The global automotive interior material market is accelerating toward a transformative decade as automakers, suppliers, and designers redefine vehicle interiors to balance luxury, sustainability, and performance. According to a recent report by Fact.MR, the market is valued at US$ 59.6 billion in 2024 and is projected to reach US$ 95.2 billion by 2034, expanding at a CAGR of 3.6% during the forecast period.

Rising consumer expectations for comfort, safety, and eco-conscious design are reshaping automotive interiors. Automakers are increasingly investing in lightweight, recyclable materials, advanced composites, and smart surface technologies to enhance vehicle aesthetics and efficiency.

Strategic Market Drivers

Sustainability and Eco-friendly Materials

With global regulations emphasizing decarbonization and circular economy principles, automakers are shifting from traditional plastics and leather toward bio-based polymers, natural fibers, and recycled fabrics. OEMs are leveraging sustainable materials not only to meet emission norms but also to align with consumer preferences for ethical and environmentally responsible vehicles.

Lightweighting and Fuel Efficiency

Lightweight interior materials—such as composite polymers, thermoplastic elastomers, and polyurethane foams—play a crucial role in improving overall vehicle fuel economy. Reducing cabin weight supports both internal combustion and electric vehicles by enhancing range, reducing energy consumption, and optimizing performance.

Rise of Connected and Autonomous Vehicles

The emergence of smart and autonomous mobility is redefining interior spaces as digital living environments. Integration of touch-sensitive panels, ambient lighting, advanced seating ergonomics, and sound-absorbing materials is creating immersive user experiences. This evolution drives demand for high-quality polymers, fabrics, and composites that combine functionality, comfort, and durability.

Premiumization and Customization Trends

As consumers demand greater personalization, automakers are expanding options for bespoke interiors featuring vegan leather, 3D-printed components, and contrast stitching. Luxury and mid-range car segments alike are adopting high-end materials to strengthen brand identity and customer loyalty.

Regional Growth Highlights

East Asia: Global Manufacturing Hub

East Asia remains a pivotal region, supported by a robust automotive manufacturing base in China, Japan, and South Korea. Strong R&D capabilities, rising EV production, and innovation in sustainable materials position the region as a leader in the automotive interior material landscape.

Europe: Driving Innovation through Sustainability

Europe’s automotive interior material market thrives on stringent environmental standards and a growing preference for eco-friendly interiors. The EU’s focus on circular materials and recyclability drives innovation in bio-based polymers and post-consumer recycled textiles. Germany, France, and Italy continue to anchor the region’s premium car segment.

North America: Advancing Comfort and Technology

The U.S. and Canada are experiencing strong demand for advanced, luxury, and tech-integrated interiors, particularly in SUVs and electric vehicles. Automakers are investing in modular designs and sustainable materials to meet changing consumer lifestyles and regulatory demands.

Emerging Economies: Rising Middle-Class Demand

Countries across Latin America, the Middle East, and South Asia present untapped growth potential due to rising disposable incomes and expanding automobile ownership. Local production incentives and increasing acceptance of hybrid and electric vehicles are driving material innovation and market penetration.

Market Segmentation Insights

By Material Type:

- Polymers dominate due to their lightweight, moldability, and cost efficiency.

- Fabric and leather alternatives are gaining traction amid growing sustainability awareness.

- Composites and foams are increasingly used in dashboards, headliners, and seat cushioning.

By Vehicle Type:

- Passenger vehicles remain the primary consumers of interior materials, driven by high production volumes and customization trends.

- Commercial vehicles are progressively integrating durable, low-maintenance materials to enhance driver comfort and fleet longevity.

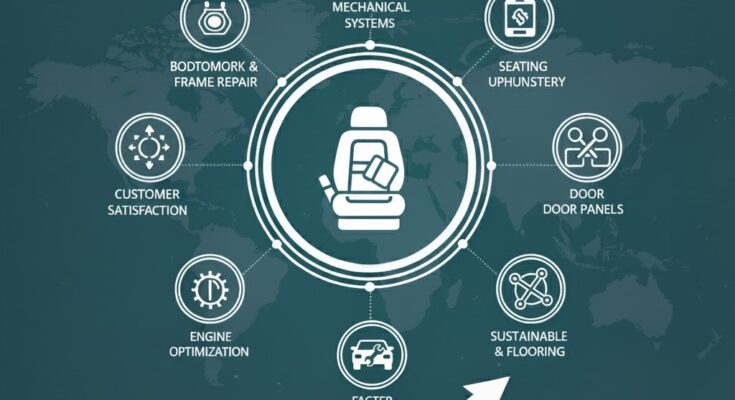

By Application:

- Key applications include dashboard, seat covers, door panels, headliners, and flooring.

- Demand is particularly strong for soft-touch materials and acoustic insulation solutions enhancing cabin comfort.

Challenges and Market Considerations

Despite steady growth, several challenges continue to shape market dynamics:

- High Material Costs: Advanced and sustainable materials can increase overall production costs, especially in mass-market vehicles.

- EV Interior Redesign: Electric vehicles require reimagined cabin layouts, prompting material suppliers to innovate new flexible designs.

- Supply Chain Pressures: Global supply constraints and raw material price fluctuations impact consistent material availability.

- Environmental Compliance: Manufacturers must adapt to evolving global sustainability regulations, adding complexity to production strategies.

Competitive Landscape

The automotive interior material market is marked by rapid innovation, mergers, and partnerships aimed at sustainable growth.

Key Companies Profiled:

BASF SE; Benecke-Kaliko AG; Borgers SE & Co. Kiara; The Dow Chemical Company; Dk-Schweizer Co.; Eagle Ottawa LLC.

Key players are investing in research and development, advanced manufacturing technologies, and strategic collaborations to maintain competitiveness.

In May 2022, Faurecia and Veolia entered into a collaboration to develop novel, eco-friendly materials for interior modules such as door panels and instrument consoles—accelerating sustainable innovation within the automotive industry.

Maufracture’s Strategic Positioning

Maufracture is strategically aligning itself with global trends to become a leader in sustainable automotive interior solutions through:

- Innovation in Material Science: Developing lightweight, durable, and recyclable interior materials tailored for both EVs and conventional vehicles.

- Global Footprint Expansion: Strengthening market presence across Asia-Pacific, North America, and Europe through OEM partnerships and localized production.

- Sustainability Commitment: Incorporating bio-based and recycled inputs while reducing carbon footprints in the manufacturing process.

- Collaborative Development: Partnering with automakers to co-create interiors that combine comfort, aesthetics, and environmental responsibility.

Future Outlook: Redefining Comfort for a Sustainable Mobility Era

As the automotive industry advances toward electrification, autonomy, and sustainability, the role of interior materials will become even more central in shaping the identity and performance of vehicles. Future innovations will revolve around eco-materials, smart surfaces, and modular designs that enhance both user experience and environmental impact.

Manufacturers that embrace green innovation, digital integration, and design flexibility will lead the transition toward a cleaner, smarter, and more luxurious mobility ecosystem. With its commitment to R&D, strategic collaboration, and sustainability, Maufracture is positioned to drive the next generation of automotive interiors—where comfort meets conscience.