Fact.MR’s industry analysis reveals that the global organic acids market is projected to reach a valuation of US$ 17 Bn by 2031, expanding at a CAGR of 6% across the 2021 to 2031 assessment period.

Organic acids are widely used in the food & beverages industry due to their versatile antioxidant properties. There are over 600 organic acids available globally, and the food & beverages industry consumes over 45% of these organic acids.

SWOT analysis has been performed in the market study to investigate the strengths, weaknesses, opportunities and threats of each player, both at global and regional levels.

Key Takeaways from Market Study

- Global organic acids market is expected to reach valuation of US$ 17 Bn by 2031.

- Demand for organic citric acid expected to expand at CAGR of 4.6% across analysis period.

- China to account for 40% of global organic acid production over coming 10 years.

- Market in Brazil accounts for 23% of global revenue share.

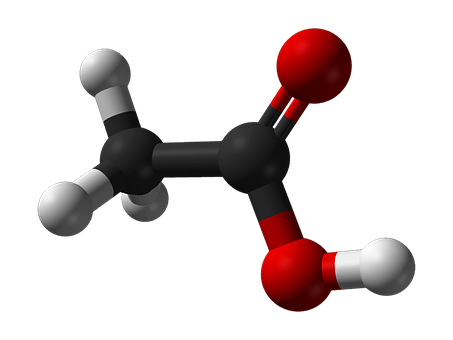

- Demand for acetic acid to heighten over coming years owing to rising demand from food & beverages industry.

- Increased demand for green substitutes and crucial need to improve bio-refining processes creating opportunities for bio-based organic acid manufacturers.

Key Segments Covered in Organic Acids Industry Research

-

By Product

- Organic Acetic Acid

- Organic Formic Acid

- Organic Lactic Acid

- Organic Citric Acid

- Organic Propionic acid

- Organic Ascorbic acid

- Organic Gluconic acid

- Organic Fumaric acid

- Organic Malic acid

-

By Application

- Bakery and Confectionery

- Dairy

- Beverages

- Poultry, Meat, and Seafood

- Livestock Feed

- Companion Animal Feed

- Pharmaceuticals

- Industrial

The Market insights of Organic Acids will improve the revenue impact of businesses in various industries by:

- Providing a framework tailored toward understanding the attractiveness quotient of various products/solutions/technologies in the Organic Acids Market

- Guiding stakeholders to identify key problem areas pertaining to their consolidation strategies in the global Organic Acids market and offers solutions

- Assessing the impact of changing regulatory dynamics in the regions in which companies are keen on expanding their footprints

- Provides understanding of disruptive technology trends to help businesses make their transitions smoothly

- Helping leading companies make strategy recalibrations ahead of their competitors and peers

- Offers insights into promising synergies for top players aiming to retain their leadership position in the market & supply side analysis of Organic Acids market .

Crucial insights in Organic Acids market research report:

- Underlying macro- and microeconomic factors impacting the Sales of Organic Acids market.

- Basic overview of the Organic Acids, including market definition, classification, and applications.

- Scrutinization of each market player based on mergers & acquisitions, R&D projects, and product launches.

- Adoption trend and supply side analysis of Organic Acids across various industries.

- Important regions and countries offering lucrative opportunities to market stakeholders.

The Demand of Organic Acids Market study includes the current market scenario on the global platform and also Sales of Organic Acids Market development during the forecast period.

Competitive Landscape

Key organic acids manufacturing companies are mainly involved in research & development activities to develop new production technologies and cater to the growing needs of end-use industries.

Moreover, manufacturers are also entering into long-term partnerships with end-use industries, global players, and raw material suppliers to have a strong presence in the worldwide market.

Some of the key developments are:

- In November 2018, Celanese Corporation, a chemical and specialty materials company announced the expansion of production facility of acetic acid at Clear Lake, Texas from 1.3 million tons to 2 million tons by late 2021. Moreover, the company has recently announced the acquisition of synthetic gas production units from Linde plc, an industrial gas company. This acquisition will enable the company to reduce the production cost of acetic acid as syngas is the key raw material.

- In May 2019, BASF-YPC, a 50:50 joint venture in Nanjing, China announced the startup of 30 kilotons production plant of propionic acid. The total production capacity of two plants increased to 69 kilotons per annum.

- In July 2019, Royal DSM, a science-based company in nutrition, health and sustainable living announced the upgradation of its vitamin C (ascorbic acid) facility in Jiangshan, China to enhance quality, safety, sustainability, and production efficiencies.