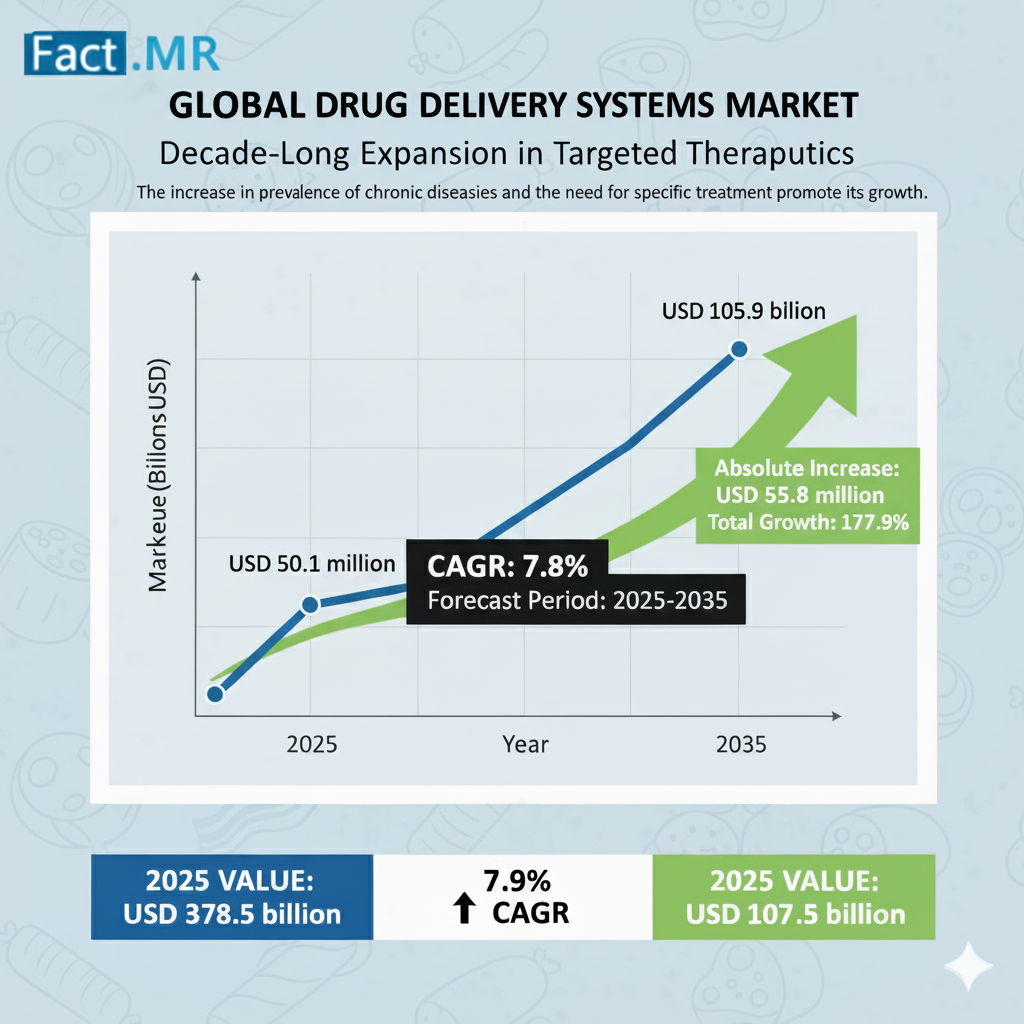

The global drug delivery systems market is projected to increase from USD 50.1 billion in 2025 to USD 105.9 billion by 2035, with a CAGR of 7.8% during the forecast period. the market’s growth trajectory reflects major advancements in nanotechnology, biotechnology, and patient-centric medical innovations that are reshaping how therapies are administered across the world.

This robust expansion is being driven by the increasing prevalence of chronic diseases, the aging global population, and the rising demand for non-invasive, smart, and controlled-release drug delivery platforms.

Precision and Patient-Centric Innovation Define the Future of Therapeutics:

The next decade is set to redefine therapeutic care as nanotechnology and biotechnology converge to create systems capable of targeted, sustained, and responsive drug delivery. Emerging smart drug delivery systems (SDDS) leverage materials that react to physiological changes, enabling controlled drug release only when specific biological conditions—such as pH or enzyme activity—are met.

These innovations improve therapeutic efficiency, minimize side effects, and enhance patient adherence—especially vital in treatments for cancer, diabetes, cardiovascular diseases, and respiratory disorders.

“The evolution of drug delivery is not just about convenience—it’s about precision, safety, and outcomes,” said a senior analyst at Fact.MR. “The integration of digital health monitoring, wearable injectors, and nanoparticle carriers is transforming traditional medicine into a data-driven, responsive ecosystem.”

Strong Growth Drivers and Regulatory Alignment Accelerate Adoption:

The market’s momentum is reinforced by regulatory support in key regions. The U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have streamlined frameworks for drug-device combination products, making it easier for innovators to bring advanced delivery platforms to market.

In 2024, the FDA’s “Essential Drug Delivery Outputs” (EDDO) guidance outlined critical design and performance expectations for combination therapies, fostering collaboration between pharmaceutical and device manufacturers. Similarly, the EU’s Medical Devices Regulation (MDR 2017/745) has introduced safety-driven quality standards that promote innovation without compromising patient protection.

However, challenges remain. High R&D expenditure—averaging USD 1.3 billion per novel delivery platform—along with complex compliance procedures and high manufacturing costs, continue to limit broader adoption, especially in low- and middle-income countries.

Rising Chronic Disease Burden Fuels Market Demand:

The World Health Organization (WHO) reports that nearly 74% of global deaths are caused by noncommunicable diseases (NCDs) such as cardiovascular disease, cancer, diabetes, and chronic respiratory illnesses. The increasing burden of these conditions underscores the need for efficient, targeted, and cost-effective treatment methods.

Advanced drug delivery systems—ranging from wearable injectors and transdermal patches to inhalable and nanoparticle-based formulations—are proving essential in addressing these healthcare challenges. These technologies enhance drug stability, reduce dosage frequency, and improve patient quality of life, especially in long-term treatment scenarios.

Regional Insights: Developed Nations Lead, Emerging Markets Catch Up:

1.North America continues to dominate the market due to robust healthcare infrastructure, R&D intensity, and a favorable regulatory environment for combination therapies.

2.Europe, particularly Germany and the U.K., benefits from extensive public healthcare spending and innovation-led pharmaceutical policies. Germany’s €494.6 billion healthcare expenditure (12.8% of GDP) and €9.6 billion R&D investments are driving adoption of precision delivery technologies.

3.Asia-Pacific is the fastest-growing region, powered by China’s Healthy China 2030 plan and India’s Production Linked Incentive (PLI) scheme, which encourage domestic innovation and collaboration with global pharmaceutical leaders.

4.Canada’s establishment of the Canadian Drug Agency and growing emphasis on universal pharmacare signal new opportunities for cost-effective and patient-focused delivery platforms.

Market Segmentation Highlights:

1.By Delivery Route: Injectable drug delivery remains dominant, propelled by demand for biologics, biosimilars, and wearable injectors. Innovations in needle-free systems and connected devices are expanding patient independence and safety.

2.By End User: Hospitals hold the leading market share, accounting for the largest portion of sales due to their central role in administering complex biologic and intravenous therapies.

3.By Region: Growth hotspots include Germany, India, Canada, and the U.K., each supported by policy reforms, R&D incentives, and healthcare modernization programs.

Competitive Landscape: Innovation and Collaboration at the Core:

The market’s competitive intensity is shaped by a mix of global pharmaceutical giants and device innovators focusing on integrated, patient-friendly solutions. Key players include Johnson & Johnson, Pfizer, Novartis, BD (Becton, Dickinson and Company), 3M Healthcare, Roche, AstraZeneca, GSK, Eli Lilly, and Sanofi.

Recent initiatives highlight the shift toward collaborative innovation and digital integration:

– BD (Becton, Dickinson and Company) introduced a new generation of wearable injectors and nasal spray systems at Pharmapack 2025, advancing home-based and biologics care.

– Researchers in India, Saudi Arabia, and the UAE jointly developed a colon-targeted nanoparticle drug delivery platform, marking a breakthrough in precision oncology.

– Partnerships such as Pfizer-BioNTech continue to set global benchmarks for mRNA delivery systems and scalable manufacturing.

Industry leaders are actively pursuing AI-enabled adherence monitoring, smart injectables, and digital therapeutics integration, signaling a future where connected drug delivery becomes the new standard.

Challenges and Opportunities Ahead:

While innovation drives market expansion, affordability and accessibility remain critical concerns. Bridging the healthcare gap between developed and emerging economies will require collaboration between governments, NGOs, and private sector players.

Initiatives such as the WHO prequalification program and regional health innovation funds are expected to improve access to affordable advanced drug delivery systems by 2035, particularly in resource-limited regions.

Final Outlook:

The decade from 2025 to 2035 marks a pivotal phase for the global drug delivery systems market, defined by scientific breakthroughs, digital integration, and patient empowerment. For manufacturers, investors, and healthcare providers, this sector represents a dynamic opportunity to redefine how medicines are administered and experienced—ushering in a new era of precision medicine, accessibility, and global health innovation.

Browse Full Report-https://www.factmr.com/report/4768/drug-delivery-systems-market