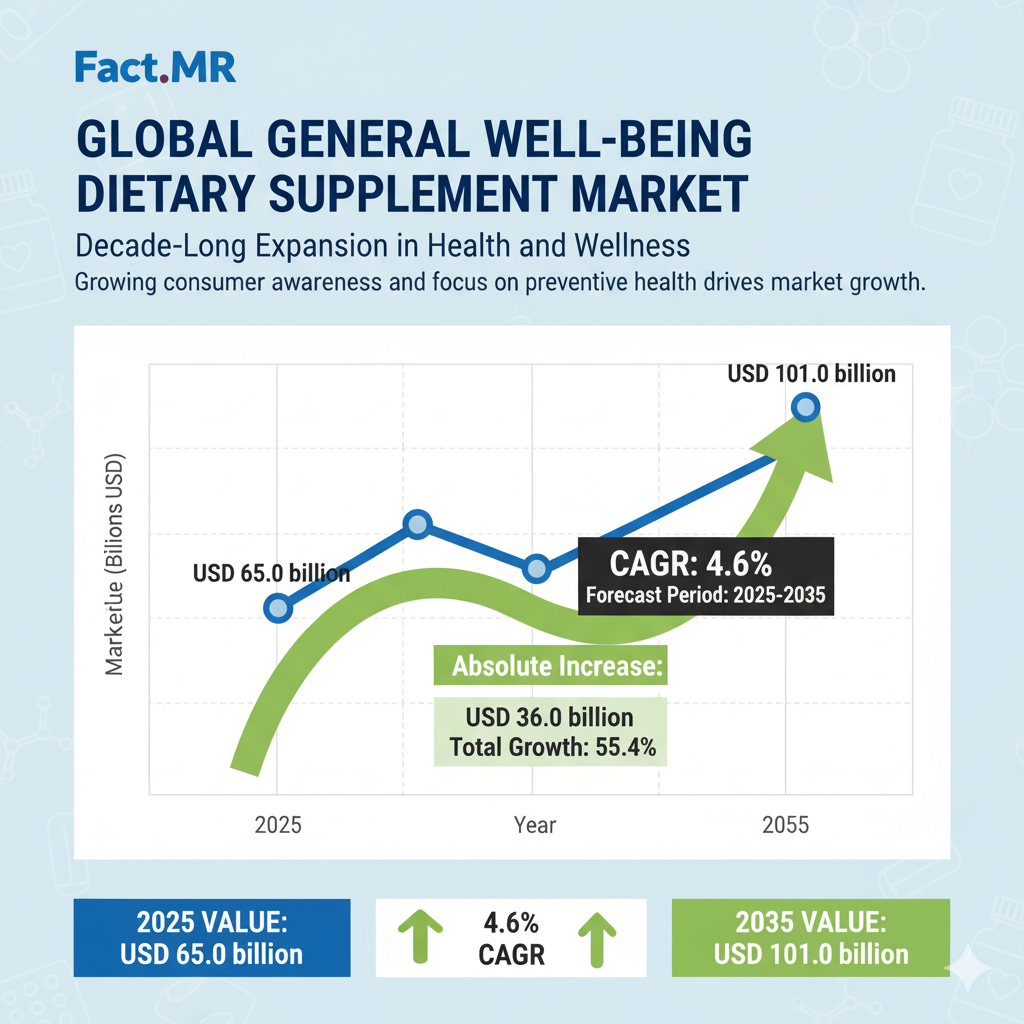

The global general well-being dietary supplement market is likely to reach USD 101.0 billion by 2035, recording an absolute increase of USD 36.0 billion over the forecast period. The market is valued at USD 65.0 billion in 2025 and is set to rise at a CAGR of 4.6% during the assessment period. This impressive expansion underscores the surging consumer demand for preventive healthcare, rising health consciousness, and the integration of digital and personalized nutrition platforms in global wellness ecosystems.

Industry giants such as Nestlé Health, Haleon, Bayer, Pfizer, Amway, and DSM-Firmenich are leading this transformation with advanced supplement formulations, cutting-edge bioavailability technologies, and evidence-based nutritional solutions. The decade ahead is expected to witness the market expanding by nearly USD 36.0 billion, driven by consumers’ growing preference for holistic wellness and scientifically validated supplement systems.

Market Momentum and Key Growth Drivers:

The general well-being dietary supplement industry has evolved into a cornerstone of modern preventive healthcare. Between 2025 and 2030, the market is projected to add USD 16.4 billion, accounting for 45.6% of total forecast growth. This initial phase of expansion will be propelled by rising awareness of preventive health solutions, technological innovation in nutritional delivery systems, and the rapid digitalization of wellness ecosystems.

From 2030 to 2035, the market is expected to gain another USD 19.6 billion, representing 54.4% of decade-long growth. This next phase will be marked by personalized supplement innovations, AI-enabled nutrition tracking, and strategic partnerships between supplement manufacturers and healthcare providers.

“Consumers are increasingly demanding tailored nutritional solutions that not only enhance health outcomes but also align with their individual wellness goals,” said a senior analyst at Fact.MR. “Companies that integrate science-backed nutrition with digital health ecosystems are poised to gain a lasting competitive edge.”

Segmental Highlights: Tablets Lead, Vitamins Dominate:

By Form: The tablets segment remains the dominant market category, capturing 35% of global share in 2025. Tablets lead due to their cost efficiency, precision dosing, and extended shelf stability, supported by advanced compression and coating technologies that enhance nutrient absorption.

Capsules/softgels follow with a 30% market share, favored for their enhanced bioavailability and premium positioning in wellness products. Powders hold 20%, while gummies and liquids comprise 15%, serving niche consumer segments seeking convenience and taste innovation.

By Ingredient: The vitamins segment dominates with 40% market share, reflecting their foundational role in preventive nutrition. Minerals account for 20%, while botanicals and probiotics each contribute 10-20%, representing the growing popularity of natural and gut-health-oriented products. The remaining 10% consists of specialized formulations including amino acids and functional blends designed for personalized nutrition programs.

By Channel: Pharmacies command the largest distribution share at 40%, driven by strong consumer trust, professional recommendations, and expanding wellness programs. E-commerce follows closely with 30%, benefiting from digital health integration and direct-to-consumer engagement. Mass retail (20%) and specialty channels (10%) continue to grow through personalized retail strategies and premium wellness offerings.

Regional Insights: Asia Pacific Leads Global Expansion:

The Asia Pacific region emerges as the fastest-growing market, fueled by government health initiatives, expanding middle-class populations, and rising urban wellness infrastructure.

– India leads the global market with a CAGR of 7.0%, supported by large-scale government health programs and expanding e-commerce penetration in cities like Mumbai, Delhi, and Bangalore.

– China, growing at 6.0% CAGR, is accelerating wellness modernization under the “Healthy China” initiative, fostering partnerships between local producers and international supplement brands.

– Mexico (4.4%), the United States (4.2%), and Germany (4.0%) exhibit stable growth through strong retail presence, high consumer awareness, and robust quality standards.

– South Korea (3.8%) and Japan (3.2%) demonstrate mature markets driven by innovation and technology-led supplement integration in national wellness systems.

In Europe, Germany maintains leadership with USD 15.6 billion market share by 2025, followed by the UK (USD 11.1 billion) and France (USD 9.1 billion). Together, these nations account for over 55% of European supplement sales, underpinned by high regulatory compliance and advanced health infrastructure.

Competitive Landscape: Innovation, Trust, and Science as Growth Catalysts:

The market remains moderately concentrated, with 20–25 major companies accounting for up to 35% of global share. Leaders such as Nestlé Health, Haleon, and Bayer continue to dominate through strong R&D pipelines, established wellness portfolios, and deep retail integration.

Emerging players like Herbalife, Bountiful, and DSM-Firmenich are investing in targeted formulations and next-generation delivery systems, while regional champions in India and China are gaining ground through agile manufacturing, localized branding, and compliance with domestic health regulations.

The next wave of competitive differentiation will center on:

- Advanced formulation science — improving bioavailability and nutrient synergy.

- Digital health integration — linking supplement intake with real-time wellness tracking.

- Sustainable manufacturing — emphasizing eco-friendly sourcing and traceability.

- Clinical validation — reinforcing efficacy through data-driven health outcome studies.

Opportunities for Industry Leaders and Policymakers:

To unlock the full potential of the dietary supplement market, industry stakeholders must align around innovation, policy reform, and consumer education:

Governments can stimulate market expansion through:

- Incentivizing local supplement manufacturing via R&D tax credits.

- Simplifying regulatory frameworks for cross-border product approvals.

- Investing in nutrition education programs and workforce development.

Industry bodies should focus on:

- Defining standardized certification systems for supplement efficacy.

- Promoting evidence-based nutrition awareness campaigns.

- Supporting professional training for healthcare and retail specialists.

Manufacturers and technology firms are encouraged to:

- Develop AI-driven nutrition platforms for personalized recommendations.

- Enhance bioavailability through nanotechnology and encapsulation.

- Build collaborative R&D networks to sustain long-term innovation.

Future Outlook:

With the global market set to reach USD 101.0 billion by 2035, the general well-being dietary supplement industry represents a pivotal opportunity for investors, manufacturers, and policymakers alike.

As health systems worldwide shift toward preventive and personalized care, dietary supplements will remain integral to achieving public wellness goals. Industry leaders that embrace scientific rigor, digital transformation, and sustainability are poised to shape the next decade of wellness innovation.

Browse Full Report-https://www.factmr.com/report/general-well-being-dietary-supplement-market