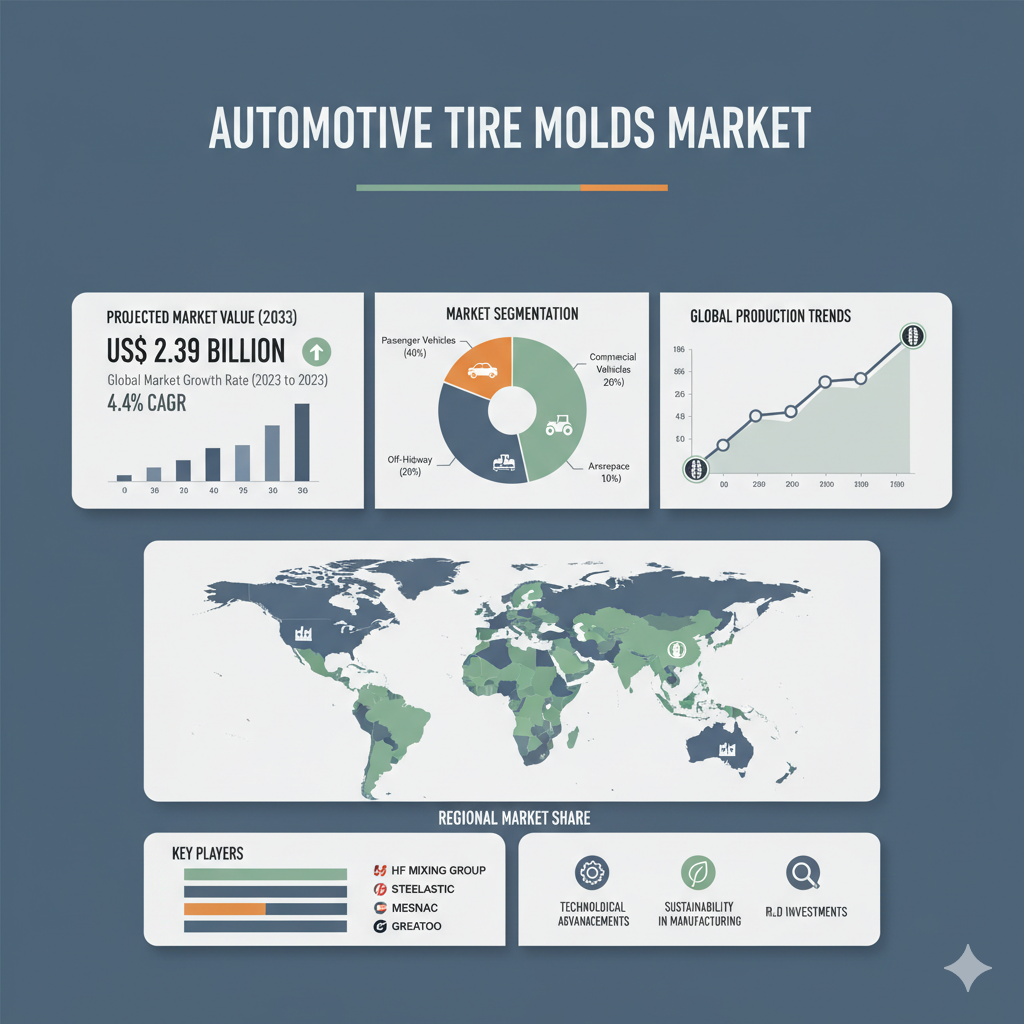

The global automotive tire molds market is valued at US$ 1.56 billion in 2023 and is forecasted to reach US$ 2.39 billion by 2033, expanding at a steady CAGR of 4.4% from 2023 to 2033. This projected growth highlights the importance of tire mold innovation, regional expansion, and competitive positioning as manufacturers adapt to the evolving demands of the automotive industry.

Market Segmentation: By Mold Type and Tire Application

A key aspect of the automotive tire molds market lies in its segmentation by mold type and tire application. The market is broadly classified into Segmented Molds and Two-Piece Molds, and by tire type into Passenger Car Radial Tires (PCR), Truck & Bus Radial Tires (TBR), and Off-The-Road Tires (OTR).

Segmented molds dominate the market due to their versatility and effectiveness in producing complex tire structures. Their capacity to create intricate tread patterns and ensure consistent quality has made them the preferred choice among tire manufacturers. Two-piece molds, though still relevant, are gradually being overshadowed by segmented mold designs that deliver superior performance and efficiency.

When viewed by application, the Passenger Car Radial Tires (PCR) segment represents the largest market share. This dominance is attributed to the increasing global production of passenger vehicles and the demand for high-performance and fuel-efficient tires. The Truck & Bus Radial (TBR) and Off-The-Road (OTR) segments, meanwhile, continue to contribute substantially, particularly in regions with strong commercial and industrial activities, such as construction and mining.

This segmentation analysis provides insight into where the most significant growth opportunities lie, guiding manufacturers toward more specialized production and technological investments.

Recent Developments and Technological Trends

The automotive tire molds market is witnessing continuous innovation and technological advancement. Manufacturers are increasingly adopting digital tools and smart manufacturing techniques to enhance precision and production efficiency. One notable development is the use of virtual molding simulation technologies, which allow companies to optimize designs and minimize defects before physical production begins. This digital shift helps reduce lead times and development costs, improving overall product quality.

Another trend shaping the market is the growing demand for eco-friendly and retread tires. As sustainability becomes a core focus in the automotive sector, tire mold producers are developing molds suitable for retread and hybrid tires. This shift not only supports environmental goals but also helps reduce material waste and production costs.

Additionally, the global emphasis on lightweight vehicles and low-rolling-resistance tires is influencing mold design. Manufacturers are prioritizing molds capable of producing tires that enhance fuel efficiency and performance. Precision engineering, enhanced surface finishes, and improved heat management within molds are becoming critical design parameters.

Regional expansion is also playing a vital role in the market’s evolution. The Asia-Pacific region, particularly China and India, continues to lead the demand for tire molds due to the strong presence of vehicle manufacturing facilities and growing domestic consumption. Many mold suppliers are setting up operations or forming partnerships in these markets to serve local tire producers more effectively.

Competitive Landscape: Key Players and Market Strategies

The competitive environment of the automotive tire molds market is characterized by both established players and emerging regional firms striving to expand their market presence. Prominent companies include A-Z GMBH, Anhui Mcgill Mould Co. Ltd., Anhui Wide Way Mould Co. Ltd., Beijing Tianyang Electronics Co. Ltd., Bridgestone Corporation, Continental AG, Dahmen Maschinen, Yokohama Rubber Co., and Michelin.

Bridgestone Corporation continues to invest in mold innovation to align tire performance with electric and hybrid vehicle requirements. Continental AG is expanding its product range, focusing on specialized tires that demand advanced mold geometries. Similarly, manufacturers such as Anhui Wide Way Mould and Anhui Mcgill Mould are leveraging their cost advantages and technological expertise to strengthen their positions in the Asian market.

European firms like A-Z GMBH and Dahmen Maschinen maintain a competitive edge through precision engineering and high-quality manufacturing standards, catering primarily to premium tire producers.