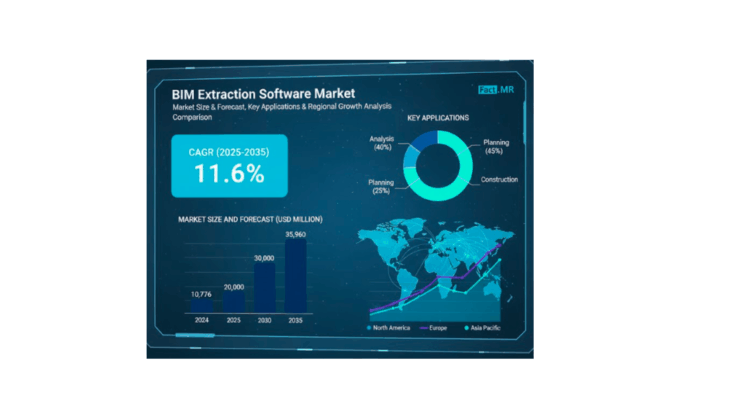

The global BIM extraction software market is poised for significant growth, projected to expand from USD 10,776 million in 2024 to USD 35,960 million by 2035, reflecting a CAGR of 11.6% during the forecast period (2025–2035). The growing demand for digital construction tools, smart infrastructure, and data-driven project management is driving market momentum across the architecture, engineering, and construction (AEC) sectors.

BIM extraction software plays a critical role in converting complex building information into usable data formats for analysis, planning, and construction. By streamlining workflows and supporting the extraction of 3D models, quantities, and attributes from BIM files, the software facilitates informed decision-making, accurate cost estimation, and enhanced project efficiency.

Market Drivers: Precision, Efficiency, and Digital Transformation

The push for greater project precision and efficiency is a key driver of BIM extraction software adoption. Traditional construction methods often suffer from cost overruns, schedule delays, and design conflicts. BIM extraction software mitigates these issues by providing real-time access to model data and enabling collaborative decision-making at every stage of the project lifecycle.

Government mandates for BIM adoption—such as Level 2 BIM requirements in the UK and similar initiatives across Europe and Asia—further bolster adoption in public and private sectors. Additionally, the integration of AI and cloud computing into construction workflows provides scalable, collaborative platforms that enhance BIM’s potential.

With environmental regulations tightening globally, stakeholders are increasingly leveraging BIM for sustainability assessments and lifecycle cost evaluations. These converging forces—regulatory compliance, technological advancement, and market demand—are driving widespread adoption of BIM extraction solutions worldwide.

Regional Market Trends

North America holds a significant share of the market, driven by early adoption of BIM in public infrastructure projects and high digitization of construction practices. The U.S. General Services Administration (GSA) has promoted industry-wide BIM compliance, encouraging widespread use of extraction software for improved project efficiency.

East Asia, led by China, Japan, and South Korea, is witnessing rapid adoption driven by large-scale urban development, smart city initiatives, and integration of AI and IoT technologies in construction projects. Government-led programs promoting digital construction standards and productivity improvements are strengthening the region’s market presence.

Western Europe, with countries like the UK, Germany, and France at the forefront, emphasizes policy-driven BIM adoption. The UK’s Level 2 BIM mandate has influenced practices across Europe, with nations increasingly leveraging BIM for sustainability compliance, lifecycle management, and operational efficiency.

Challenges Facing Small Construction Firms

Despite clear benefits, small and medium-sized construction firms face barriers to adoption. High initial costs, technical infrastructure requirements, and interoperability issues between software providers create hurdles for these firms.

The lack of widely accepted BIM data standards and a steep learning curve further complicate adoption, particularly in regions with low digital literacy. Data security concerns regarding cloud-based platforms also contribute to hesitation among stakeholders, slowing the pace of digital transformation across the construction sector.

Country-Wise Insights

-

United States: Emerges as a mature, innovation-driven hub for BIM extraction software. Advanced adoption across public and private infrastructure projects, combined with AI and cloud integration, enhances workflow efficiency, predictive analytics, and sustainability planning.

-

Germany: Accelerates adoption through government mandates and focus on sustainable construction. Integrated BIM extraction tools enhance design accuracy, collaborative planning, and resource efficiency, supporting energy-efficient and carbon-neutral projects.

-

China: Driven by rapid urbanization, smart city initiatives, and technology integration, BIM extraction software facilitates accurate 3D modeling, design coordination, and lifecycle management. Integration with IoT, AI, and blockchain technologies positions China as a dynamic market for BIM adoption.

Category-Wise Market Outlook

Integrated BIM modules are increasingly favored for their interoperability and efficiency within CAD/BIM platforms. They enable end-to-end workflows, connecting design and extraction functions, and are preferred over standalone tools for multidisciplinary project execution.

Cloud deployment is surging due to its flexibility, real-time collaboration capabilities, and cost-efficiency. Cloud-based solutions support remote teams, continuous updates, and scalable operations, making them especially attractive for small and medium-sized firms.

Scan-to-BIM functionality is gaining traction, driven by the need for accurate retrofitting, renovation, and smart infrastructure management. The technology converts laser scans into precise 3D models, supporting renovation, restoration, and facility management projects.

Facility management applications are growing, with BIM enabling digital twins of physical assets for efficient maintenance, energy management, and optimized space utilization, ensuring long-term asset performance.

Competitive Landscape and Recent Developments

The BIM extraction software market is witnessing technological transformation, with companies refining automated extraction from 3D models and point clouds for enhanced productivity and design accuracy.

Key players include Autodesk, Bentley Systems, Trimble, Assemble Systems, AVEVA, FARO Technologies, Leica, Microsoft, Nemetschek Group, and Tekla, among others. New entrants like ClearEdge3D, PointCab GmbH, and Geo-Plus offer specialized point cloud-to-BIM solutions, further diversifying the competitive landscape.

Recent developments:

-

FARO Technologies (June 2023): Released version 2023.0 of As-Built Modeler software, improving scan-to-BIM workflows, point cloud compatibility, and software security.

-

Autodesk (May 2023): Launched Autodesk Forma, a cloud-based platform integrating AI for early-stage planning, automation, and environmental assessments, enhancing decision-making in AEC workflows.

Segmentation Overview

-

By Component: Standalone BIM extraction tools, integrated BIM modules, implementation & integration, support & maintenance, consulting

-

By Deployment Mode: On-premise, cloud-based

-

By Functionality: 3D model extraction, data & attribute extraction, point cloud processing & scan-to-BIM, clash detection, documentation, quantity takeoff & cost estimation

-

By Application: Architectural design, structural engineering, MEP modeling, construction planning, facility management, renovation & restoration

-

By End User: Architects, engineers, general contractors, construction managers, facility managers, surveying professionals

-

By Industry Vertical: Residential, commercial, industrial, healthcare, transportation, utilities & energy

-

By Region: North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

Conclusion

The BIM extraction software market is on a trajectory of sustained growth, driven by digital construction adoption, smart infrastructure development, and demand for efficiency, collaboration, and sustainability. Industry leaders and manufacturers now have a strategic opportunity to capitalize on these trends through innovation, integration, and advanced technological solutions.

Browse Full Report : https://www.factmr.com/report/bim-extraction-software-market