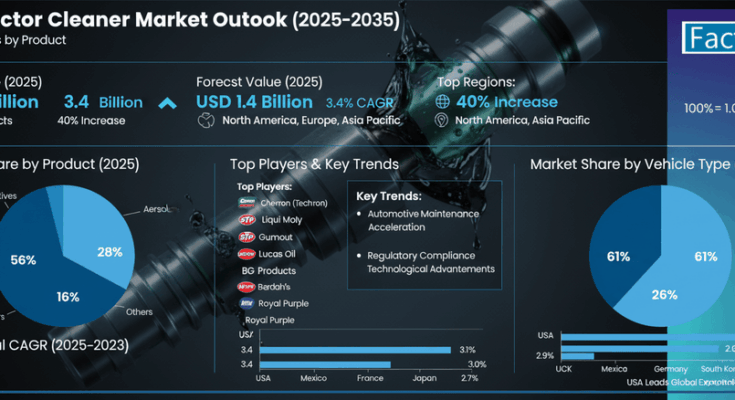

The global fuel injector cleaner market is projected to reach USD 1.4 billion by 2035, up from USD 1.0 billion in 2025, growing at a compound annual rate of 3.4%. This decade-long expansion reflects major advances in additive chemistry, engine performance optimization, and the increasing integration of fuel system cleaners into global automotive maintenance practices.

Market Outlook and Key Growth Data

The market is expected to expand by a factor of 1.4 over the next decade, strengthened by the adoption of advanced polyetheramine (PEA)-based liquid additive systems and enhanced cleaning formulations designed for modern gasoline and hybrid engines. North America will lead global sales, with the United States forecast to grow at 3.7% CAGR, supported by environmental regulations and expanding automotive aftermarket infrastructure.

Between 2025 and 2030, global market value is projected to grow by USD 170 million, primarily driven by fleet-level maintenance adoption and retail channel expansion. The period from 2030 to 2035 will contribute an additional USD 240 million, reflecting the influence of digital maintenance analytics, system integration, and smart-cleaning protocols tailored to modern engines.

Chemical Formulation and Engineering Parameters

Fuel injector cleaner technologies are centered on liquid-phase detergents and dispersants formulated with active compounds such as polyetheramine (PEA), polyisobutylene amine (PIBA), and polyisobutylene (PIB). PEA-based systems dominate due to their high detergency, strong deposit removal efficiency, and resistance to ethanol-based corrosion, delivering up to 90% injector flow restoration efficiency in standard testing conditions.

These cleaners are designed to:

- Remove combustion deposits and restore optimized spray patterns.

- Prevent injector fouling and maintain consistent air-fuel ratios.

- Disperse water contaminants and reduce gum formation.

- Improve combustion efficiency, engine responsiveness, and emission balance.

Modern formulations also include lubricity enhancers and antioxidants, ensuring compatibility with E10–E15 fuel blends while meeting international additive compliance standards.

Market Segmentation and Application Distribution

The liquid additive segment holds approximately 56% market share, reflecting its versatility and ease of integration into preventive maintenance schedules. Aerosol and direct spray segments represent about 28%, primarily supporting professional workshops and high-intensity cleaning requirements, while the remainder covers niche or specialized applications.

In terms of vehicle categories:

- Passenger cars account for 61% of demand, driven by urban ownership growth and maintenance awareness.

- Light commercial vehicles (LCVs) hold 26%, driven by logistics fleet maintenance and emission performance mandates.

- Heavy commercial vehicles (HCVs) represent 13%, underscoring the growing need for high-performance cleaning solutions to maintain operational uptime in industrial transport sectors.

Regional Performance and Market Leadership

North America will remain the technological and commercial epicenter of global market growth, bolstered by U.S. regulatory frameworks supporting emission reduction and sustainable maintenance initiatives. Europe—particularly Germany, France, and the UK—continues to prioritize advanced additive adoption through OEM collaboration and vehicle certification standards.

In Asia-Pacific, the market is defined by Korea and Japan’s emphasis on precision-engineered automotive systems and integration of injector cleaning into scheduled maintenance cycles. Expansion is also accelerating in Mexico and Southeast Asia, where adoption of liquid cleaning technologies is rising due to automotive modernization programs and the scaling of urban transportation fleets.

Competitive Landscape and Innovation Focus

The industry features a moderate consolidation level with nearly a dozen global companies accounting for one-third of market share. Market leaders include Chevron, STP, and Liqui Moly, renowned for robust PEA formulations and OEM-aligned cleaning standards. Competitive differentiation focuses on cleaning performance accuracy, chemical system compatibility, and environmental safety rather than price leadership.

Emerging manufacturers across North America, Europe, and Asia-Pacific are focusing on developing localized formulations tailored to regional fuel compositions. Innovation efforts concentrate on optimizing molecular stability and integrating additive data into digital vehicle maintenance systems.

Advancements are being made in:

- Nanostructured detergents enabling faster deposit removal.

- AI-assisted additive dosing optimizing performance per vehicle type.

- Hybrid solvent-dispersant chemistry reducing carbon throughput in high-performance engines.

Future Roadmap 2030–2035

By 2035, nearly two-thirds of certified automotive service workshops are expected to employ digital maintenance suites integrated with real-time injector diagnostics. These systems will link telemetry feedback with dosing precision, reducing both fuel waste and engine degradation.

Parallel developments in smart additive analytics, eco-friendly solvent systems, and bio-based detergent chemistries will create a new standard for sustainable automotive maintenance. This integration marks the transition from static cleaner usage to predictive maintenance architecture, supporting the next stage of global automotive efficiency.

Technical Insight and Global Impact

The expanding fuel injector cleaner market exemplifies the convergence of chemical sciences, mechanical optimization, and digital maintenance intelligence. It enables automotive companies to deliver higher operational reliability, lower emissions, and improved combustion uniformity—all while minimizing maintenance intervals and lifecycle costs.

As automotive technologies evolve, so too will the role of cleaner additives—from reactive chemical solutions to integral components of data-driven vehicle health ecosystems. With innovation accelerating across every formulation and region, the next decade is poised to redefine the interface between chemical engineering and transportation performance excellence.

Browse Full report : https://www.factmr.com/report/766/fuel-injector-cleaner-market