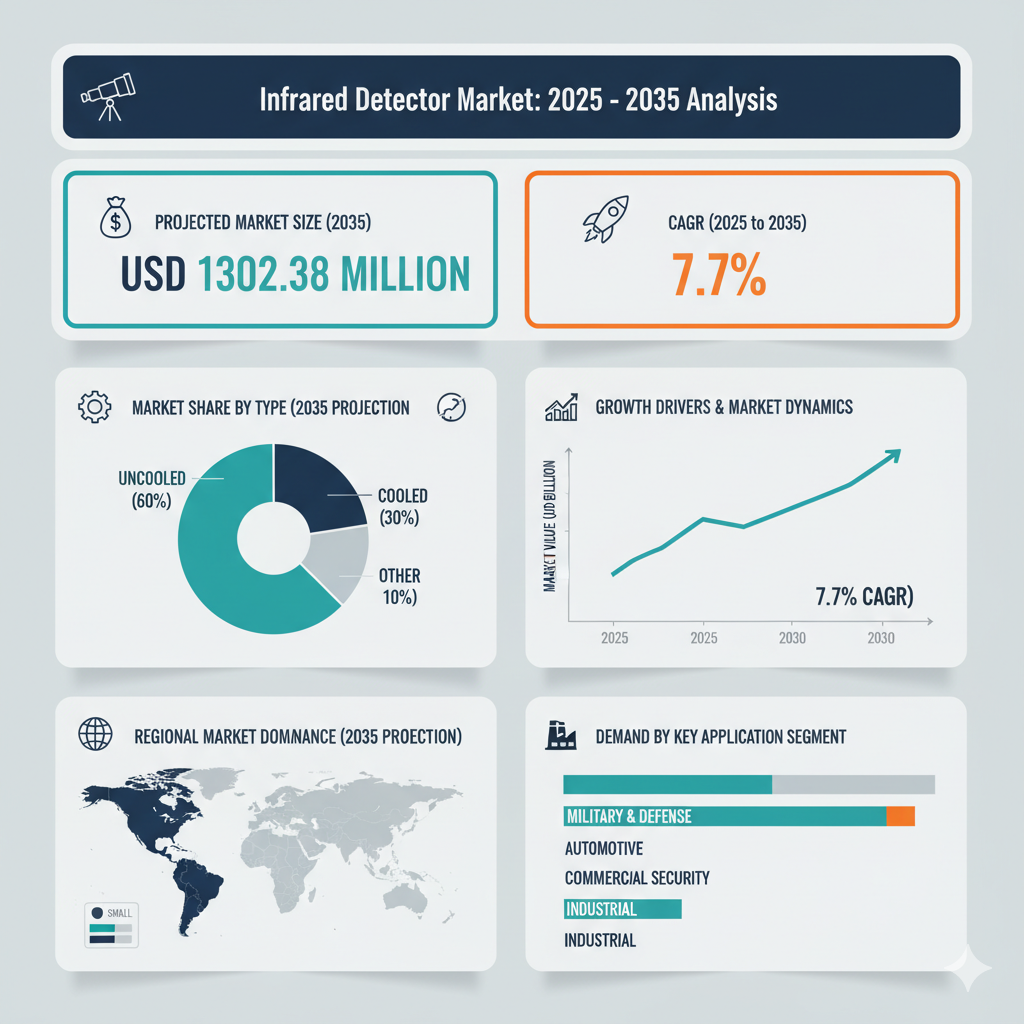

The Infrared Detector Market Analysis, By Spectral Range, By Technology, By Application, and Region – Market Insights 2025 to 2035 underscores a rapidly evolving sector. In 2025, the global infrared detector market is valued at USD 620.27 million. As per Fact.MR’s projections, the market will sustain a compound annual growth rate (CAGR) of 7.7%, reaching USD 1,302.38 million by 2035.

This article explores the segmentation across spectral ranges, technologies, applications, and geographies, and highlights recent developments—particularly among key players—and offers a detailed competitive analysis.

Market Segmentation: Key Dimensions

By Spectral Range

Infrared detectors are segmented into short-wave infrared (SWIR), mid-wave infrared (MWIR), and long-wave infrared (LWIR) types. Among these, SWIR detectors are expected to outpace others, with a projected CAGR of around 8.0% over the 2025–2035 period. Their adoption is being propelled by industrial inspection, agricultural monitoring, security systems, and IoT-based sensing where low-light imaging is valuable.

By Technology

From a technology standpoint, the market includes mercury cadmium telluride (MCT), indium gallium arsenide (InGaAs), pyroelectric, thermopile, microbolometer, and other detector types. The MCT segment stands out, expected to grow at a CAGR of 8.4% from 2025 to 2035 due to its high sensitivity and broad spectral detection range. Such detectors find strong traction in military, scientific, and defense imaging applications.

By Application

Application-wise, the market divides into automotive, consumer electronics, medical, military, and security segments. Among these, the automotive segment is projected to grow at a CAGR of 7.5% during 2025–2035. The growing use of thermal cameras in advanced driver assistance systems (ADAS), night vision, and pedestrian detection are major drivers in this vertical.

By Region

Geographically, the infrared detector market covers North America, Latin America, Western Europe, East Asia, South Asia & Oceania, and the Middle East & Africa. China is expected to post one of the strongest growth rates (around 8.3% CAGR) due to industrialization, consumer electronics expansion, and supportive government initiatives. The United States market is estimated to grow at a CAGR of 7.5%, driven by demand in aerospace, defense, and autonomous vehicle systems. Europe, including nations such as Germany, France, and the UK, will see growth fueled by automotive innovation, environmental regulations, and smart infrastructure adoption.

Recent Developments and Market Trends

In the 2024–2025 period, the infrared detector sector has witnessed significant momentum. Rising demand from automotive safety systems, industrial automation, and consumer electronics has spurred investments in sensor miniaturization, higher sensitivity, and integration with AI-enabled image processing.

Thermal imaging applications in surveillance and defense have particularly strengthened growth. Governments across multiple regions are increasing procurement of infrared-based detection systems to enhance border security, public safety, and infrastructure monitoring.

Another emerging trend is the integration of infrared detectors into smart devices and IoT ecosystems, including smart homes, building energy systems, and wearable health monitoring. This has boosted the demand for low-power, compact detectors that maintain performance with reduced energy consumption. Artificial intelligence and machine learning integration with infrared imagery are also gaining traction, enabling real-time analytics, predictive diagnostics, and adaptive environmental sensing.

Key Players and Competitive Analysis

The market is moderately consolidated, with a few dominant firms commanding significant shares and a broader range of smaller specialists.

Teledyne FLIR remains a leading player, accounting for nearly one-third of the market share due to its extensive portfolio of thermal imaging solutions for industrial, automotive, and defense sectors. Raytheon Technologies follows closely, leveraging its dominance in defense and aerospace infrared systems. L3Harris Technologies maintains a strong presence with a focus on military surveillance, space applications, and advanced IR sensor development. Leonardo S.p.A. and BAE Systems continue to strengthen their positions in the defense and security markets, while Lynred in France is gaining traction in high-performance cooled detectors for both defense and industrial use.

Other notable participants include Lockheed Martin, Thales, Hamamatsu Photonics, Bosch, Texas Instruments, Sensors Unlimited, and Smiths Detection. These players are heavily investing in R&D, mergers, and strategic partnerships to enhance their product offerings and expand into new regions.

Many leading companies are focusing on innovation in miniaturization, power efficiency, and AI-enabled imaging. Partnerships, acquisitions, and vertical integration strategies are being used to expand global reach and accelerate market penetration. However, the industry faces several challenges, including rapid technological obsolescence, environmental compliance regulations, export restrictions for defense applications, and global supply chain disruptions affecting component availability.