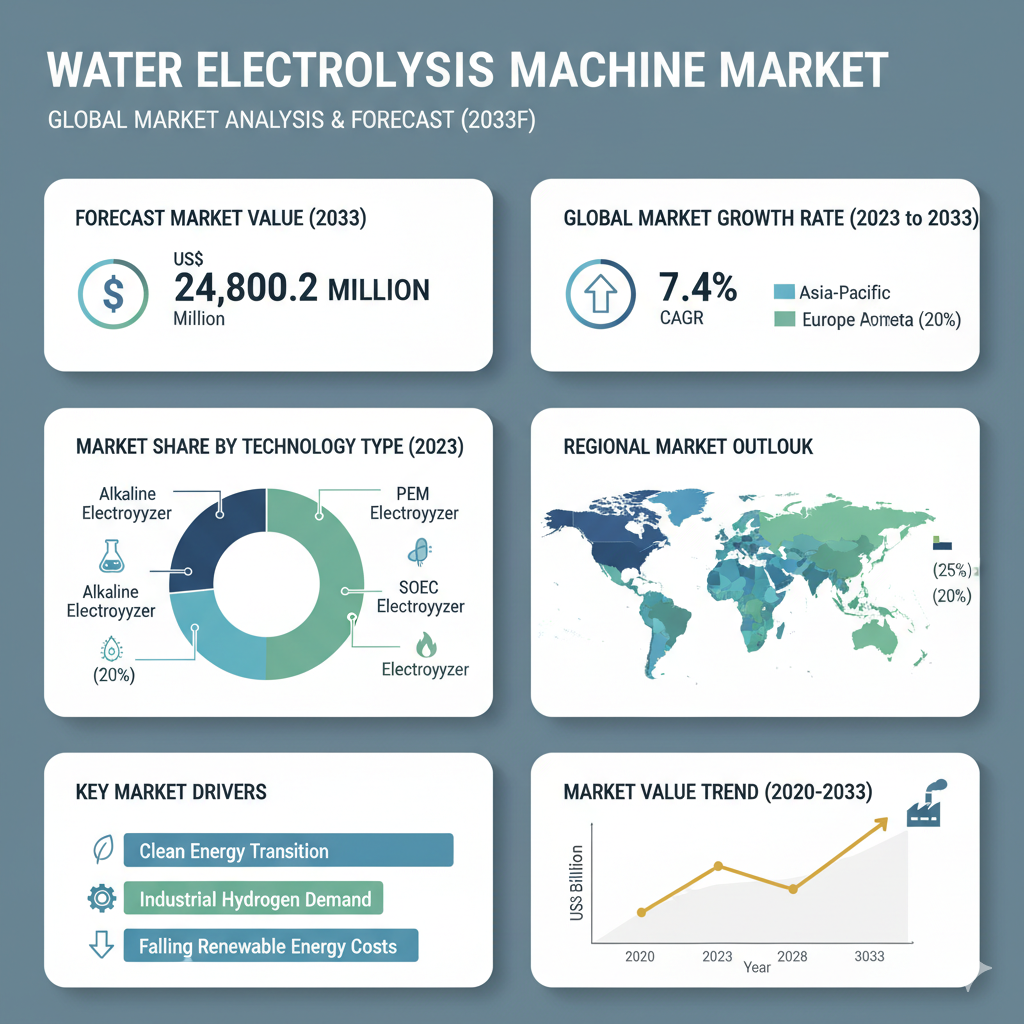

The global water electrolysis machine market is entering a period of remarkable growth, driven by the increasing demand for green hydrogen, global decarbonization initiatives, and technological advancements that enhance efficiency and scalability. The market is estimated to reach a valuation of US$ 12,145.4 million in 2023 and is projected to top US$ 24,800.2 million by 2033, growing at a CAGR of around 7.4% during the forecast period from 2023 to 2033.

Market Segmentation Overview

The market can be analyzed across multiple dimensions to understand where the strongest growth opportunities lie.

By Type, the key categories include Proton Exchange Membrane (PEM), Alkaline Water Electrolysis, and Others. Among these, PEM technology is anticipated to remain dominant due to its ability to produce high-purity hydrogen efficiently and its flexibility to operate under variable power conditions. These features make PEM systems highly suitable for renewable energy integration and on-site hydrogen production.

By Input Power, water electrolysis machines are classified into Below 5 kW, 2 kW–5 kW, and Above 5 kW segments. Smaller systems are typically used for laboratory or pilot-scale operations, while mid- to high-power machines cater to industrial hydrogen production. The increasing deployment of large-capacity electrolysis systems for commercial applications is expected to drive demand in the Above 5 kW segment.

By Hydrogen Production Capacity, the market is divided into Below 500 L/hr, 500–2000 L/hr, and Above 2000 L/hr. The higher production capacity segments are projected to experience rapid expansion due to growing industrial use and the need for bulk hydrogen supply for chemical and energy sectors.

By End Use, major industries utilizing water electrolysis machines include Chemicals, Petroleum, Pharmaceuticals, Power Plants, Electronics and Semiconductors, and Steel Plants, among others. The chemicals and steel industries are emerging as the primary consumers of hydrogen for production and processing purposes, while the power and electronics sectors are increasingly adopting hydrogen for clean energy generation and advanced manufacturing.

By Region, the market demonstrates strong geographical diversity. North America and Europe currently lead in adoption due to supportive policy frameworks and large-scale hydrogen infrastructure projects. China and other parts of East Asia are rapidly expanding production capacity, driven by industrial demand and government investments in hydrogen technologies. Meanwhile, emerging markets in South Asia, Oceania, and the Middle East are becoming attractive regions for new investments due to rising energy transition goals.

Recent Developments and Key Trends

The water electrolysis machine industry has witnessed significant technological progress in recent years. Continuous research and innovation have led to the development of advanced electrode materials and improved electrolyzer designs that offer higher efficiency, greater durability, and reduced operating costs. The introduction of digital technologies such as predictive analytics, smart sensors, and remote monitoring systems has further optimized performance and maintenance, enhancing reliability for large-scale applications.

Collaborations and partnerships have become central to market expansion. Manufacturers are forming alliances with renewable energy developers, industrial gas suppliers, and power companies to scale up hydrogen production and build integrated hydrogen ecosystems. These partnerships aim to strengthen supply chains and ensure consistent access to renewable electricity sources for electrolysis operations.

The growing focus on cost reduction is another critical trend shaping the market. With increased manufacturing capacity and standardization of electrolyzer components, economies of scale are driving down costs, making green hydrogen production more competitive with fossil-based alternatives. Modular system designs also allow companies to scale up operations more efficiently and flexibly.

Government initiatives worldwide are playing a vital role in accelerating market adoption. Policies such as carbon pricing, renewable energy incentives, and hydrogen economy roadmaps are providing financial and regulatory support to companies investing in electrolysis technologies. Such policy frameworks are expected to catalyze further investment in both developed and developing regions over the next decade.

Competitive and Industry Landscape

The water electrolysis machine market is highly competitive, with both established industrial firms and emerging innovators driving progress. Prominent players include Nel ASA, ITM Power PLC, Cummins Inc., McPhy Energy S.A., Cockerill Jingli Hydrogen, Elogen, and Teledyne Technologies, among others. These companies are focusing on expanding production capacity, developing efficient PEM and alkaline systems, and pursuing strategic collaborations to enhance market presence.

European players such as Nel ASA and ITM Power have established strong positions through their involvement in large-scale hydrogen infrastructure projects. In contrast, companies like Cummins and McPhy are leveraging their industrial expertise to target both mobility and stationary hydrogen applications. Asian manufacturers are increasingly gaining traction by offering cost-effective systems supported by local government incentives.

Competition in the market primarily revolves around efficiency, cost-effectiveness, product durability, and scalability. Companies that can deliver modular and adaptable systems while ensuring long operational lifespans and low maintenance costs are likely to maintain a competitive advantage.