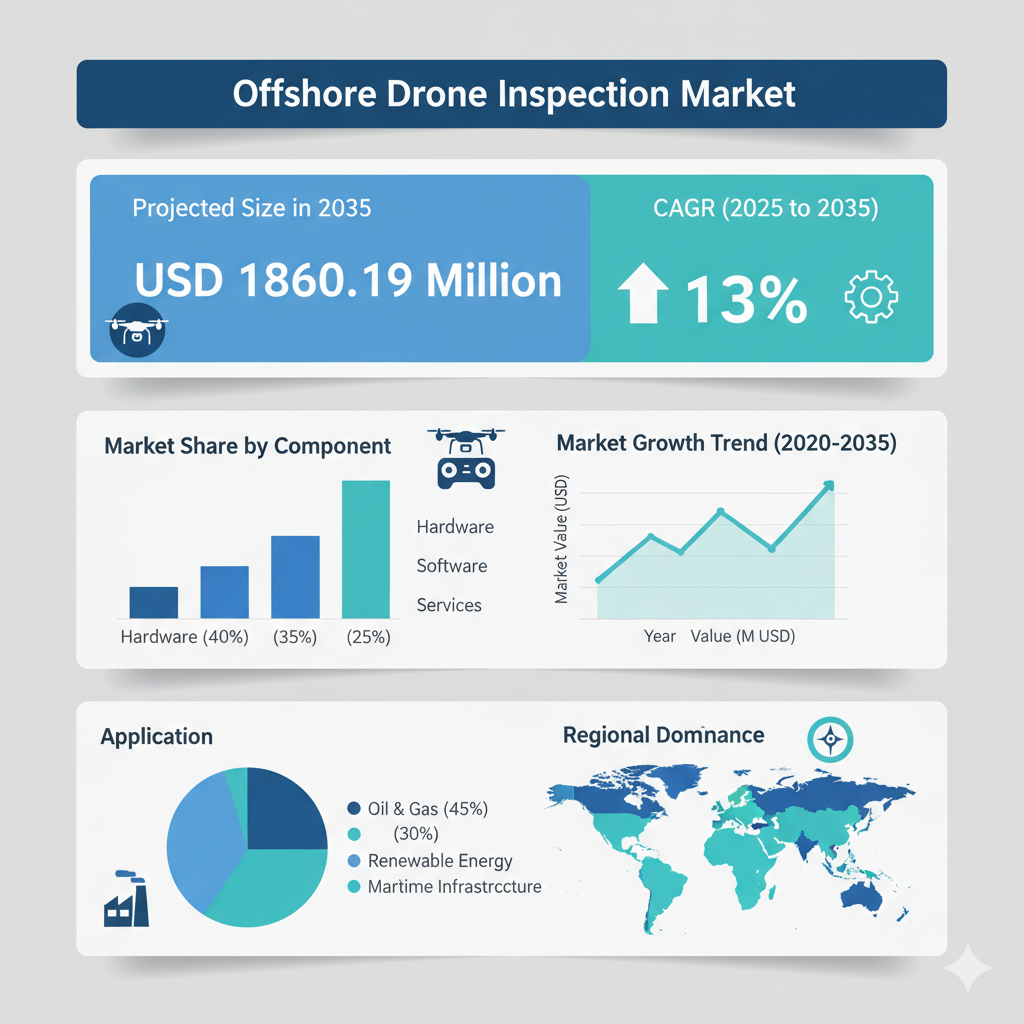

The global offshore drone inspection market is on a strong growth trajectory. The global offshore drone inspection market is projected to be valued at USD 547.99 million by 2025, and according to Fact.MR’s forecast, the industry is expected to grow at a compound annual growth rate (CAGR) of 13 %, reaching USD 1,860.19 million by 2035.

Market Segmentation: By Type, Material, Function, Usage, Ownership & Region

The offshore drone inspection market is segmented across multiple dimensions to better understand its dynamics and growth patterns.

By Drone Type

The market includes fixed-wing, rotary (multirotor), and hybrid drones. Fixed-wing drones offer extended range and endurance, making them ideal for large-area inspections over offshore platforms and wind farms. Rotary drones are more suitable for close-in, localized inspections where maneuverability is essential. Hybrid models combine attributes of both, offering a balance between range and agility. Fixed-wing drones are expected to register robust growth due to their efficiency in long-distance offshore inspection tasks.

By Material

Drone construction materials greatly influence durability, weight, and corrosion resistance. The most common materials include carbon fiber, aluminum alloys, and hybrid composites. Carbon fiber remains a preferred choice because it is lightweight and resistant to corrosion, while aluminum provides a cost-effective option in certain regions.

By Function and Usage

In terms of function, drones are primarily used for inspection and maintenance, mapping and surveying, surveillance and monitoring, and filming or documentation. Among these, inspection and maintenance dominate the market as drones are increasingly utilized to assess structural integrity, detect corrosion or cracks, and inspect welds in offshore installations. This segment is projected to exhibit significant growth, especially in the oil and gas and offshore wind sectors.

By Ownership

Ownership models are divided into drone-as-a-service (DaaS) and in-house ownership. Many operators now prefer the DaaS model as it reduces the need for capital investment and operational risk. Large oil and gas companies, however, may still maintain their own drone fleets for regular inspections, ensuring data security and operational control.

By Application

Key application areas include oil and gas rigs, offshore wind turbines, ports, marine infrastructure, and subsea facilities. While the oil and gas sector has traditionally led the demand for offshore drone inspection services, the growing offshore wind industry is becoming an equally strong driver of market expansion.

By Region

Geographically, the market spans North America, Latin America, Europe, East Asia, South Asia & Oceania, and the Middle East & Africa. Each region presents unique growth drivers—North America benefits from extensive offshore oil and gas operations, Europe leads in offshore wind energy, and Asia-Pacific is emerging as a key growth hub due to increasing investments in energy infrastructure.

Recent Developments and Market Trends

The offshore drone inspection industry has witnessed rapid technological advancements and evolving operational trends. In recent years, there has been a clear shift toward automated and AI-powered drone systems. Offshore operators, particularly in the North Sea and Gulf of Mexico, are increasingly deploying hybrid drones with artificial intelligence and real-time defect detection capabilities, reducing downtime and minimizing human exposure to hazardous environments.

The integration of predictive analytics and machine learning is becoming a cornerstone of modern inspection operations. Drones equipped with intelligent software are enabling condition-based maintenance, predictive failure analysis, and efficient inspection scheduling, thereby enhancing productivity and safety.

Regulatory and sustainability factors also play a crucial role. Stricter safety and environmental standards are prompting offshore operators to rely on drone-based inspections, which ensure precision and minimize environmental risk. In Europe, sustainability goals are driving investments in low-emission drone technologies, while in Asia and the Middle East, governments are updating aviation and maritime regulations to accommodate drone operations beyond the visual line of sight (BVLOS).

Strategic collaborations and mergers are shaping the competitive landscape. Leading players are focusing on expanding service portfolios, integrating automation, and developing modular drone designs with enhanced sensor payloads. Such partnerships enable faster technological advancement and global reach, allowing companies to cater to the growing demand across energy sectors.

Key Players and Competitive Landscape

The offshore drone inspection market is highly competitive, featuring a mix of established players and emerging innovators. Prominent companies include Cyberhawk Innovations Ltd., Percepto, Terra Drone Corporation, Avitas Systems (a subsidiary of Baker Hughes), Aerodyne Group, and Texo DSI. Each of these firms brings a distinct specialization to the market—ranging from AI-driven inspection software to LiDAR-based imaging and digital twin technologies.

Cyberhawk Innovations leads in the integration of AI-powered inspection analytics, while Percepto has established a strong foothold in autonomous operations. Terra Drone Corporation dominates in the Asia-Pacific region with its advanced mapping technologies, and Aerodyne Group continues to expand its drone-as-a-service operations across Southeast Asia and Africa. These companies compete primarily on the basis of technology innovation, service quality, and global coverage.