The vibrant world of cosmetics has long prized exotic ingredients, but few carry the mystique and functional promise of Dead Sea mud. Rich in minerals such as magnesium, calcium, potassium, and bromine, Dead Sea mud cosmetics are becoming more than spa luxuries—they are entering mainstream skincare, driven by wellness, clean beauty, and consumer demand for natural efficacy.

Market Size, Forecast & Growth Trajectory

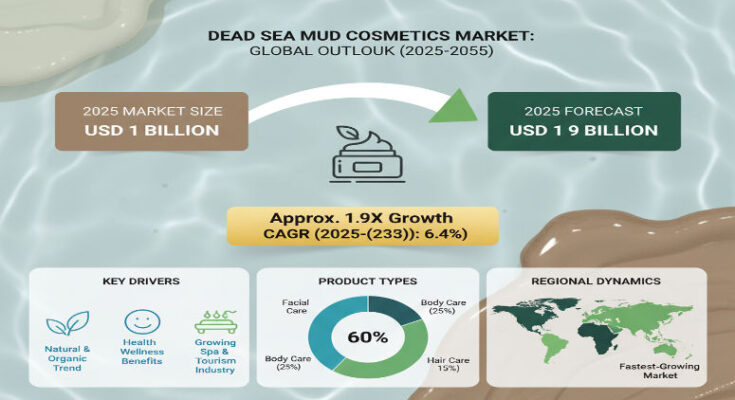

Today, the Dead Sea Mud Cosmetics Market is tracking a steady upward path. In 2025, global market size is projected at around USD 1.0 billion, growing at a compounded annual growth rate (CAGR) of approximately 6.4%. By 2035, market value is expected to cross USD 1.9 billion, nearly doubling in a decade. This growth is grounded in increasing awareness of skin conditions like acne, eczema, psoriasis and a broader trend toward natural, mineral-rich skincare. (FactMR data)

Other industry players echo similar trajectories. One recent analysis places the 2024 market value at about USD 1.5 billion, with projections to reach USD 4.3 billion by 2033, representing a higher CAGR in the range of 12-13%. These differences reflect variations in region-scope, product definitions, and distribution channels, but all agree: Dead Sea mud cosmetics are riding a growth wave. (IMARC, Allied, etc.)

What’s Fueling the Surge: Trends & Consumer Behaviors

Several converging trends have turned Dead Sea mud cosmetics from niche spa treatments into everyday skincare:

-

Clean Beauty & Natural Ingredients: Increasingly, consumers distrust heavily synthetic cosmetics. Products made with natural, mineral-rich elements like Dead Sea mud carry strong appeal for skin detoxifying, anti-inflammatory, oil-balancing, and healing properties.

-

Beauty Rituals & Self-Care Culture: Masks, scrubs, and full facial/body treatments are regaining popularity—not just for utility but for experience. Mud masks deliver instant gratification and perceived luxury, especially in facial care routines.

-

Digital Discovery & Influencers: Younger consumers are discovering Dead Sea mud cosmetics via online channels and social media, influencer reviews, and skin-care content. Authentic testimonials about results and sourcing tend to drive purchase decisions.

-

Regulatory Betterment & Transparency: Brands that emphasize honest labeling, ethical sourcing (especially concerning Dead Sea mineral extraction), cruelty-free or vegan certifications, and dermatological testing are gaining consumer trust. These practices are becoming competitive requirements rather than optional differentiators.

Segment Insights: Product Types, Gender, Distribution

Breaking down the market:

-

Product Types: Facial products lead the category, comprising over 40-45% of sales in many markets. Mud masks, facial scrubs, cleansers, exfoliants dominate. Hair care formulations (hair masks, scalp-focused mud shampoos/conditioners) are growing fastest, as awareness rises about scalp health and holistic hair care.

-

Gender / End-Users: Women’s care remains the dominant segment (approximately 65-70%), driven by facial and body product demand. However, male grooming is a growing sub-segment: products marketed for men’s skincare or hair/scalp problems are gaining traction, especially via digital marketing and male-focused cosmetic lines.

-

Distribution Channels: Physical/Offline retail still holds a significant portion in many regions—especially specialty stores, boutiques, spas. Yet the fastest growth is in the online channel, with e-commerce enabling direct-to-consumer sales, broader access, and lower barriers for new brands.

Regional Insights: United States & Europe

United States: The U.S. market is expanding strongly. Consumer demand for natural skincare, anti-aging, and wellness-oriented cosmetics continues to rise. Dead Sea mud products are benefiting from high disposable incomes and increasing interest in therapeutic skin solutions. Brands that guarantee mineral purity, dermatological support, and clean-label credentials are performing well. Online sales and wellness retail chains are major conduits, enabling reach beyond spa and boutique channels.

Regulatory scrutiny in the U.S. is also pushing brands to back marketing claims with evidence, which raises costs but also consumer confidence. Stores like Sephora, Ulta, and specialty natural beauty shops are increasingly stocking Dead Sea mud product lines.

Europe: Europe remains a sophisticated, trend-sensitive market, with strong share of total global sales. Countries like Germany, France, the UK, and Nordic regions have long histories of appreciating natural, mineral-based skincare. European consumers are particularly attentive to ethical sourcing, certifications (organic, vegan, cruelty-free), environmental impact, and ingredient origin—all of which play in favor of Dead Sea mud cosmetics.

Offline retail remains strong in Europe for these products, given the traditional prestige of spa, dermatologist-recommended and boutique retail experiences. However, online penetration is increasing rapidly, especially in Western Europe, helping smaller or niche brands scale.

Competitive Landscape & Key Players

Several brands lead this market, differentiated by heritage, quality, and positioning:

-

AHAVA, Inc. has long held a leadership position, leveraging its proprietary access to Dead Sea minerals, consistent formulation, strong brand story, and wide global distribution in premium retail and spa channels.

-

Premier Dead Sea, Seacret, Dead Sea Spa Magik, and HB Health & Beauty Ltd. are also significant players, catering to various segments—luxury, mid-premium, spa-based, and online direct-to-consumer.

-

Mid-market and value brands are also gaining ground, especially in emerging markets and via online channels.

The competitive advantage today hinges not just on product function, but on storytelling: demonstrating authenticity (minerals from the Dead Sea), ethical extraction, clinical claims, dermatological backing, and sensory experience (texture, scent, feel).

Challenges and Strategic Considerations

While growth prospects are strong, the market does face headwinds:

-

Sustainability & Environmental Concerns: Maintaining responsible extraction practices from the Dead Sea, ensuring supply stability, and avoiding overharvesting or ecological disruption are critical. Consumers are increasingly aware and sensitive to these issues.

-

Claims & Regulation: Products that claim therapeutic benefits (for acne, psoriasis, etc.) may attract regulatory scrutiny (depending on jurisdiction). Credible clinical data and clear marketing are essential.

-

Price Sensitivity: Premium positioning demands premium pricing. In price-sensitive markets, brands must find balance—offering effective formulations at accessible price points without diluting brand equity.

-

Differentiation Over Saturation: As more brands enter the space, noise increases. Brands must differentiate not only by ingredient and function, but by experience, sustainability, packaging, and trust.

Outlook & Editorial Perspective

From where I sit, the Dead Sea Mud Cosmetics Market is transitioning from niche wellness/spa sectors into broader skincare mainstream. Over the period 2025-2035, I expect brands that invest in clean formulations, ethical sourcing, clinical validation, and strong digital storytelling will lead the pack.

North America and Europe will remain key battlegrounds for premium and luxury lines; Asia-Pacific and Latin America will drive volume growth, especially among upwardly mobile consumers looking for natural, therapeutic skincare.

For industry players, strategic moves include: expanding online presence; forming dermatologist or spa partnerships; obtaining sustainability or vegan/organic certifications; investing in product line extensions (hair, men’s grooming); and perhaps most significantly, communicating the origin, provenance and mineral credentials of Dead Sea mud in compelling ways.