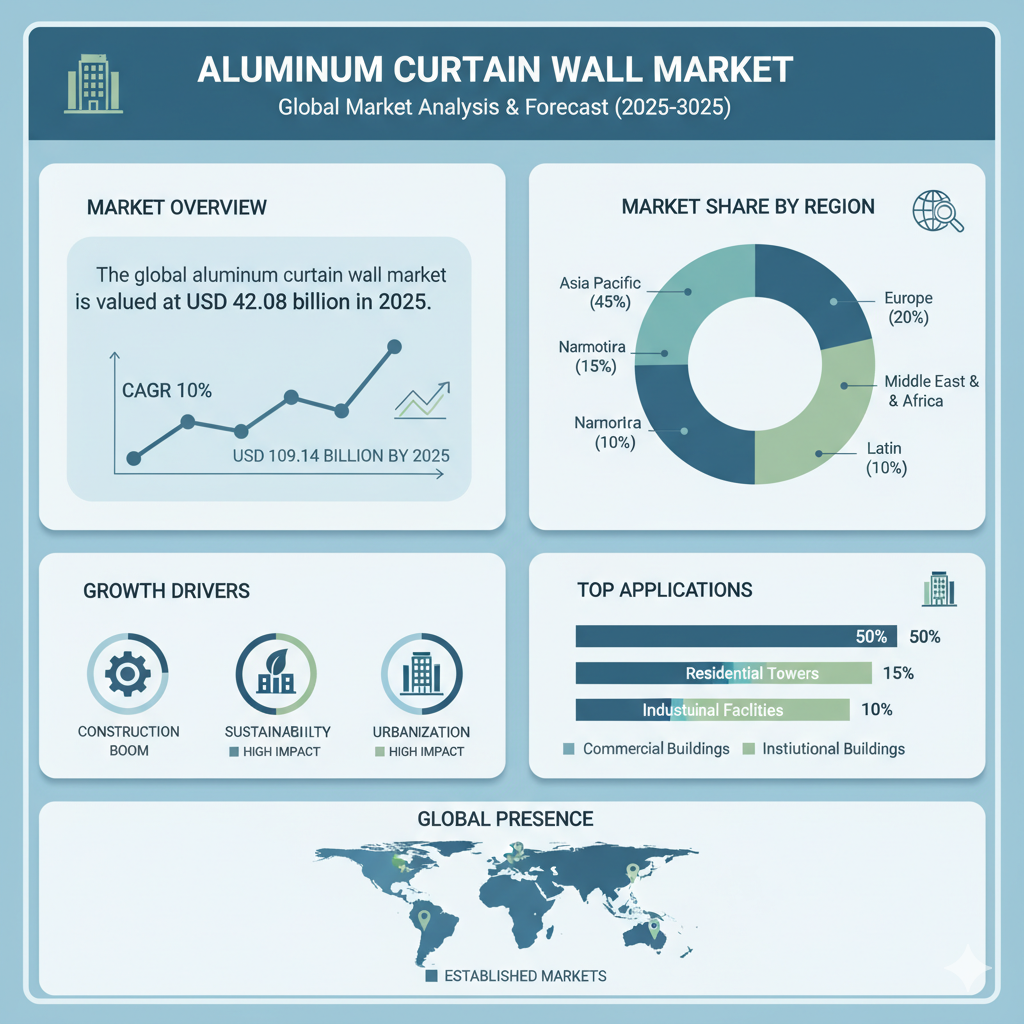

The global aluminum curtain wall market is valued at USD 42.08 billion in 2025. As per Fact.MR analysis, the aluminum curtain wall market is projected to grow at a CAGR of 10 % and reach USD 109.14 billion by 2035.

Market Overview: Segments and Regional Landscape

By Type: Stick-built, Semi-unitized, and Unitized Systems

The aluminum curtain wall market is segmented by system type into stick-built, semi-unitized, and unitized systems.

- Stick-built systems are traditional site-assembled systems, offering flexibility in design and adaptability to irregular façades.

- Semi-unitized systems provide a hybrid approach—some offsite prefabrication with partial onsite assembly.

- Unitized systems, which are fully prefabricated offsite and shipped as modules ready for installation, have gained strong traction, especially in high-rise and commercial buildings.

Unitized systems are expected to grow strongly from 2025 to 2035 (at a CAGR of about 8.2 %) due to their installation speed, higher precision, quality control, and reduced labor risk onsite.

By Application: Commercial vs. Residential

In terms of end use, the market divides into commercial and residential applications.

- The commercial segment currently dominates, due to heavy demand from office towers, hotels, airports, shopping malls, institutional buildings, and mixed-use complexes. In fact, over 80 % of façade installations in 2024 were in commercial projects.

- Residential applications also contribute, but growth is relatively more modest, especially in luxury condominiums or high-end multifamily towers that adopt curtain-wall style façades.

Growth in commercial applications is expected to continue slightly outpacing residential, largely driven by stricter energy-efficiency regulations, rising urbanization, redevelopment in business districts, and strong investment in green buildings.

By Region: Global Reach & Hotspots

The market is geographically segmented into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East & Africa.

Some regional highlights and growth trajectories:

- East Asia stands out as one of the fastest-growing regions, with projected CAGR of 11.6 % from 2025 to 2035, backed by strong government infrastructure programs, smart city initiatives, and adoption of unitized façades in large mixed-use developments.

- North America is expected to grow at about 9.2 % CAGR over the forecast period. Commercial real estate renovations, sustainable retrofits, and federal/state incentives are fueling demand.

- Europe (especially Germany, France, UK) is also a strong market, propelled by strict codes, green building policies, and architectural demand for high-performance façades.

- Middle East / Gulf region sees adoption driven by extreme climatic demands, preference for durable, high-efficiency systems, and large-scale real estate projects in cities like Dubai, Abu Dhabi, and Riyadh.

- South Asia & Pacific (including India) is poised for steady growth, though adoption rates may lag due to cost sensitivity, regulatory enforcement variability, and infrastructure constraints.

Thus, while adoption is global, the pace, preferred system types, and specification preferences vary markedly by region.

Recent Developments, Key Players & Competitive Dynamics

Recent Developments

- There is a significant shift toward unitized systems, especially in fast-growing urban markets in China, India, and GCC nations, due to labor constraints and tight schedules.

- Many firms are investing in façade-integrated photovoltaics (building-integrated solar), advanced thermal break technologies, and smart façade elements (IoT-enabled glazing, responsive shading) to differentiate offerings.

- Regional supply-chain resilience has become a strategic focus. Firms are forming extrusion and fabrication partnerships in local growth markets to reduce logistics risk and input cost volatility.

- Sustainability and green certification alignment (LEED, BREEAM, and local building codes) are increasingly critical; product pipelines now often target low-embodied carbon aluminum, recyclability, and compliance with environmental product declarations (EPDs).

- Some leading players are adopting innovation strategies such as AI/3D modeling to shorten design cycles, or launching region-specific systems (e.g. hurricane-rated systems for U.S. Gulf region).

Key Players & Competitive Analysis

The competitive landscape is concentrated among a handful of global and regional players.

- YKK AP, Inc. holds one of the largest shares (~15–20 %). It pursues expansion in Asia and North America, with plans for modular façades integrated with solar modules.

- Schüco International (Germany) captures about 12–18 % of the market, focusing on Europe and advanced smart façade systems. Their partnership with Siemens (2025) is aimed at boosting intelligent building automation.

- Kawneer (Howmet Aerospace), strong in North America, holds around 10–15 %. It is investing in hurricane-rated curtain walls for Gulf/Florida markets and LEED-compliant product lines.

- Oldcastle BuildingEnvelope (CRH) commands 8–12 %. Its strength lies in leveraging CRH’s logistics and undertaking M&A and regional partnerships to buffer raw material volatility.

- Reynaers Aluminium targets the Europe and Middle East segments, with 7–10 % share; it plans to establish an R&D hub in UAE for desert-resilient façade innovations.

- Josef Gartner (Permasteelisa Group) holds 5–8 %, specializing in luxury and complex façades. Their recent initiative in AI-powered 3D modeling is projected to cut turnaround time by ~30 %.

Other notable players include EFCO Corporation, Enclos, GUTMANN AG, Aluplex, Alutech, HansenGroup, Heroal, HUECK System GmbH, Kalwall, Aluk Group, and various regional manufacturers and façade specialists.

Competitive pressures and differentiators:

- Innovation & product differentiation: To compete, companies must integrate advanced features (smart façades, photovoltaics, thermal optimization).

- Sustainability & compliance: Firms that ensure low-carbon aluminum, recyclability, and certifications will likely gain favor in regulated markets.

- Local presence & supply chain: Regional manufacturing/fabrication footprints reduce costs and speed delivery—this is becoming a strategic necessity in emerging markets.

- Cost constraints: In cost-sensitive markets, stick-built or semi-unitized systems may remain favored; premium players must balance performance versus affordability.

- Brand reputation & track record: Past successful landmark projects and façade performance credibility influence procurement in major commercial developments.