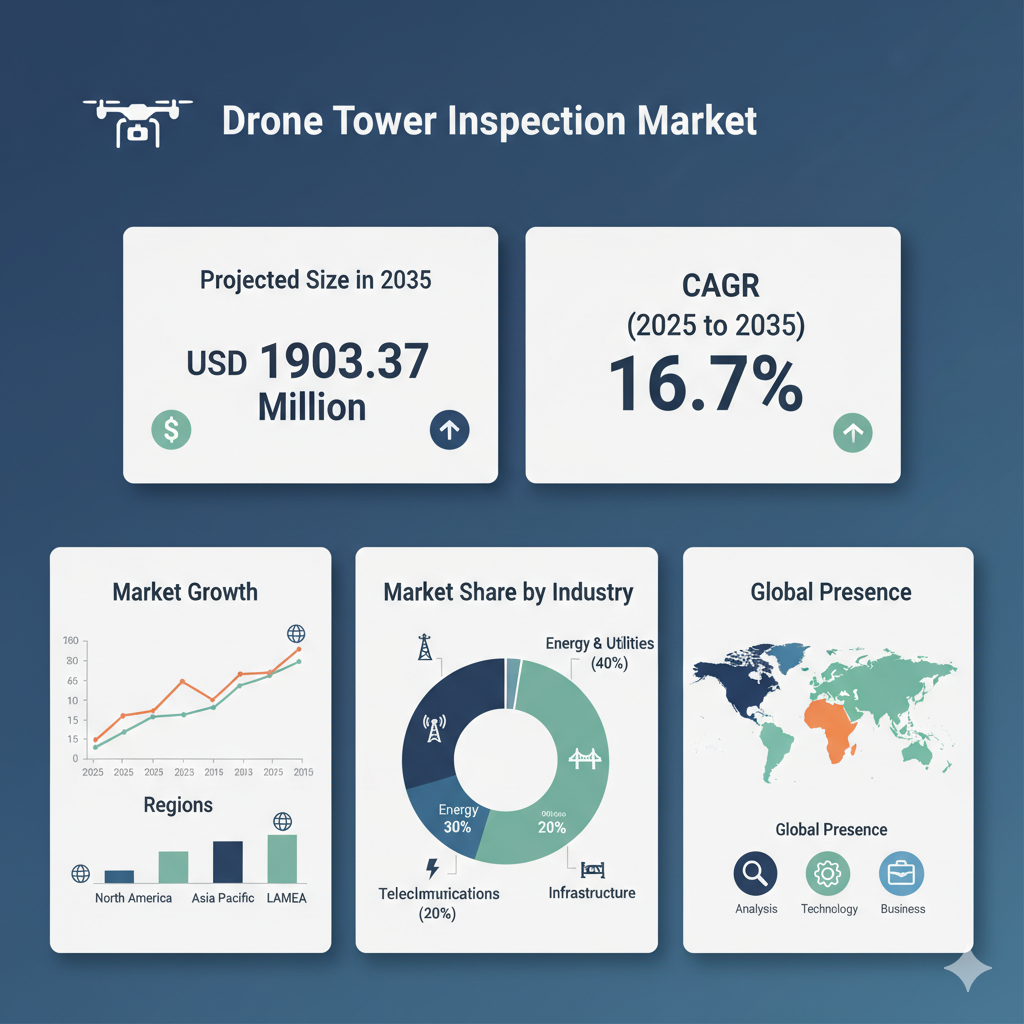

The global drone tower inspection market is valued at USD 406.27 million in 2025. As per Fact.MR’s analysis, this market is anticipated to grow at a CAGR of 16.7% between 2025 and 2035, ultimately reaching USD 1,903.37 million by 2035.

Market Overview & Growth Trajectory

The rising demand for safer, more efficient, and cost-effective methods of infrastructure monitoring is driving the adoption of drone tower inspections. This approach is quickly replacing traditional manual inspections that often require workers to scale towers or use expensive rope access systems. In 2024, the adoption of drone technology gained strong momentum, especially across regions with extensive infrastructure investments such as North America and Europe. Telecom and energy firms are increasingly integrating drones to minimize downtime, reduce operational costs, and ensure safety during inspections.

Over the next decade, advancements in artificial intelligence, automation, and high-precision sensor technologies like LiDAR and thermal imaging are expected to further propel industry growth. Additionally, as governments refine and expand regulatory frameworks around commercial drone use, the deployment of drones for tower inspection is expected to scale more rapidly across global markets.

Drone Tower Inspection Market Segmentation

By Drone Type

The market is segmented into Fixed Wing, Hybrid, and Rotary drones. Fixed-wing drones offer superior endurance and range, making them ideal for large-scale or remote inspection projects. Rotary drones, on the other hand, provide enhanced maneuverability, which is particularly advantageous for inspecting vertical or hard-to-reach structures. Hybrid drones bridge the gap between endurance and agility, allowing operators to perform both long-distance and detailed close-up inspections effectively.

By Operation

Based on operation, the market includes Remotely Piloted, Optionally Piloted, and Fully Autonomous drones. While remotely piloted systems dominate current use due to reliability and regulatory acceptance, the market is gradually shifting toward greater autonomy. Fully autonomous drones are being tested for large-scale deployments, where repetitive inspection routines and AI-driven data analytics can minimize human intervention and optimize accuracy.

By End-Use Industry

The major end-use industries are Telecommunication, Energy and Power, Construction and Mining, and Others. Telecommunication remains the largest segment due to the growing number of cell towers and the rapid expansion of 5G networks that require frequent maintenance checks. The energy and power sector is also emerging as a significant adopter, using drones to inspect transmission lines, wind turbines, and substations. In construction and mining, drones are increasingly utilized for monitoring tower-based installations, scaffolding, and structural integrity assessments.

By Region

Regionally, the market is categorized into North America, Latin America, Europe, East Asia, South Asia & Oceania, and Middle East & Africa. North America currently leads due to advanced drone regulations, higher infrastructure spending, and the presence of major drone manufacturers. Europe follows closely, driven by strict safety standards and innovation in automation technologies. Meanwhile, Asia-Pacific is projected to register the fastest growth rate, supported by large-scale telecom expansion and the ongoing industrialization of developing nations.

Recent Developments and Competitive Landscape

Recent technological developments have significantly influenced the drone tower inspection market. Manufacturers are integrating artificial intelligence and advanced analytics into drone systems to enhance defect detection, image processing, and predictive maintenance capabilities. Real-time data transmission, cloud storage, and automated reporting have become essential features, improving inspection efficiency and reliability.

In addition, global regulatory progress—such as clearer operational guidelines for commercial drones—has reduced uncertainty for service providers and encouraged wider adoption. Companies are increasingly offering Drone-as-a-Service (DaaS) models to make inspection technology accessible without heavy capital investment. Strategic partnerships between drone manufacturers and telecom or energy companies are also expanding, helping integrate drones seamlessly into existing maintenance and monitoring frameworks.

From a competitive perspective, the market features several key players that continue to innovate and expand their portfolios. DJI Innovations remains a market leader due to its strong brand presence and diverse range of inspection drones. Skydio has gained recognition for its autonomous navigation and obstacle avoidance systems, while Parrot Drones focuses on long-range and beyond-visual-line-of-sight operations. Cyberhawk Innovations and Flyability are also prominent, with the former specializing in AI-driven analytics and the latter excelling in confined-space and collision-tolerant drone designs. AeroVironment, Quantum Systems, Terra Drone, and PrecisionHawk are further strengthening competition by offering advanced inspection platforms and data analysis services.