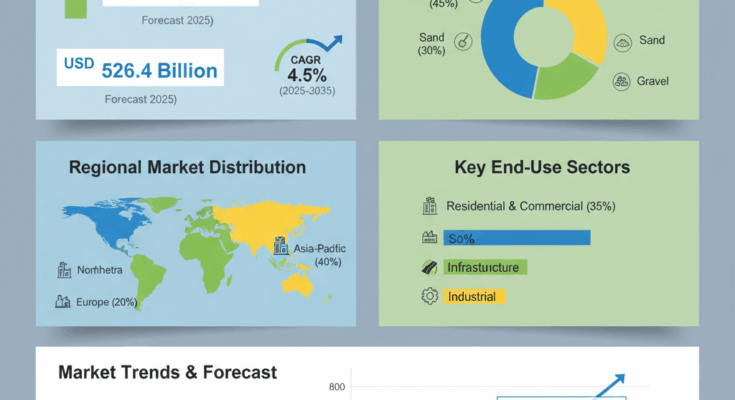

According to market projections, the global concrete aggregate market is forecast to reach USD 817.5 billion by 2035, rising from USD 526.4 billion in 2025, with a compound annual growth rate (CAGR) of 4.5% during the forecast period. This growth is supported by ongoing investments in smart city projects, road networks, and sustainable building materials.

Market Segmentation by Production

The market for concrete aggregates is broadly categorized by production type into natural, artificial, processed, and colored aggregates.

Natural Aggregates include traditional materials such as sand, gravel, crushed stone, and lime rock, which remain the most widely used due to their cost-effectiveness and availability. These materials are integral to mass concrete production and infrastructural applications.

Artificial Aggregates are produced from industrial by-products such as blast furnace slags, cinders, and fly ash. Their use is expanding as sustainability becomes a core concern in modern construction. These aggregates help reduce carbon footprints and promote circular economy practices by recycling industrial waste.

Processed Aggregates, including perlite, burnt clays, shale, and processed fly ash, are engineered to provide specific mechanical advantages, such as enhanced insulation or reduced weight, which are essential in lightweight concrete and architectural projects.

Colored Aggregates, such as glass ceramics and manufactured marbles, are gaining popularity in decorative and high-end architectural applications where aesthetic appeal is a key factor. These materials also reflect a growing trend toward customized and sustainable design solutions.

Segmentation by Bulk Density

Concrete aggregates are classified by bulk density standards, including ASTM C33, C330, and C637.

- ASTM C33 defines requirements for normal-weight aggregates used in structural concrete.

- C330 covers lightweight aggregates that contribute to energy-efficient construction.

- C637 establishes specifications for heavyweight aggregates often used in radiation shielding and specialized industrial structures.

This classification allows manufacturers and contractors to select materials tailored to specific performance criteria and project demands.

Segmentation by Mechanical Properties

The mechanical properties of concrete aggregates play a crucial role in determining the quality and performance of concrete. The market is segmented by attributes such as abrasive power, water absorption, and porosity.

- Abrasive power influences surface durability and wear resistance, crucial for pavements and heavy-duty industrial floors.

- Water absorption affects concrete’s strength and durability; aggregates with low absorption rates are preferred for high-performance concrete.

- High porosity materials, while lighter, are more suited to thermal insulation applications rather than structural use.

Segmentation by Particle Size

Based on particle size, the market is divided into fine aggregates and coarse aggregates.

- Fine aggregates, primarily sand or crushed stone dust, fill voids between larger particles, improving concrete compactness.

- Coarse aggregates, such as gravel and crushed rock, provide structural integrity and reduce shrinkage.

The balance between these two types determines concrete’s workability, strength, and finish.

Regional Outlook

The regional distribution of the concrete aggregate market reflects global infrastructure trends.

- North America and Western Europe are mature markets focusing on renovation and sustainable construction technologies.

- East Asia and South Asia & Pacific represent the fastest-growing regions, driven by rapid urbanization in China, India, and Southeast Asia.

- Latin America and Eastern Europe are witnessing moderate growth supported by public infrastructure projects.

- The Middle East & Africa region is seeing strong demand due to megaprojects, including smart cities and large-scale industrial developments.

Highlighting Recent Developments: Key Players and Competitor Analysis

Recent years have seen notable technological innovations and strategic partnerships in the concrete aggregate sector. Leading companies such as LafargeHolcim Ltd., HeidelbergCement AG, CEMEX S.A.B. de C.V., CRH plc, and Vulcan Materials Company dominate the global market, focusing on sustainable production and product innovation.

- LafargeHolcim has introduced eco-friendly aggregate solutions derived from recycled concrete and waste materials.

- HeidelbergCement is investing in carbon capture and utilization (CCU) technologies to minimize emissions during aggregate and cement production.

- CEMEX continues to expand its digital platforms, improving supply chain efficiency and customer engagement.

- Vulcan Materials Company has enhanced its domestic production capabilities in the U.S., focusing on high-quality crushed stone and gravel for infrastructure projects.

Competitor analysis indicates that sustainability, automation, and resource efficiency are shaping market competition. Manufacturers are integrating smart logistics systems, automated sorting technologies, and data-driven quality control to improve product consistency and operational efficiency.