The global industrial hydrogen market is witnessing accelerated growth, propelled by the worldwide clean energy transition, rising demand for sustainable industrial processes, and the increasing adoption of hydrogen as a key enabler in decarbonization strategies. According to a recent report by Fact.MR, the market is projected to expand from USD 187.9 billion in 2024 to USD 311.6 billion by 2034, registering a steady CAGR of 5.1% over the forecast period.

Hydrogen’s growing role in refining, chemical processing, metallurgy, and clean fuel production underscores its significance as both a traditional industrial feedstock and a cornerstone of the future energy economy. As governments and corporations accelerate net-zero commitments, industrial hydrogen production and infrastructure are evolving rapidly to support low-carbon and green hydrogen pathways.

Strategic Market Drivers

Decarbonization and Net-Zero Commitments

Rising global pressure to curb carbon emissions is fueling investment in low-carbon hydrogen technologies. Major economies including the U.S., Germany, Japan, and South Korea are implementing national hydrogen strategies and carbon neutrality roadmaps. This policy shift is boosting demand for hydrogen across steelmaking, ammonia production, and heavy transport sectors—key emitters now transitioning toward clean alternatives.

Industrial Demand Expansion

Hydrogen remains a critical input in refining, fertilizers, methanol, and petrochemical manufacturing. As industrial activities rebound post-pandemic and as sectors adopt more sustainable feedstocks, the need for high-purity hydrogen has surged. The versatility of hydrogen in enabling cleaner industrial processes has positioned it as an indispensable component of global manufacturing.

Technological Advancements in Production and Storage

Innovation in electrolysis, carbon capture, and cryogenic storage is transforming hydrogen economics. The cost of renewable-powered electrolysis is declining sharply, making green hydrogen increasingly competitive with fossil-derived variants. Meanwhile, improvements in liquefaction and pipeline infrastructure are enhancing the feasibility of large-scale distribution and cross-border hydrogen trade.

Government Incentives and Hydrogen Infrastructure Investments

Public-private partnerships and funding initiatives are strengthening the hydrogen ecosystem. Large-scale projects for hydrogen hubs, refueling stations, and industrial clusters are underway globally. Countries like Japan, the U.S., and the European Union are allocating billions in subsidies to advance green hydrogen capacity and end-use adoption in mobility, power generation, and industry.

Regional Growth Highlights

East Asia: Driving Global Hydrogen Leadership

East Asia dominates global hydrogen production and consumption, led by Japan, South Korea, and China. Japan’s “Hydrogen Society” vision and South Korea’s roadmap for hydrogen mobility infrastructure are creating a strong industrial foundation. China’s significant investment in electrolyzers and hydrogen refueling infrastructure positions the region as a global innovation and production hub.

Europe: Pioneering Green Hydrogen Initiatives

Europe’s leadership in renewable integration and carbon pricing frameworks has made it the epicenter of green hydrogen development. The European Union’s “Fit for 55” and REPowerEU strategies are accelerating hydrogen adoption across refineries, ammonia plants, and heavy industries. Germany, the Netherlands, and France are key contributors to advancing electrolyzer technology and hydrogen storage.

North America: Expanding Through Energy Diversification

The U.S. and Canada are witnessing rising investments in blue and green hydrogen infrastructure. Supportive legislation such as the U.S. Inflation Reduction Act, offering tax incentives for clean hydrogen production, is catalyzing domestic output and export potential. Industrial applications in chemicals, steel, and energy storage are rapidly evolving to integrate hydrogen solutions.

Emerging Markets: Unlocking New Potential

Regions including the Middle East, Latin America, and Africa are emerging as hydrogen export powerhouses. Abundant renewable resources and strategic proximity to global trade routes make them ideal for green hydrogen production. Governments in Saudi Arabia, Chile, and the UAE are investing in large-scale electrolyzer projects to capture future export opportunities.

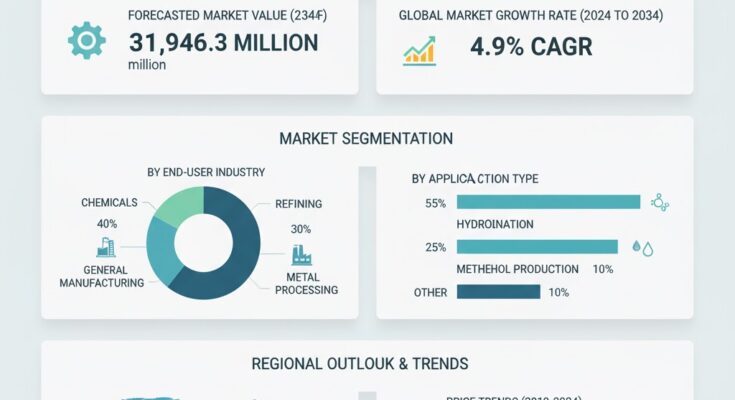

Market Segmentation Insights

By Production Method

- Steam Methane Reforming (SMR) remains dominant, accounting for over 60% of global production, though it faces pressure from carbon regulations.

- Electrolysis-based production is expanding rapidly, driven by renewable integration and carbon-neutral goals.

- Coal Gasification and Partial Oxidation retain relevance in specific markets with fossil resource abundance.

By Application

- Refining and Chemical Processing continue to be the largest consumers of industrial hydrogen.

- Metallurgy and Glass Manufacturing are increasingly adopting hydrogen to replace carbon-intensive fuels.

- Emerging sectors such as mobility, power generation, and energy storage are poised for exponential growth.

Challenges and Market Considerations

Despite its growth momentum, the industrial hydrogen market faces several challenges:

- High Production Costs: Green hydrogen remains costlier than fossil-based alternatives, necessitating continued government support and technology innovation.

- Infrastructure Gaps: Limited hydrogen transport and refueling networks hinder widespread adoption.

- Storage and Safety Concerns: Hydrogen’s volatility requires advanced containment and safety protocols.

- Policy and Certification Disparities: Inconsistent standards across regions complicate international trade and investment flows.

Competitive Landscape

The industrial hydrogen market is highly competitive and technology-driven, featuring a mix of established industrial gas giants and emerging clean energy innovators.

Key Companies Profiled:

Taiyo Nippon Sanso, Messer Group, Air Products, Yingde Gases, Air Water, Linde Group, Air Liquide, Reliance Industries Ltd., Mitsubishi Gas Chemical Company Inc., and Evonik Industries AG.

These companies are focusing on scaling hydrogen production through renewable pathways, integrating carbon capture technologies, and expanding global infrastructure networks. Strategic partnerships, acquisitions, and R&D initiatives are shaping the competitive dynamics of the market.

Recent Developments

- In July 2023, Air Liquide and KBR announced a strategic collaboration to offer comprehensive low-carbon ammonia solutions, leveraging their combined expertise to advance sustainable hydrogen-based ammonia production.

- In July 2023, Air Products & Chemicals, Inc. secured the role of hydrogen and technology provider for Alberta’s first hydrogen fuel cell passenger vehicle fleet, launched by Edmonton International Airport, marking a milestone in hydrogen mobility adoption.

Future Outlook: Hydrogen as the Cornerstone of the Energy Transition

The next decade marks a transformative phase for the industrial hydrogen economy. As industries pursue decarbonization and nations scale renewable infrastructure, hydrogen will serve as the bridge between traditional manufacturing and a clean energy future.

Manufacturers investing in electrolysis efficiency, digital monitoring systems, and large-scale production hubs are poised to lead the transition. With innovation accelerating across the value chain, the industrial hydrogen market is set to become a cornerstone of global sustainability—powering industries, fueling transportation, and enabling a zero-carbon future.