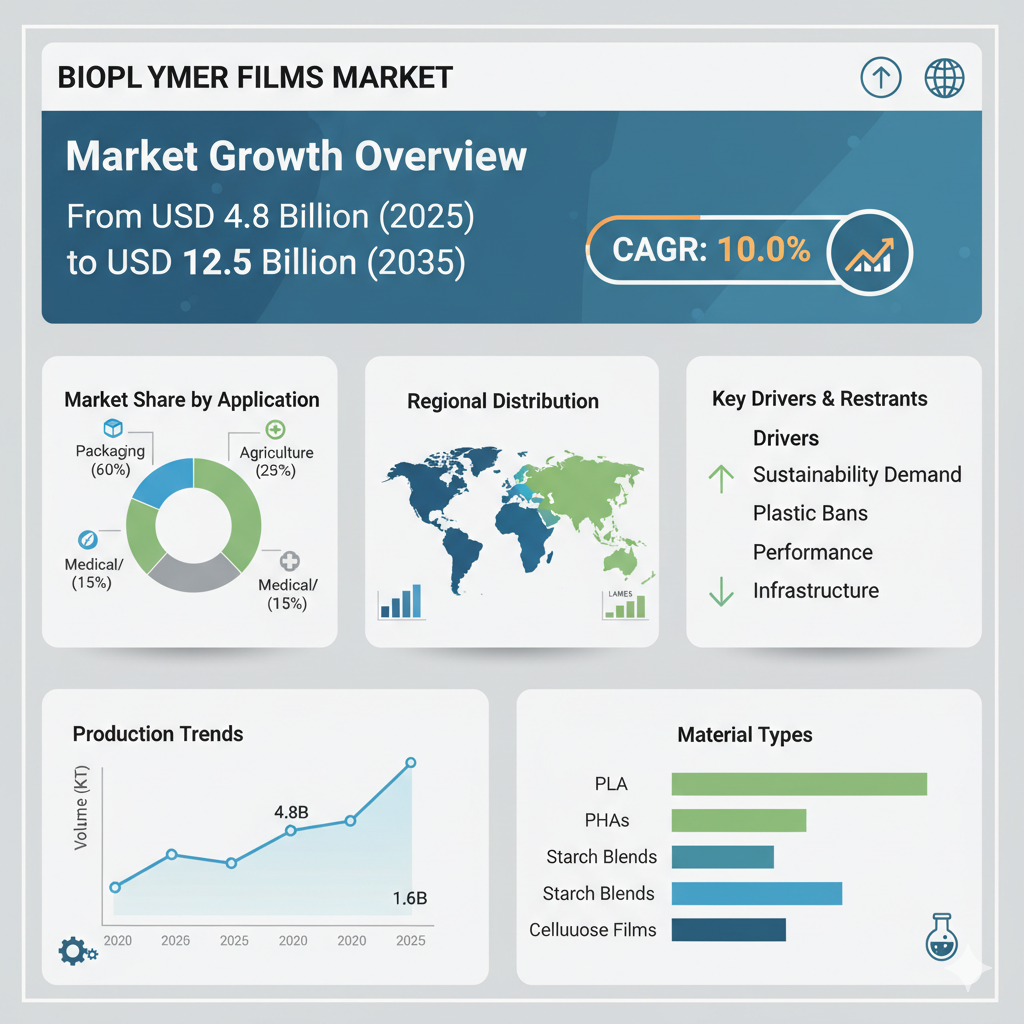

The biopolymer films market stands at the threshold of a decade-long expansion trajectory that promises to reshape sustainable packaging and biodegradable materials technology. The market’s journey from USD 4.8 billion in 2025 to USD 12.5 billion by 2035 represents substantial growth, with the market projected to rise at a compound annual growth rate (CAGR) of 10.0%. This impressive expansion reflects the accelerating adoption of biodegradable film systems, the tightening of environmental regulations, and rising demand from packaging and consumer goods sectors for sustainable alternatives.

Over the first half of the decade, between 2025 and 2030, the market is expected to climb to around USD 7.6 billion, gaining significant momentum. The latter half of the decade, from 2030 to 2035, is anticipated to contribute a larger share of growth as biopolymer films become deeply integrated into circular economy systems and mainstream packaging infrastructure.

Market Segmentation: Material, Application, and End Use

Material Type

Polylactic Acid (PLA) films are expected to remain the dominant material segment, capturing a large portion of the global market share by 2025. Their strong biodegradability, mature production processes, and compatibility with composting standards make them a preferred choice for various packaging applications. Starch-based films, on the other hand, offer cost advantages and are derived from renewable sources such as corn, potatoes, or tapioca. These films are particularly effective in short shelf-life packaging formats and agricultural applications.

Polyhydroxyalkanoate (PHA) films are emerging as a key innovation within the market due to their excellent biodegradability in diverse environments such as marine and soil ecosystems. Though their production costs are currently higher than PLA, ongoing technological advancements and increased production capacity are expected to improve their commercial viability. Other materials, such as cellulose-based and protein-based films, occupy niche segments, serving specialized functions like antimicrobial coatings and active packaging solutions.

Application

Food packaging represents the largest application segment of the biopolymer films market, accounting for more than half of total demand. With global consumers increasingly favoring eco-friendly packaging options, food manufacturers are turning to biopolymer films to balance performance, safety, and sustainability. These films offer excellent oxygen and moisture barrier properties, extending shelf life while ensuring product integrity.

In agriculture, biopolymer films are widely used for mulch films, greenhouse covers, and silage wraps, providing the added advantage of biodegradability that eliminates the need for post-harvest cleanup. The personal care sector is also witnessing rising adoption of biopolymer films in sachets, cosmetic packaging, and hygiene products, where biodegradability and skin compatibility are key selling points. Other niche applications include medical packaging, industrial films, and specialty films used in electronics and textiles.

End Use

Flexible packaging remains the leading end-use segment, covering applications such as pouches, wrappers, and bags. The shift toward flexible formats is driven by consumer convenience, reduced material usage, and improved sustainability credentials. Biopolymer films in this category are increasingly being engineered for high tensile strength and barrier performance to rival conventional plastics.

Rigid packaging, although smaller in share, is gaining attention through the integration of biopolymer films as liners or lamination layers in trays, containers, and cartons. This hybrid approach allows manufacturers to maintain structural integrity while incorporating biodegradable elements. Regionally, Asia Pacific is emerging as the fastest-growing market due to strong packaging demand, rapid industrialization, and supportive environmental policies. North America and Europe continue to lead in technology innovation and regulatory enforcement, ensuring the widespread adoption of biopolymer-based materials.

Recent Developments and Competitive Landscape

Recent years have witnessed significant advancements in technology, product innovation, and strategic collaborations within the biopolymer films industry. Companies are increasingly focusing on developing multilayer films, antimicrobial coatings, and smart packaging solutions that can extend product shelf life and enhance environmental performance.

Capacity expansion is another key trend, with leading manufacturers investing heavily in new production plants and scaling up existing operations to meet growing global demand. These expansions aim to bring down production costs, improve supply reliability, and enhance material consistency. Regulatory changes are also driving innovation, as governments around the world tighten restrictions on single-use plastics and promote biodegradable alternatives through incentives, certifications, and sustainability targets.

The competitive landscape is moderately concentrated, with major players accounting for more than half of the global market share. NatureWorks LLC remains a frontrunner in PLA film production, leveraging its large-scale operations and strong brand partnerships. BASF SE continues to innovate through its extensive chemical portfolio, focusing on biodegradable polymers and coatings that complement film applications. Novamont S.p.A. plays a significant role in compostable materials, while Danimer Scientific is making strides in PHA-based solutions, offering a biodegradable alternative to traditional plastics.

Request for Discount: https://www.factmr.com/connectus/sample?flag=S&rep_id=11150

Buy Now at USD 4500: https://www.factmr.com/checkout/11150

Check out More Related Studies Published by Fact.MR Research:

Structural Insulated Panels Market: https://www.factmr.com/report/structural-insulated-panels-market

SDHI Fungicide Market: https://www.factmr.com/report/sdhi-fungicides-market

Hydrogenated Cosmetic Ingredients Market: https://www.factmr.com/report/hydrogenated-cosmetic-ingredients-market

Formic Acid Market: https://www.factmr.com/report/4279/formic-acid-market