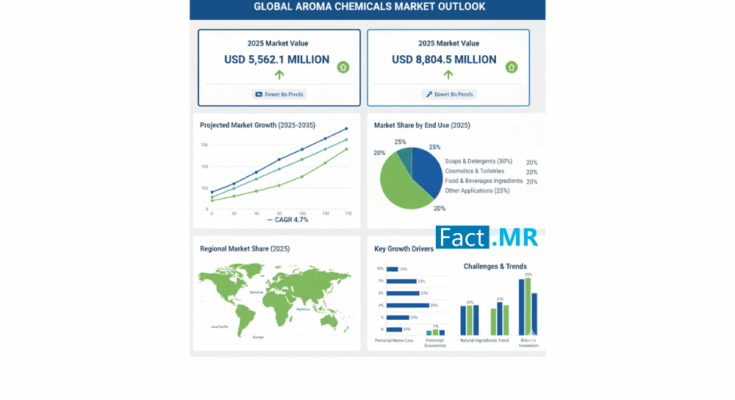

The global aroma chemicals market is projected to grow from USD 5,562.1 million in 2025 to USD 8,804.5 million by 2035, registering a compound annual growth rate (CAGR) of 4.7%. The expansion is fueled by rising demand in personal care, home care, and food & beverage sectors, particularly in the rapidly developing Asia Pacific region, where urbanization and disposable income growth are transforming consumer consumption patterns.

Aroma Chemicals Market Growth Drivers

Consumer emphasis on sensory experiences and product differentiation is propelling investment in innovative scent solutions. While synthetic aroma chemicals dominate due to cost-effectiveness and scalability, there is a significant shift toward natural and bio-based ingredients, prompted by clean-label initiatives and environmental regulations.

Technological advancements, such as encapsulation and controlled-release systems, are enhancing fragrance stability and longevity, making aroma chemicals more effective across applications. Leading players, including Givaudan and BASF, are expanding capacity, investing in biotech-based production, and innovating to meet evolving regulatory frameworks such as REACH and IFRA guidelines.

Growth in emerging Asia Pacific markets is also a major driver, supported by increasing middle-class populations, urbanization, and rising personal care expenditures. Manufacturers are responding with capacity expansion, strategic partnerships, and mergers & acquisitions, ensuring readiness to meet both demand and compliance requirements.

Aroma Chemicals Market Regional Insights

-

Asia Pacific leads the global market, accounting for over 30% of demand. Countries such as China, India, Japan, and Southeast Asian nations are experiencing rapid uptake of scented personal care, home care, and food products. The region benefits from a strong presence of contract manufacturers and fragrance formulators, enhancing domestic aroma chemical production. China remains a hub for synthetic aroma chemicals, while India is witnessing growing interest in natural extracts.

-

North America maintains steady demand, particularly in fine fragrance, personal care, and food & beverage sectors. Regulatory compliance and preference for allergen-free and sustainable ingredients drive innovation in bio-based aroma chemistry, with companies like IFF and Givaudan leading R&D initiatives.

-

Europe is a mature market emphasizing regulatory compliance, sustainability, and clean-label products. Countries such as Germany, France, and Switzerland remain key hubs for aroma chemical production. EU regulations under REACH and IFRA encourage the development of safer, greener alternatives. Major players, including Symrise and Firmenich, continue to invest in traceable, environmentally friendly ingredients.

-

Latin America is emerging as a growth market, driven by the increasing adoption of personal care and hygiene products in Brazil and Mexico. The demand for affordable fragrances and locally sourced ingredients is spurring regional production investments.

-

Middle East & Africa shows moderate growth, with rising urbanization and tourism driving demand for premium personal care and home care products. Gulf states, in particular, are fostering local blending activities and luxury fragrance imports.

Aroma Chemicals Market Challenges

The aroma chemicals market faces operational constraints, including:

-

Volatile raw material prices: Natural aroma compounds, such as essential oils and botanical extracts, are affected by climate variability, agricultural yield fluctuations, and geopolitical factors.

-

Regulatory pressures: Compliance with REACH, FDA, and IFRA standards requires costly product reformulation and safety testing.

-

High R&D costs: Developing new aroma molecules demands significant investment in toxicological assessments, compliance validation, and commercial rollout, favoring established global players over smaller entrants.

Aroma Chemicals Market Country-Wise Outlook

-

USA: Growth is driven by personal care, home care, and food & beverage demand. Consumer preference is shifting toward natural, sustainable, and allergen-free products, with manufacturers investing in bio-based and clean-label fragrance ingredients. The sector also leverages advancements in encapsulation and controlled-release technologies for improved scent longevity.

-

China: The market is expanding due to strong industrial infrastructure, domestic consumption, and regulatory evolution. China is a major global exporter of synthetic aroma chemicals, while domestic consumers increasingly demand premium, safer, and natural fragrance products. Investments in green chemistry, fermentation-based synthesis, and bio-based aroma chemicals are reshaping production.

-

Japan: Steady growth is driven by sophisticated consumer preferences and emphasis on sensory experiences. Bio-based and low-sensitizer aroma chemicals are increasingly used in skincare, bath products, and household goods. Companies like Takasago, T. Hasegawa, and Mitsubishi Gas Chemical are focusing on sustainable production, microencapsulation, and fermentation-based aroma synthesis.

Aroma Chemicals Market Segment Analysis

-

By Application: Soaps & detergents hold the largest share due to consistent consumer demand and hygiene emphasis. Fragrances in laundry, dishwashing, and surface care products influence perceived efficacy and freshness.

-

By Compound: Alcohol-based aroma chemicals dominate due to versatility, stability, and compatibility across personal care, home care, and fragrance applications. Synthetic aroma chemicals remain key for cost-effective, scalable solutions, while natural variants are gaining traction in premium segments. Benzenoid compounds lead by type, valued for strong, lasting scents and broad formulation compatibility.

-

By Region: Europe holds the leading market share, supported by mature personal care, fragrance industries, and regulatory oversight. Key players include Givaudan, Symrise, Firmenich, and BASF, focusing on sustainable and compliant aroma chemicals.

Aroma Chemicals Market Competitive Landscape

The aroma chemicals market features global and regional players competing on innovation, sustainability, and scale. Leading companies like BASF, Symrise, and Solvay emphasize sustainable production and R&D. Regional firms, such as Kelkar Group, Privi Organics, and Kalpa Sutra Chemicals, serve cost-sensitive markets, while specialty players like Robertet and Bell Flavors focus on fine fragrance and food sector customization.

Aroma Chemicals Market Recent Developments

In April 2023, Solvay partnered with Ginkgo Bioworks to strengthen its R&D capabilities in the USA, reflecting the industry’s push toward biotech-driven and sustainable aroma chemical solutions.

Aroma Chemicals Market Outlook

Driven by urbanization, rising disposable income, and clean-label trends, the global aroma chemicals market is poised for steady growth through 2035. Manufacturers investing in sustainability, bio-based innovations, and advanced formulation technologies are well-positioned to lead the industry, deliver consumer-preferred solutions, and meet evolving regulatory expectations.

Browse Full Report : https://www.factmr.com/report/5374/aroma-chemicals-market