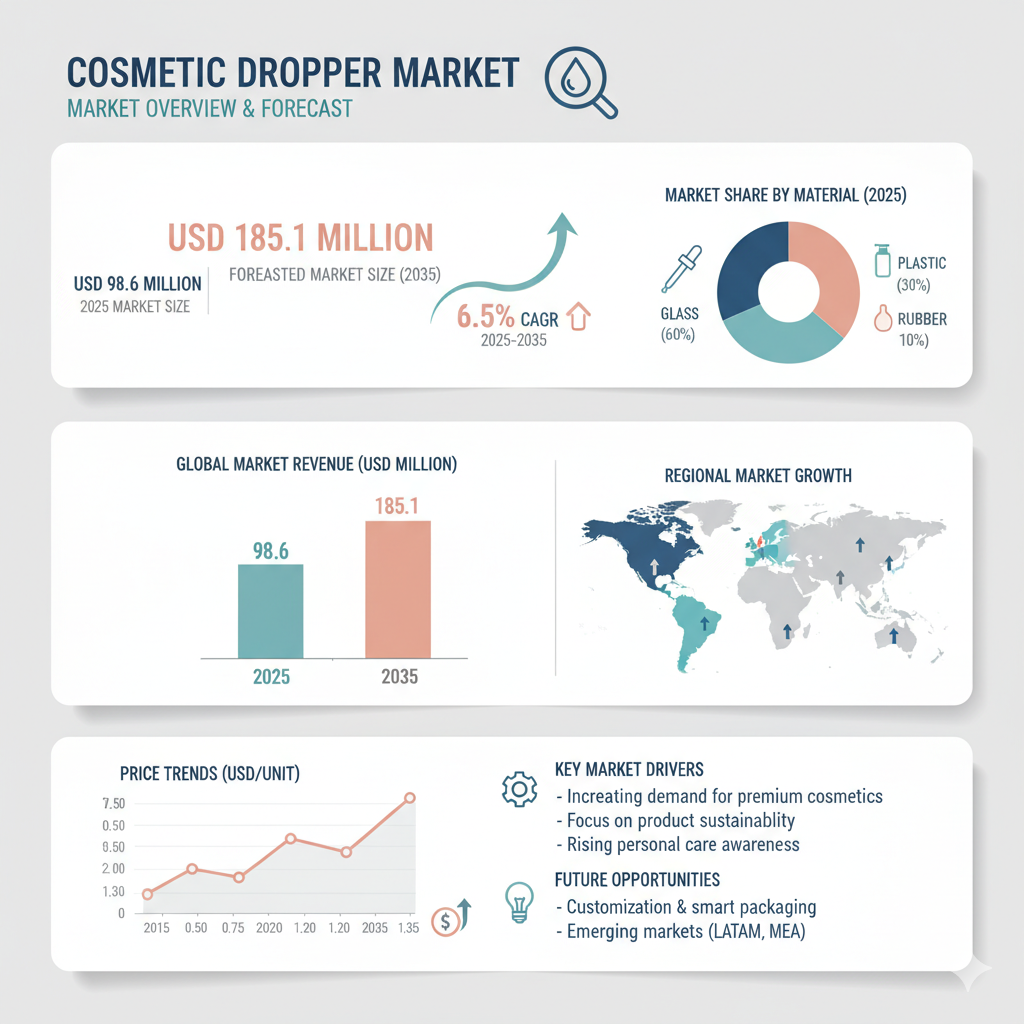

The global cosmetic dropper market is forecast to reach USD 185.1 million by 2035, up from USD 98.6 million in 2025. Over the forecast period, the industry is expected to grow at a compound annual growth rate (CAGR) of 6.5 %.

This trajectory underscores the growing importance of droppers in the cosmetic sector, especially as brands seek to combine functional precision, contamination control, and premium packaging aesthetics. Key drivers include the rising popularity of serums, targeted skincare products, and consumer preferences for sustainable packaging solutions.

Market Segmentation by Material, Size & Pipette Style

By Material

- Plastic

Plastic droppers are widely used in more affordable or mass-market cosmetic lines due to their low cost, durability, and light weight. Innovations in recyclable and bio-based plastics are making them more appealing from a sustainability standpoint. - Rubber

Rubber components (such as bulb or sealing elements) are often integrated into dropper assemblies to provide flexibility and sealing. Their role is secondary but critical in ensuring reliable function and compatibility with formulations. - Aluminum

Aluminum is less common but used in some premium or hybrid dropper systems where lightweight metal aesthetics or barrier properties are desired. - Glass (Type I / Type III)

Glass remains the dominant material for cosmetic droppers, particularly for higher-end skincare products. Type I (borosilicate) and Type III (neutral glass) grades are preferred for chemical stability, transparency, and premium feel. Many brands perceive glass as more environmentally friendly and able to preserve sensitive actives.

By Sizes

Common sizes used in dropper assemblies include 13 mm, 15 mm, 18 mm, and 20 mm.

- Among these, the 18 mm dropper size is often considered the industry standard. It balances dosing precision with practical capacity, making it suitable for common serum and cosmetic volumes.

- The 15 mm size is favored for compact or travel-sized skincare products, where a sleek design and minimal footprint are valued.

- Smaller sizes (13 mm) might be used for niche or mini formats, while 20 mm is sometimes used in formulations demanding higher volume or robustness.

By Pipette Style

Droppers are further differentiated by their tip or pipette styles: Straight Tip, Bent Tip, Stub Tip, Blunt Tip.

- The Straight Tip is the most widely used, owing to its versatility, ease of design, and reliable control.

- Bent Tip designs are gaining traction because they allow access to product near the bottom edges or corners of bottles, reducing waste and enhancing user experience.

- Stub Tip and Blunt Tip options are generally used in formulations that require gentler flow or lower dispense volumes, minimizing splatter or drips.

Regional Outlook

North America

North America leads the cosmetic dropper market, driven by strong demand for premium skincare, a mature retail and e-commerce landscape, and consumer emphasis on hygiene and precise dosing. The United States in particular is a key growth engine.

Latin America

In Latin America, growth is moderate. As disposable incomes rise and skincare awareness increases, regional and international cosmetic brands are integrating droppers into formulations, especially in urban markets.

Western & Eastern Europe

Western Europe demonstrates steady growth, propelled by eco-conscious consumer behavior, stringent packaging regulations, and innovations in refillable and recyclable dropper systems. Eastern Europe is catching up, supported by aspirational brand adoption and spillover from Western European beauty trends.

East Asia

East Asia, particularly China and Japan, is a high-potential region. In China, multi-step skincare routines and the booming serum market are fueling strong demand for droppers. Japan’s beauty culture emphasizes precision, minimalism, and premium design—traits that align well with dropper-based solutions.

South Asia & Pacific

South Asia & Pacific, including India, present growing opportunities, especially in tier-1 and tier-2 markets where demand for aspirational skincare is rising. Local brands are increasingly adopting droppers to match global aesthetics and functionality.

Middle East & Africa

This region shows moderate growth. Urbanization, rising skincare adoption, and brand penetration contribute to demand. However, challenges such as logistics, cost sensitivity, and supply chain infrastructure can limit rapid expansion.

Highlighting Recent Developments, Key Players & Competitive Dynamics

Recent Developments

- In September 2023, Luxury Cosmetic Solutions Holdings S.à r.l acquired a 51 % stake in Virospack SL, a leading manufacturer of premium cosmetic droppers. This acquisition underscores the strategic value placed on dropper technology and premium packaging assets.

- In May 2024, Aptar Beauty launched NeoDropper, an advanced dropper platform aimed at offering more precise dispensing in skincare applications. This launch reflects the increasing emphasis on user experience, dosing accuracy, and functional innovation in the dropper domain.

Key Players & Competitive Analysis

Major firms operating in the cosmetic dropper space include Virospack SL, LUMSON S.p.A, Williamson Manufacturing Pty Ltd, Remy & Geiser GmbH, PARAMARK Corporation, Pacific Vial Manufacturing Inc., and Comar LLC.

These players compete along multiple fronts:

- Material and structural innovation: To balance premium aesthetics, barrier properties, and cost, manufacturers offer glass, hybrid, or high-clarity plastics, often combining decorative finish, UV barrier coatings, or tinting.

- Functional differentiation: Calibrated pipettes, vented closures, wiper inserts, bulb materials (silicone, nitrile, TPE) optimized for various active formulations—all help to stand out.

- Sustainability credentials: Recycled content (PCR glass or plastics), monomaterial designs for easier disassembly, lightweighting, refill systems, and solvent-free decoration are part of the competitive toolkit.

- Customization and speed to market: To appeal to indie and direct-to-consumer brands, many dropper suppliers offer low minimum order quantities (MOQs), rapid prototyping, decorative options (hot-foil stamping, silk-screening), tamper-evident caps, and robust packaging trials.

- Regulatory and quality compliance: Firms differentiate by documentation of leachables/extractables, REACH/Prop-65 compliance, and life cycle assessment (LCA) proofs.

The acquisition of Virospack and the introduction of NeoDropper underscore a few strategic themes: (1) consolidation to control premium dropper supply chains, (2) emphasis on innovation to capture differentiation in the cosmetic packaging space, and (3) positioning around sustainability and advanced precision.