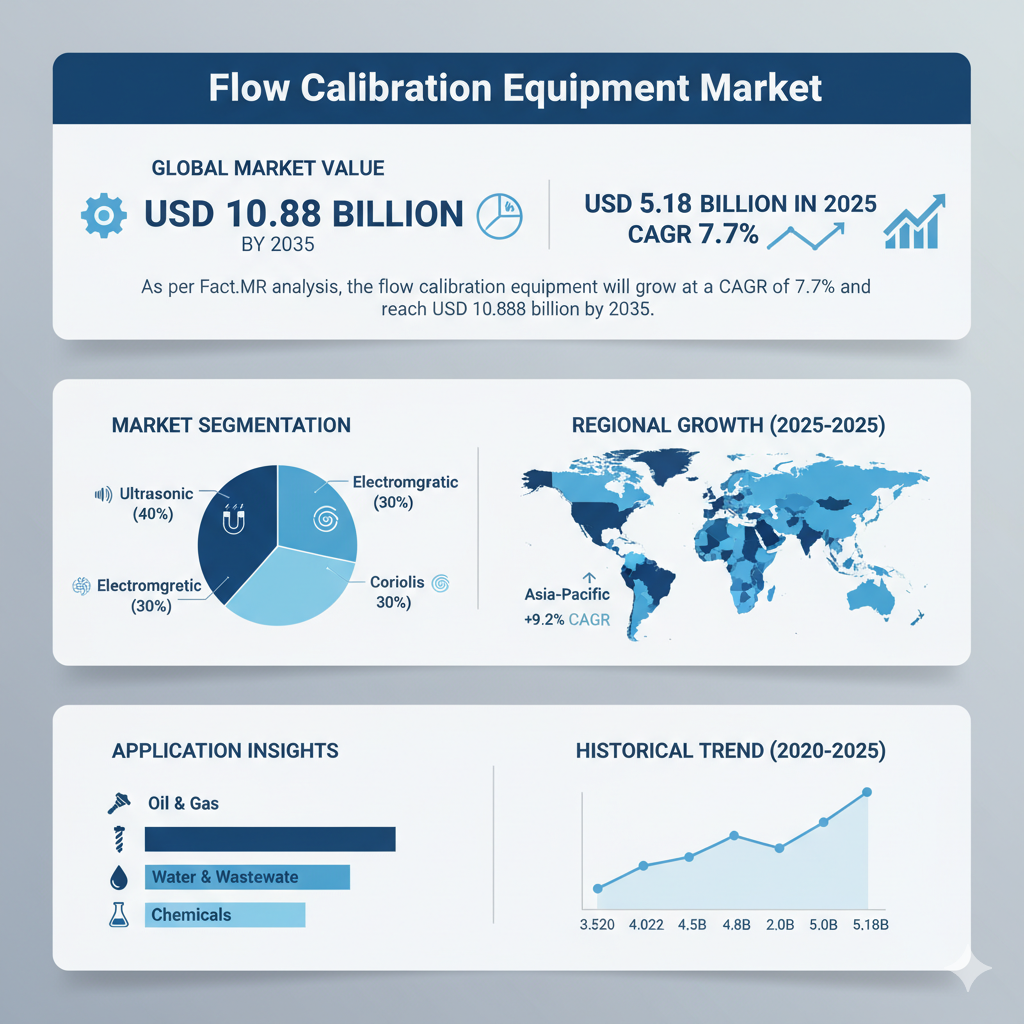

The global flow calibration equipment market is valued at USD 5.18 billion in 2025. As per Fact.MR analysis, the market is projected to grow at a CAGR of 7.7 %, reaching USD 10.88 billion by 2035.

Market Overview and Segmental Structure

The scope of the Flow Calibration Equipment Market Analysis encompasses segmentation by Type, by Flow Medium, by Flow Meter Type, by Calibration Site, by End-Use Industry, and by Region.

- By Type: The market is divided into Calibration and Recalibration services. The calibration segment is expected to expand significantly through 2035, fueled by regulatory demand for accurate metering in industries such as oil & gas, pharmaceuticals, and water utilities.

- By Flow Medium: The segmentation includes Water Flow, Liquid (other than water), Air Flow, Gas Flow. Among these, the water flow segment is anticipated to grow strongly, driven by utility, water treatment, and irrigation applications.

- By Flow Meter Type: The classification includes Volume Flow Meters (e.g., differential head, rotameters) and Mass Flow Meters (e.g., Coriolis, thermal). Volume flow meter calibration is projected to expand notably, especially as differential-type meters are extensively used in municipal and industrial pipelines.

- By Calibration Site: This covers In-House, User Site, Laboratory calibration strategies. Among these, in-house calibration is expected to be the fastest growing as firms seek to reduce dependence on third parties and minimize downtime.

- By End-Use Industry: Sectors covered include Agriculture, Aerospace & Defense, HVAC, Power & Energy, Water Management, Oil & Gas / Petrochemical, Industrial Manufacturing, Pharmaceuticals, Chemical Industry, Laboratories & Institutes, Others. Particularly, the petrochemical & oil & gas segment is forecast to witness strong growth, driven by demand for precise measurement in process optimization and custody transfer.

- By Region: The geographic spread includes North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East & Africa. Key regional markets such as the U.S., Europe, China, Japan, and South Korea are leading in both technological adoption and production capacity.

Together, these segmentations provide a full matrix to track demand, growth pockets, and structural shifts across industries and geographies.

Recent Developments and Market Dynamics

Technological and Digital Advancements

Recent years have witnessed the integration of IoT, AI, remote diagnostics, and software-embedded calibration platforms. Regulatory tightening has led many industries to shorten recalibration cycles, boosting demand for systems with automated diagnostics and real-time monitoring. Decentralized calibration models—capable of remote performance tracking and on-site adjustments—are emerging as preferred solutions.

In 2025 and beyond, rising momentum is expected for automation-led calibration infrastructure. AI-based diagnostics and IoT-connected modules will be increasingly adopted in manufacturing, utilities, and energy sectors. A trend toward multi-fluid calibration platforms (capable of handling water, gases, and chemicals) is also shaping vendor differentiation strategies.

Regulatory and Compliance Pressures

Stricter regulatory mandates such as ISO/IEC 17025 and traceability standards are compelling end users to adopt more reliable, digitally traceable calibration systems. In regions such as Europe and North America, audit readiness and compliance have become major procurement drivers.

Environmental and sustainability goals are also influencing adoption. Modular, energy-efficient calibration systems aligned with green initiatives are gaining preference, particularly in regions focusing on carbon neutrality and water conservation.

Supply Chain and Cost Challenges

A key challenge across the value chain is the supply constraint of precision sensors and microcontrollers, which has led to component delays and cost inflation. Regional differences in price sensitivity also exist—while U.S. and European buyers may absorb a premium for traceability, Asian buyers often emphasize cost efficiency.

In response, some OEMs are experimenting with equipment leasing or pay-per-calibration models to reduce upfront capital expenditure and attract small-scale industrial users.

Key Players & Competitive Landscape

The flow calibration equipment market is moderately consolidated, with several leading global players commanding significant share. Below is an overview of major competitors and their strategies:

- Siemens AG: Holds a significant market share by leveraging its industrial automation expertise. Siemens integrates machine learning analytics into its flow calibration systems, enhancing efficiency and traceability.

- Emerson Electric Co.: Strengthened its test and measurement portfolio through acquisitions and modular calibration benches gaining traction, particularly in the petrochemical and water industries.

- Endress+Hauser Group: Expanding its calibration laboratories in India and Southeast Asia, the company is focusing on the pharmaceuticals and water management sectors.

- ABB Ltd.: Incorporates energy-efficient modules and is exploring blockchain-based calibration traceability, targeting smart grid and industrial applications.

- Yokogawa Electric: With its FlowNavigator 2.0 platform, Yokogawa is advancing AI-driven calibration systems for chemical plants and LNG facilities.

- KROHNE Group: Recently launched its portable OPTIMASS 6400 system to serve specialty chemical users, focusing on mobile lab strategies in emerging markets.

Other notable participants include Honeywell, Schneider Electric, Badger Meter, Brooks Instrument, OMEGA Engineering, TSI, Fluke, TE Connectivity, Alicat, McCrometer, RITTER Messtechnik, and Ametek. Competition is increasingly driven by innovation in software integration, service reliability, and cost optimization.