expansion. Growth during this period will be driven by advanced flavor enhancement technologies, strategic collaborations between beverage producers and concentrate manufacturers, and a growing emphasis on processing efficiency and sustainability.

Tea Concentrate Market Segmental Insights

By Type – Black Tea Leads with 50% Market Share: Black tea concentrates dominate the market, capturing around half of total demand in 2025. The segment’s leadership is supported by robust flavor profiles, high consumer acceptance, and superior compatibility across beverage and foodservice applications.

Key technological advantages include:

- Advanced extraction systems ensuring high flavor consistency.

- Enhanced process reliability supporting large-scale beverage manufacturing.

- Broad application versatility, serving both B2B and B2C markets.

Green tea concentrates account for 35% market share, driven by rising health consciousness, while herbal and specialty concentrates make up the remaining 15%, catering to niche and functional beverage applications.

By Application – RTD Beverages Dominate: The RTD beverage segment holds approximately 45% of global demand, reflecting surging consumer preference for convenient, high-quality tea-based drinks.

The foodservice segment, with 35% share, remains a key contributor, supported by expanding café chains, hospitality modernization, and menu diversification. The bakery segment (10%) benefits from the use of tea concentrates in flavored desserts, confectionery, and specialty baked goods.

Tea Concentrate Market Regional Dynamics:

Asia Pacific – The Global Growth Engine: Asia Pacific leads the global tea concentrate market, with India (6.0% CAGR) and China (5.5% CAGR) emerging as key growth hubs. India’s leadership is supported by food processing policies, manufacturing expansion, and tea industry modernization, while China’s rapid adoption of advanced extraction technologies and industrial-scale processing facilities drives long-term potential.

North America – Innovation Hub for RTD Applications; The United States, growing at 4.0% CAGR, continues to lead global beverage innovation, with strong emphasis on RTD tea development and processing automation. Leading beverage brands are forming partnerships with concentrate suppliers to optimize flavor integrity and scalability.

Europe – Processing Excellence and Quality Leadership; Germany (3.8% CAGR) and the United Kingdom (3.5% CAGR) dominate the European landscape, integrating precision extraction and quality management systems into beverage production. European beverage modernization initiatives are fueling demand for compliant, high-efficiency tea concentrate systems.

Tea Concentrate Market Drivers

– Rising Demand for Convenience Beverages: Global RTD consumption is projected to expand by 20–30% annually, directly boosting concentrate utilization.

– Government Support for Food Processing: Policy incentives in India, China, and the U.S. are promoting beverage manufacturing modernization, strengthening adoption of extraction-based systems.

– Technological Advancements: Real-time flavor monitoring, AI-driven extraction control, and automation in processing are enhancing production efficiency and taste consistency.

– Sustainability Focus: Companies are transitioning to low-energy extraction and recyclable packaging, aligning with circular economy goals.

Tea Concentrate Market Key Restraints and Challenges

Despite strong growth potential, high capital investment, complex flavor validation, and limited expertise in developing regions hinder large-scale adoption. Companies addressing these challenges through training programs, regional partnerships, and automation solutions are likely to gain competitive advantage.

Tea Concentrate Market Competitive Landscape

The tea concentrate market is moderately consolidated, with top three players controlling 25–30% of global share.

– Tata Consumer, Unilever, and Nestlé lead through advanced extraction technologies and diversified beverage portfolios.

– Keurig Dr Pepper and Ito En strengthen regional presence with customized concentrate solutions.

– Coca-Cola, Starbucks, Kerry Group, and Döhler focus on flavor innovation and application-specific formulations.

– Emerging regional players in India, China, and Mexico are increasing competition by offering cost-efficient and localized concentrate solutions.

Strategic Imperatives for Industry Leaders:

To sustain growth, manufacturers and investors should:

– Expand R&D investments in next-generation extraction technologies and automated flavor systems.

– Establish local production facilities in high-growth regions to enhance responsiveness and cost efficiency.

– Form strategic alliances with beverage companies to co-develop custom flavor profiles.

– Adopt intelligent extraction platforms integrating real-time quality monitoring and predictive analytics.

Tea Concentrate Market Outlook:

The tea concentrate market represents a critical enabler for beverage innovation, offering 50–70% greater flavor consistency and superior production efficiency compared to traditional methods. With projected growth from USD 2.85 billion in 2025 to USD 4.45 billion by 2035, the sector stands at the forefront of global beverage transformation.

As manufacturers, investors, and policymakers converge around innovation, quality, and sustainability, tea concentrate technology will define the next decade of beverage excellence — blending tradition, flavor science, and industrial precision to meet the evolving tastes of global consumers.

Browse Full Report-https://www.factmr.com/report/tea-concentrate-market