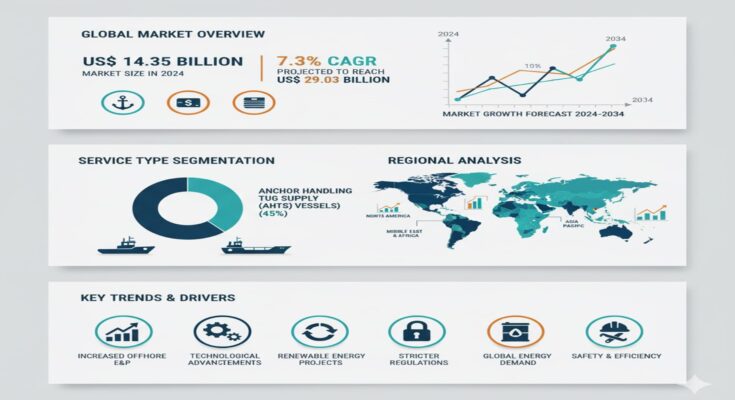

The global offshore support vessel service market is on an impressive growth trajectory, driven by the accelerating transition toward renewable energy, resurgent offshore oil & gas activity, and rapid adoption of digital fleet management solutions. According to a recent analysis by Fact.MR, the global offshore support vessel service market is valued at US$ 14.35 billion in 2024 and is forecasted to reach US$ 29.03 billion by 2034, registering a robust CAGR of 7.3% between 2024 and 2034.

Strategic Market Drivers

- Rising Renewable Energy Deployment

The rapid global expansion of offshore wind farms and marine renewable energy projects has become a major catalyst for OSV service demand. Support vessels play a crucial role in wind turbine installation, subsea cable laying, and ongoing maintenance operations. With countries such as China, Japan, and South Korea investing heavily in offshore wind infrastructure, the need for specialized support services has risen dramatically. Europe, led by the United Kingdom, Germany, and Denmark, continues to dominate offshore wind energy deployment, fueling vessel demand across the North Sea and Baltic regions.

- Rebound in Offshore Oil & Gas Exploration

After a period of subdued activity, offshore oil and gas exploration is witnessing a strong recovery. Deepwater and ultra-deepwater projects in regions like the Gulf of Mexico, West Africa, and the North Sea are spurring fresh demand for platform supply vessels (PSVs), anchor-handling tug supply (AHTS) vessels, and subsea support vessels. The renewed focus on energy security and stable crude supply is prompting operators to expand fleet charters and optimize vessel utilization.

- Fleet Digitalization and IT-as-a-Service Transformation

Digital transformation is reshaping the OSV service landscape. Leading companies are transitioning from capital-intensive (CAPEX) models to operational (OPEX) frameworks by integrating cloud-based fleet monitoring, cybersecurity systems, and remote diagnostics.

In February 2022, Vroon, a prominent OSV service provider, partnered with Navarino to implement a new IT-as-a-service platform across its 120-vessel fleet. This strategic shift enables real-time data analytics, predictive maintenance, and seamless vessel-to-shore communication—enhancing both safety and operational efficiency.

- Regulatory Compliance and ESG Imperatives

Environmental, Social, and Governance (ESG) goals are driving a wave of sustainability initiatives across the maritime sector. OSV operators are increasingly adopting low-emission propulsion systems, alternative fuels, and hybrid-electric technologies to comply with international maritime regulations. Moreover, governments worldwide are enforcing stricter safety and emission standards, compelling service providers to modernize fleets and adopt greener technologies.

Regional Growth Highlights

North America

North America remains a mature yet dynamic market, driven by ongoing deepwater projects in the Gulf of Mexico. Major players are upgrading fleets with digital systems, advanced sensors, and low-emission engines to enhance operational safety and comply with environmental regulations. The region also benefits from strong investments in offshore wind energy, particularly in the U.S. East Coast.

Europe

Europe stands as the hub of offshore renewable expansion. The European Union’s General Safety Regulation and aggressive offshore wind targets are creating consistent demand for multi-purpose support vessels. OSV operators are also leveraging automation, data analytics, and AI-based solutions to enhance performance in harsh marine environments.

Asia-Pacific

Asia-Pacific, led by China, Japan, and South Korea, represents the fastest-growing regional market. China’s large-scale offshore wind investments, coupled with its strong shipbuilding capabilities, make it a focal point for OSV fleet expansion. Japan and South Korea, known for precision engineering and technological leadership, are driving innovation in hybrid and autonomous vessel technologies.

Emerging Markets

The Middle East, Africa, and Latin America are experiencing steady growth driven by increased oil exploration, smart port development, and expansion of offshore energy infrastructure. Countries like Brazil, Saudi Arabia, and the UAE are investing in fleet modernization and digital integration to strengthen regional maritime capacity.

Market Segmentation Insights

By Vessel Type

- Platform Supply Vessels (PSVs): Dominate the global market, serving as the backbone for offshore logistics and cargo transport.

- Anchor Handling Tug Supply (AHTS) Vessels: Increasing demand from deepwater drilling activities and subsea installations.

- Crew and Utility Vessels: Witnessing consistent adoption for personnel transport, inspections, and emergency support.

By Application

- Offshore Oil & Gas Support: Largest revenue contributor due to ongoing drilling, exploration, and production operations.

- Offshore Wind Energy Services: Fastest-growing segment as nations accelerate renewable energy commitments.

- Subsea Maintenance & Inspection: Expanding steadily with the rising complexity of subsea infrastructure.

Challenges and Market Considerations

Despite robust growth potential, the OSV service market faces notable challenges:

- High Operational Costs: Advanced vessels with digital and green technologies involve significant capital investments.

- Crew Shortages: A global shortage of skilled marine professionals continues to impact service quality.

- Environmental Regulations: Stricter global emission norms are pressuring operators to accelerate decarbonization efforts.

- Technological Integration: Achieving interoperability across legacy systems and new digital platforms remains complex.

Competitive Landscape

The offshore support vessel service market is highly competitive, with companies focusing on innovation, regional expansion, and technological partnerships. Key players include:

Vroon Offshore Services Pte Ltd., A.P. Møller – Mærsk A/S, Bumi Armada Berhad, Swire Pacific Limited, Bourbon Corporation, Edison Chouest Offshore, Falcon Energy Group, Tidewater Inc., Seacor Holdings Inc., and SolstadFarstad ASA.

These industry leaders are emphasizing digital transformation, vessel automation, and hybridization strategies. Collaborative ventures with tech companies for real-time monitoring and predictive analytics are reshaping service delivery models across global fleets.

Future Outlook and Industry Leadership

The offshore support vessel service market is at a pivotal juncture, balancing the dual momentum of traditional energy resurgence and renewable energy acceleration. Over the next decade, vessel operators that prioritize digital efficiency, sustainability, and operational flexibility are poised to lead.

With a projected market value of US$ 29.03 billion by 2034, OSV service providers will continue to evolve as critical enablers of offshore energy, ensuring seamless operations, reduced carbon footprints, and enhanced safety standards worldwide.